- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Flywire Corporation's (NASDAQ:FLYW) Popularity With Investors Is Clear

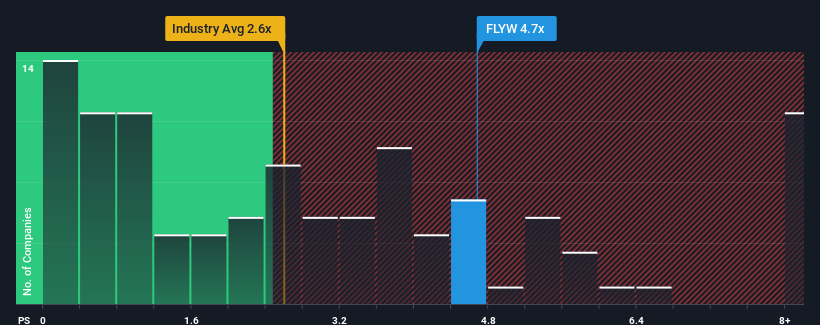

When close to half the companies in the Diversified Financial industry in the United States have price-to-sales ratios (or "P/S") below 2.6x, you may consider Flywire Corporation (NASDAQ:FLYW) as a stock to avoid entirely with its 4.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Flywire

How Flywire Has Been Performing

Flywire certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Flywire's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Flywire's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 181% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 24% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 8.5% per annum growth forecast for the broader industry.

In light of this, it's understandable that Flywire's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Flywire's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Flywire maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Diversified Financial industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Flywire that you should be aware of.

If these risks are making you reconsider your opinion on Flywire, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Flywire, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives