- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Does Flywire’s (FLYW) Expanded Workday Integration Signal a Turning Point in Operational Efficiency?

Reviewed by Sasha Jovanovic

- Flywire Corporation recently announced an expanded partnership with Workday, Inc., integrating its payments and financial software platform with Workday Student, a comprehensive student information system used by higher education institutions globally.

- This integration enables universities to streamline global billing and payment processes, automate reconciliation, and simplify payment options for students and families, while easing administrative burdens and improving data accuracy.

- Let's explore how Flywire's enhanced integration with Workday Student could influence its investment outlook, especially regarding operational efficiency gains.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Flywire Investment Narrative Recap

Flywire's value proposition rests on its ability to drive digital payment adoption across global education, healthcare, and B2B sectors while maintaining robust platform efficiencies and expanding its addressable market. The expanded integration with Workday Student directly targets Flywire’s operational efficiency catalyst, supporting streamlined client onboarding and automation; however, it may not be immediately material to offset the biggest short-term risk, macroeconomic and geopolitical impacts on international education revenue flows remain prominent concerns for the business.

Among recent company news, Flywire’s Q3 earnings announcement due on November 4, 2025 stands out as most relevant, potentially providing early signals on whether the new Workday partnership is contributing to client wins, expanded use cases, or improvements in cost efficiencies. Investors may closely monitor these upcoming results to assess how effectively Flywire’s operational improvements are translating into financial outcomes and whether they reinforce or diminish current risk factors.

Yet, as compelling as workflow automation may be for growth, investors should not lose sight of macro risks impacting education payment volumes, especially considering...

Read the full narrative on Flywire (it's free!)

Flywire's narrative projects $817.0 million revenue and $102.1 million earnings by 2028. This requires 14.8% yearly revenue growth and a $95.3 million earnings increase from $6.8 million today.

Uncover how Flywire's forecasts yield a $14.55 fair value, a 12% upside to its current price.

Exploring Other Perspectives

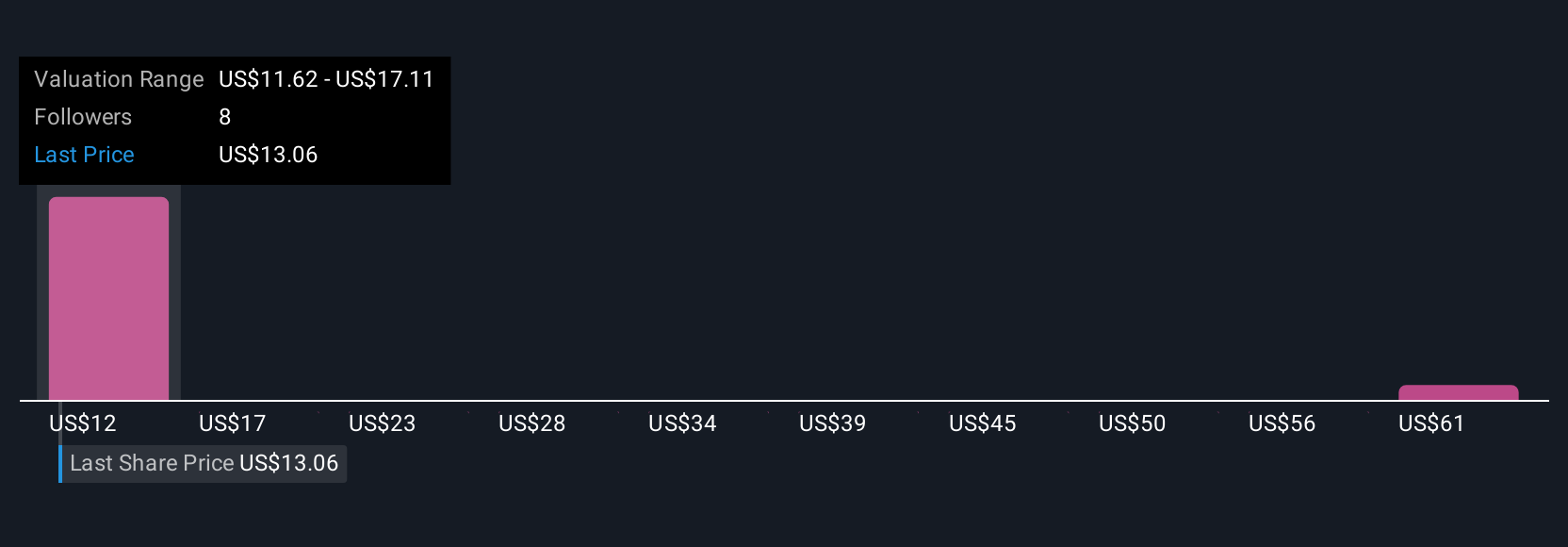

Simply Wall St Community members have published three fair value estimates for Flywire ranging from US$11.62 up to US$66.49 per share. While the wide spectrum reflects differing views on valuation, continued global expansion and new digital payment integrations could shape how market participants reassess Flywire’s revenue outlook in coming quarters.

Explore 3 other fair value estimates on Flywire - why the stock might be worth over 5x more than the current price!

Build Your Own Flywire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flywire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flywire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flywire's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives