- United States

- /

- Consumer Finance

- /

- NasdaqGS:FCFS

What FirstCash Holdings (FCFS)'s Credit Quality Concerns and Book Value Decline Mean for Shareholders

Reviewed by Sasha Jovanovic

- FirstCash Holdings recently faced heightened scrutiny as investors voiced concerns about significant credit quality challenges amid an unpredictable interest rate and inflation environment.

- A key insight is the company's tangible book value per share has been declining, alongside revenue growth that falls below industry standards.

- We'll explore how worries about credit quality could alter FirstCash Holdings' position within a financial sector under considerable pressure.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is FirstCash Holdings' Investment Narrative?

To stay invested in FirstCash Holdings right now, you likely need to believe that its core pawn lending business will maintain solid demand, as indicated by management’s recent upbeat guidance, even as broader financial sector pressures mount. The latest news around credit quality issues and declining tangible book value per share does introduce new short-term risk. Until now, discussion about FirstCash has focused on its income growth, capacity for new store openings, rising dividends, and recent buybacks, all of which would serve as potential catalysts for sentiment. However, the scrutiny around assets and credit quality could challenge that narrative, especially if concerns persist and begin to offset positive catalysts already in play. Price moves since the news suggest the impact is at least being reassessed by the market, so these shifts in risk and catalyst priorities are worth watching closely.

But beneath the headlines, asset quality has become an issue investors simply cannot ignore.

Exploring Other Perspectives

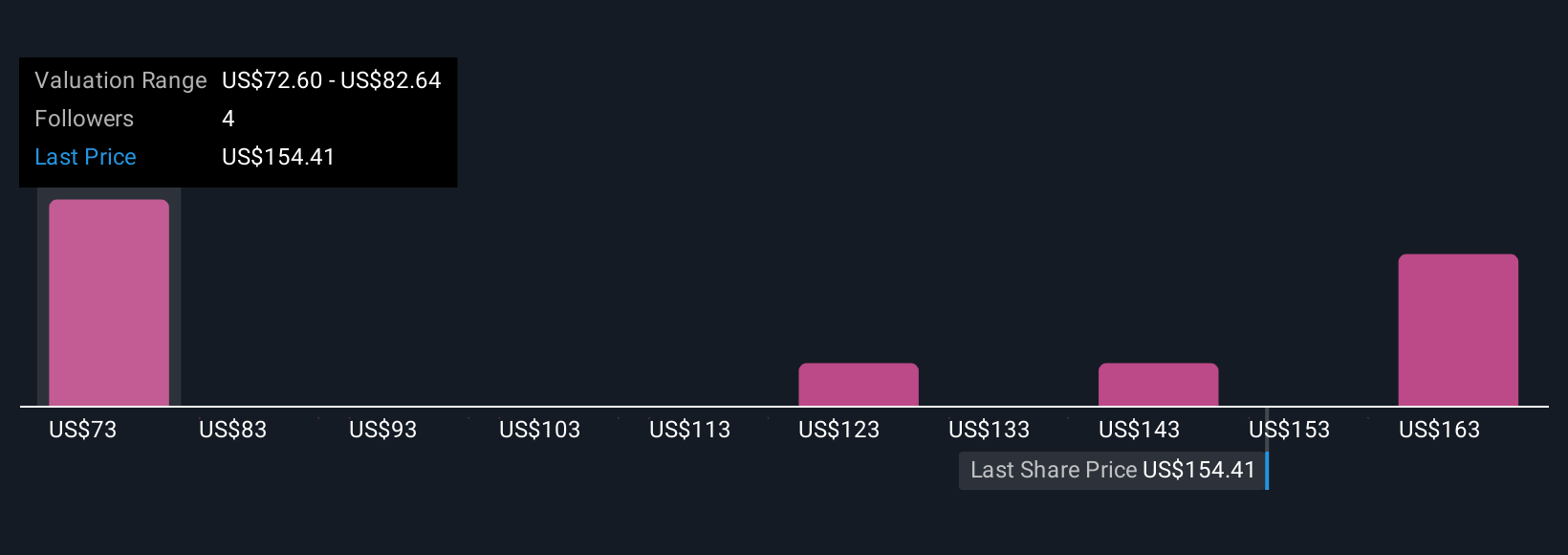

Explore 4 other fair value estimates on FirstCash Holdings - why the stock might be worth less than half the current price!

Build Your Own FirstCash Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FirstCash Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstCash Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCFS

FirstCash Holdings

Operates retail pawn stores in the United States, Mexico, and rest of Latin America.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives