- United States

- /

- Consumer Finance

- /

- NasdaqGS:FCFS

FirstCash Holdings (FCFS): Evaluating Valuation as Credit Quality Concerns and Growth Slowdown Weigh on Sentiment

Reviewed by Simply Wall St

Recent discussions reveal that FirstCash Holdings (FCFS) is confronting notable credit quality challenges and slower revenue growth. These issues come in the context of ongoing market uncertainty, which is driven by unpredictable interest rates and persistently high inflation.

See our latest analysis for FirstCash Holdings.

After a stellar run over the past year, FirstCash Holdings’ share price recently cooled off, slipping 2.1% in the past week after a 50% year-to-date surge. With a five-year total shareholder return of 218%, the stock’s long-term momentum is impressive. However, current market jitters around credit quality and growth suggest the mood is shifting to a more cautious tone.

If recent volatility in financials has you watching broader opportunities, now’s the perfect time to discover fast growing stocks with high insider ownership

Given the mix of long-term gains and new obstacles, the real question is whether FirstCash is trading at a bargain today or if the market has already adjusted the price for what's ahead. Could this be a genuine buying opportunity, or is future growth already priced in?

Price-to-Earnings of 23.4x: Is it justified?

At its last close of $154.13, FirstCash Holdings trades at a price-to-earnings (P/E) ratio of 23.4x, suggesting a premium compared to its direct peers.

The P/E ratio is a widely used measure comparing a company’s current share price to its per-share earnings. For a diversified financial such as FirstCash, it assesses how much investors are willing to pay today for a dollar of current earnings. A higher P/E signals optimism about future profit growth but can also reflect overenthusiasm or premium expectations.

Currently, FirstCash’s P/E ratio is below that of its peer group average (46.8x), implying relative value within its immediate competitive set. However, it is sharply higher than both the estimated fair P/E of 16.2x and the broader US Consumer Finance industry average of 10.3x. This creates a tension between strong recent growth and whether the market is paying too much for future prospects. If the market begins to reprice towards the fair ratio, FirstCash’s valuation could face pressure.

Explore the SWS fair ratio for FirstCash Holdings

Result: Price-to-Earnings of 23.4x (OVERVALUED)

However, slowing revenue growth and ongoing credit quality concerns could prompt investors to reassess FirstCash Holdings’ premium valuation in the near term.

Find out about the key risks to this FirstCash Holdings narrative.

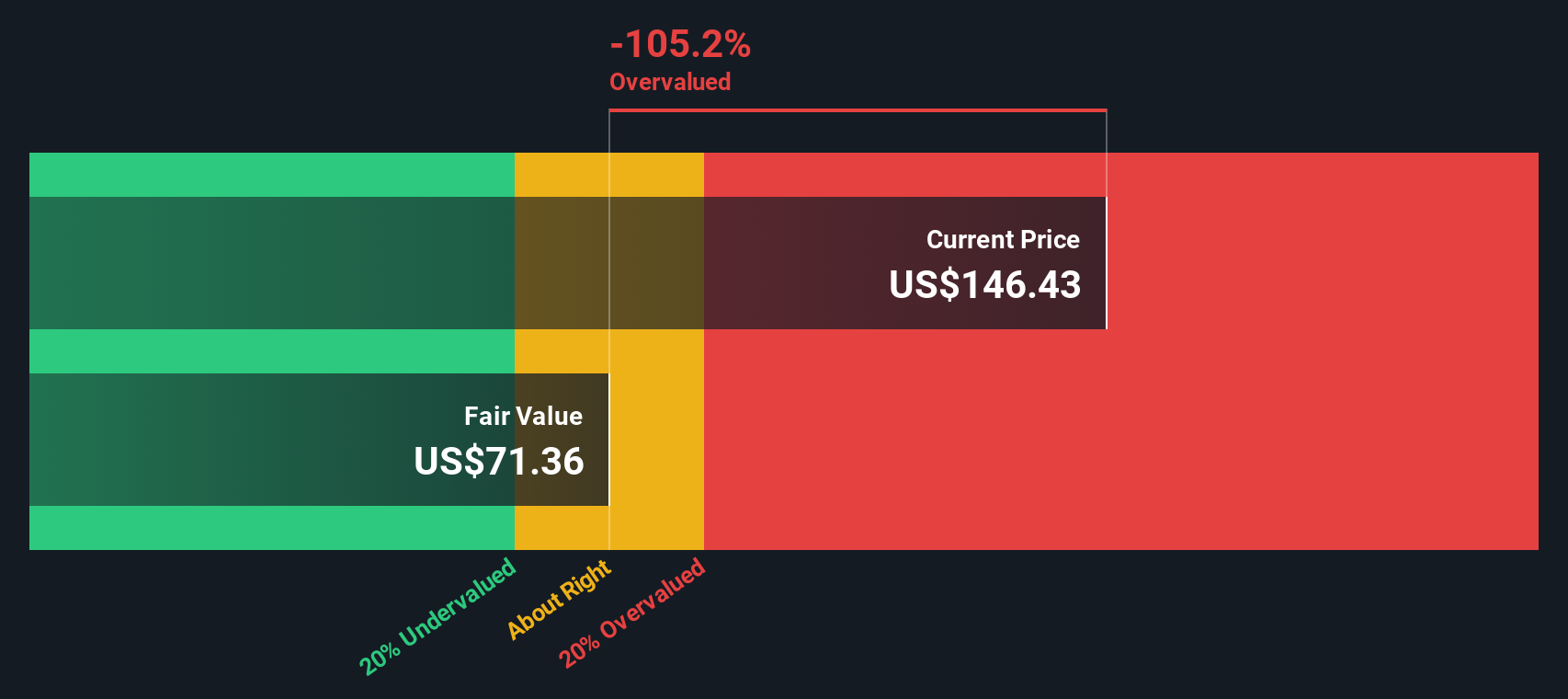

Another View: Our DCF Model Tells a Different Story

Looking beyond price-to-earnings, the SWS DCF model estimates FirstCash Holdings’ fair value at $71.5, which is well below its current price of $154.13. This suggests the stock could be significantly overvalued if cash flows do not accelerate. But do current earnings justify this premium, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FirstCash Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FirstCash Holdings Narrative

If you see things differently, or want to dig into the details on your own terms, you can shape your own perspective in minutes. Do it your way.

A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities pass you by. Use the Simply Wall Street Screener to quickly pinpoint stocks tailored to your interests and investment goals.

- Tap into reliable cash flow by targeting attractive yields and financial stability when you check out these 17 dividend stocks with yields > 3%.

- Fuel your portfolio with high-potential innovation by starting with these 27 AI penny stocks, which are reshaping the future through artificial intelligence.

- Catch value before the crowd by assessing companies that look undervalued based on fundamentals with these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCFS

FirstCash Holdings

Operates retail pawn stores in the United States, Mexico, and rest of Latin America.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives