- United States

- /

- Consumer Finance

- /

- NasdaqGS:FIGR

Figure Technology Solutions (FIGR): Assessing Valuation After Recent Sector Shifts

Reviewed by Kshitija Bhandaru

Figure Technology Solutions (FIGR) has recently attracted attention from investors following a series of shifts in the broader financial services sector. The company's stock performance is being closely watched as market participants consider its place in this evolving landscape.

See our latest analysis for Figure Technology Solutions.

Figure Technology Solutions' share price has seen a modest uptick lately, with a 7-day share price return of 0.03%, hinting that investor sentiment is cautiously improving after earlier moves in the financial technology space. The stock’s performance suggests potential for momentum to build as markets recalibrate to sector shifts.

If you're weighing your next opportunity in the finance sector, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given FIGR's modest recent gains and ongoing sector shifts, the key question now is whether the current share price undervalues the company's future prospects or if the market has already factored in what comes next.

Price-to-Sales Ratio of 29.2x: Is it justified?

Figure Technology Solutions is currently trading at a steep premium, with its Price-to-Sales ratio at 29.2x as of the last close of $40.3. This stands out as significantly higher than both peer and industry averages, raising the question of whether investors are anticipating rapid growth or overpaying for current performance.

The price-to-sales ratio compares a company's market capitalization to its total revenue, making it a useful valuation measure for firms with new or inconsistent profits, like Figure Technology Solutions which became profitable only this year. A high P/S ratio can reflect investor optimism about future growth or profitability, but it may also imply elevated expectations that could be difficult to meet.

In this case, Figure Technology Solutions looks expensive, as its P/S multiple not only far exceeds the average of direct peers (2.7x), but also is much higher than the US Consumer Finance industry average of 1.6x. This sharp difference suggests the market is pricing in aggressive expansion or exceptional margins, even though the available financial data is limited and the company's track record as a public firm is still emerging. If a fair ratio was established through regression analysis, it might indicate a more reasonable level for the stock to trade towards.

See what the numbers say about this price — find out in our valuation breakdown.

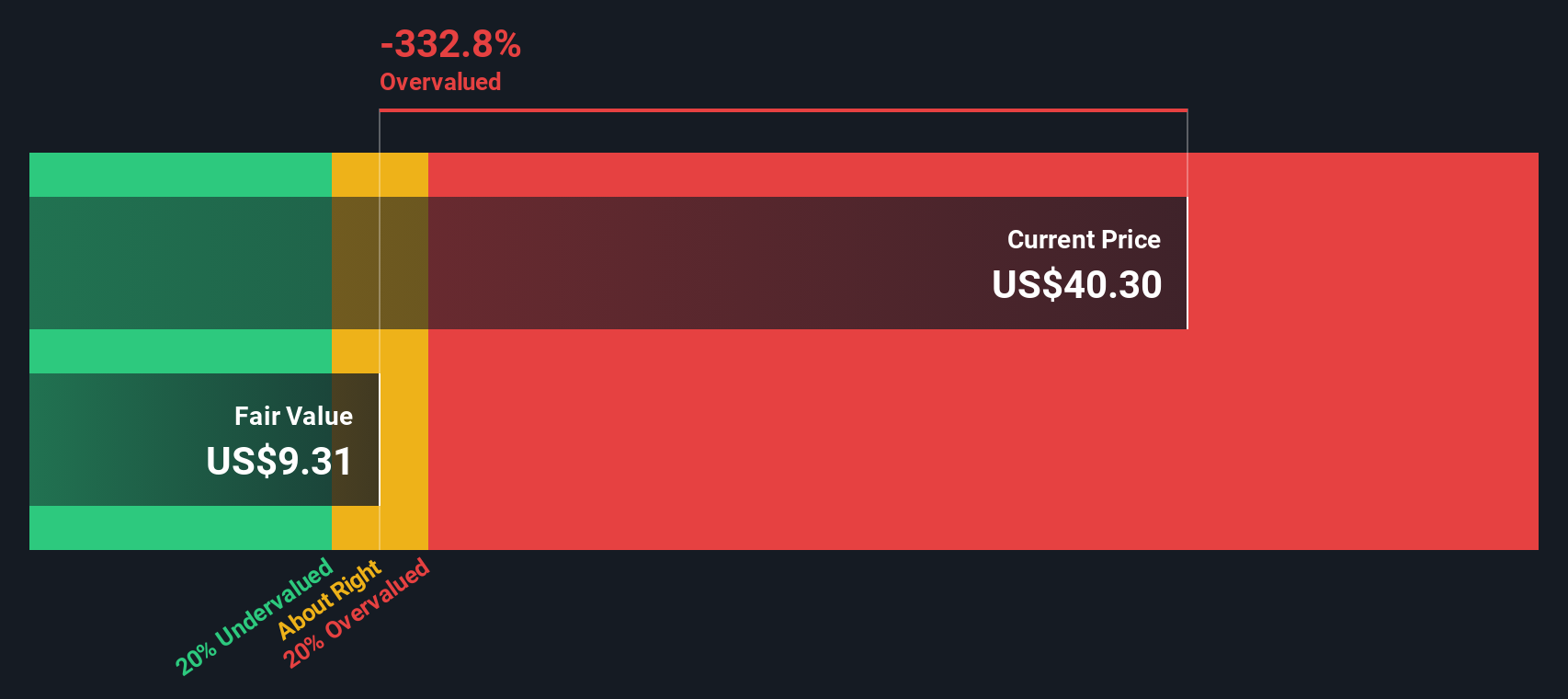

Result: Price-to-Sales of 29.2x (OVERVALUED)

However, limited financial history and a lack of clear long-term growth trends could pose challenges to sustaining the company’s current high valuation.

Find out about the key risks to this Figure Technology Solutions narrative.

Another View: Discounted Cash Flow Model Raises More Questions

Taking a broader perspective, the SWS DCF model delivers an even more cautious outlook. It suggests Figure Technology Solutions’ fair value is $9.31 per share, which is much lower than the current trading price of $40.3. This method implies the company is significantly overvalued. Does this highlight fresh risks investors should not ignore?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Figure Technology Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Figure Technology Solutions Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, building an independent view is quick and straightforward. You can put together your own narrative in under three minutes. Do it your way

A great starting point for your Figure Technology Solutions research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves come from seeing every angle. Give yourself an edge by checking out other unique opportunities. Act now so you won't miss what's next.

- Unlock powerful income potential by following these 19 dividend stocks with yields > 3%, delivering reliable yields above 3% in today’s market.

- Tap into high-growth tech trends by backing these 24 AI penny stocks, creating tomorrow’s breakthroughs in artificial intelligence and automation.

- Strengthen your portfolio’s value with these 902 undervalued stocks based on cash flows, poised for gains based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIGR

Figure Technology Solutions

Develops and operates a blockchain-based consumer lending platform.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives