- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Flywire (FLYW): Fresh Look at Valuation Following Recent Share Price Rebound

Reviewed by Kshitija Bhandaru

Flywire (FLYW) shares have moved modestly in recent trading sessions, attracting some attention from investors. The stock is up nearly 15% over the past 3 months, while still down about 14% for the past year.

See our latest analysis for Flywire.

Flywire’s recent 90-day share price return of nearly 15% hints at a spark of momentum, even as the one-year total shareholder return remains in negative territory. This pattern suggests investors are cautiously shifting their outlook, weighing the company’s growth potential against past challenges.

If Flywire’s latest moves have you thinking bigger, it could be the right moment to extend your search and check out fast growing stocks with high insider ownership.

With shares rebounding but still trading below last year’s levels, the key question now is whether Flywire remains undervalued, or if recent gains suggest the market has already factored in future growth prospects.

Most Popular Narrative: 6.6% Undervalued

The most followed narrative suggests Flywire’s consensus fair value sits slightly above its last close price, raising questions about whether the recent rally still leaves room for upside. With the market moving, attention turns to the drivers behind this upbeat valuation call.

Ongoing investment in proprietary technology, AI-driven automation, and integration capabilities is yielding significant platform efficiencies (for example, 25% operational cost improvements, 90% automated payment matching, and 40% automated customer service), underpinning Flywire's ability to maintain or increase net margins and deliver stronger earnings leverage as scale increases.

Want to know why analysts are bullish? Let’s just say their future earnings assumptions are far from conservative. High-margin projections, rapid client onboarding, and an ambitious roadmap all play a critical role. Uncover the bold financial projections propelling expectations beyond the current share price.

Result: Fair Value of $14.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory challenges and margin pressure in faster-growing business lines could quickly shift the outlook and weaken Flywire's current growth narrative.

Find out about the key risks to this Flywire narrative.

Another View: Is the Market Overpricing Optimism?

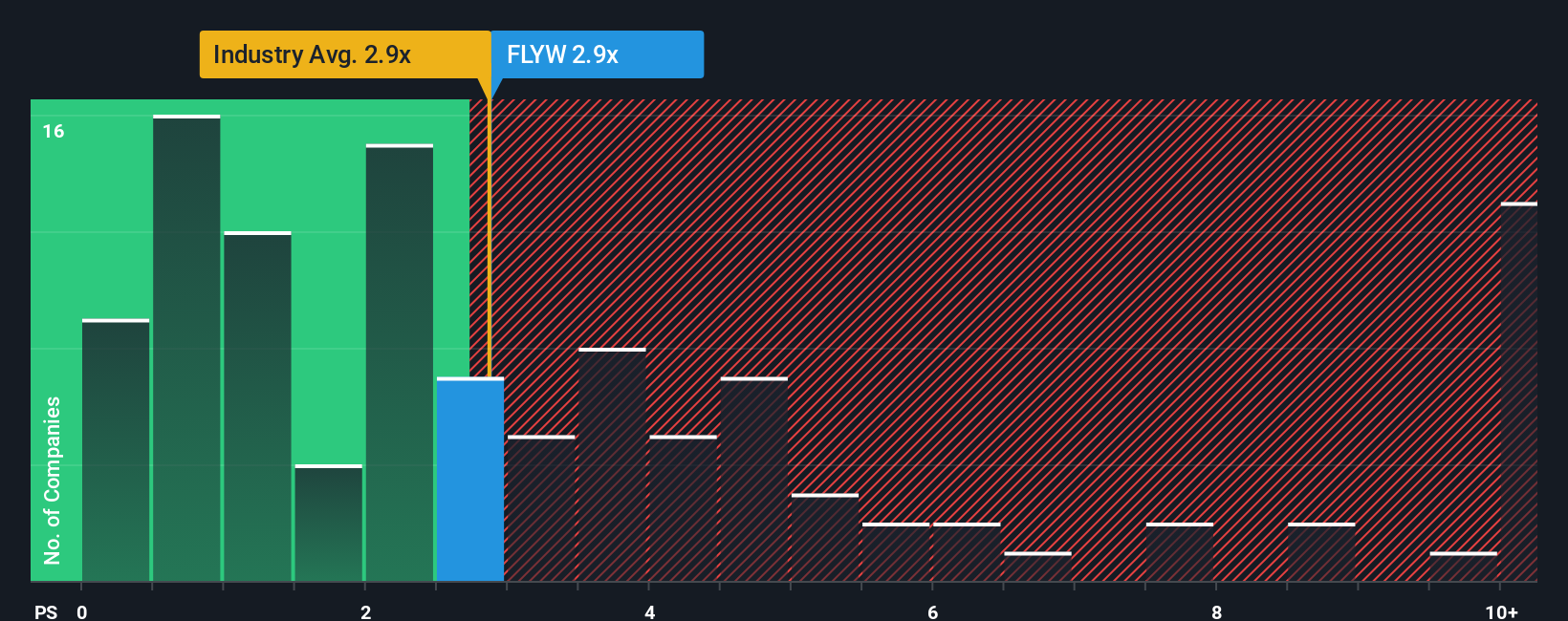

While the consensus narrative sees Flywire as undervalued, a look at its price-to-sales ratio tells a more cautious story. Shares trade at 3.1 times sales, making them more expensive than both the industry average (2.9x) and the company’s own fair ratio (2.5x). This suggests expectations may be running ahead of fundamentals and raises the risk of a pullback if high growth does not materialize. So, is the market pricing in too much hope too soon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flywire Narrative

If you see things differently, or want to dive deeper into the numbers yourself, you can shape your own Flywire story in just a few minutes. Do it your way.

A great starting point for your Flywire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t settle for just one idea. Get ahead of the crowd and target emerging trends, solid returns, and high-value potential, all at your fingertips on Simply Wall St.

- Spot opportunities for steady income by tapping into these 19 dividend stocks with yields > 3% with yields above 3% that could strengthen your portfolio’s foundation.

- Unlock unique angles in technology by following these 24 AI penny stocks where artificial intelligence is creating fresh growth stories you don’t want to miss.

- Seize the chance to find unloved bargains among these 909 undervalued stocks based on cash flows that may be trading below their true value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives