- United States

- /

- Consumer Finance

- /

- NasdaqGS:EZPW

Does EZCORP’s (EZPW) Record Revenue and Latin America Expansion Reinforce Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

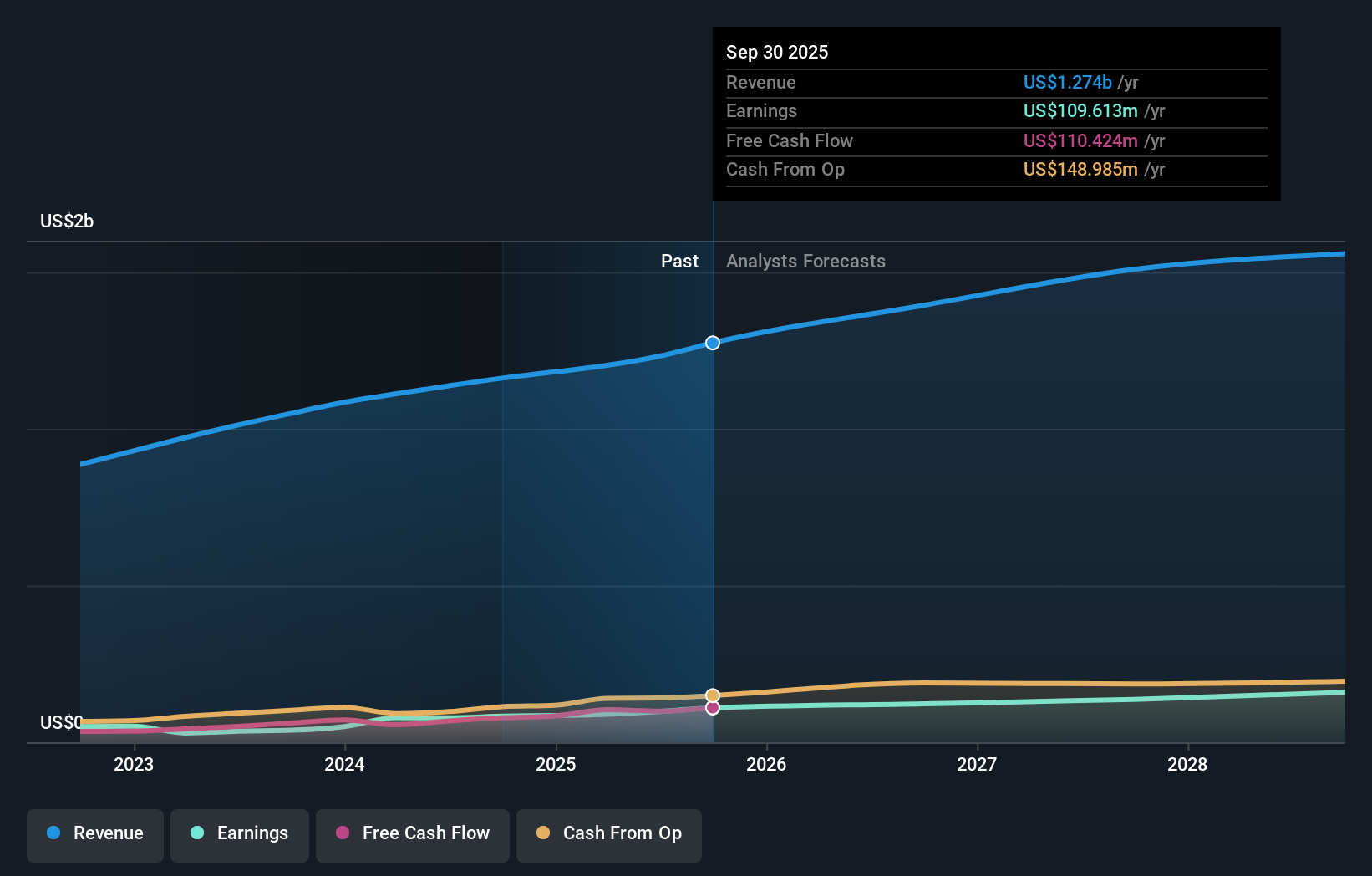

- EZCORP, Inc. released its fourth quarter and full-year 2025 earnings results, reporting record revenue of US$336.81 million for the quarter and US$1.27 billion for the year, as well as higher net income and earnings per share compared to the prior year.

- The company’s growth was fueled by expanding its store base, including 77 new acquisitions in Mexico, alongside a significant boost in digital customer engagement and robust pawn loan demand.

- We'll examine how EZCORP's record-breaking revenue and expansion in Latin America influence its overall investment narrative and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

EZCORP Investment Narrative Recap

If you’re considering owning EZCORP, the core investment thesis rests on continued growth from expanding its Latin American footprint and capturing rising demand for pawn loans and digital services. The latest earnings confirmed record revenue and earnings, but did not fundamentally change the company’s key short-term catalyst, ongoing demand for collateral-based lending, and the most substantial risk remains its heavy reliance on gold prices and jewelry-related merchandise margins. Among recent developments, EZCORP’s announcement of acquiring 77 additional stores in Mexico is particularly significant. This move directly supports the primary growth catalyst of geographic expansion and diversifies the firm’s revenue streams, enhancing its exposure to large underserved markets while potentially smoothing out performance across different economic environments. But it’s important to remember that, despite this rapid growth, dependence on gold prices and jewelry volumes creates a risk investors should be aware of if...

Read the full narrative on EZCORP (it's free!)

EZCORP's narrative projects $1.5 billion revenue and $137.5 million earnings by 2028. This requires 6.8% yearly revenue growth and a $39.4 million earnings increase from $98.1 million today.

Uncover how EZCORP's forecasts yield a $23.40 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$15.12 to US$25 based on four unique analyses. This diversity of opinion stands against the backdrop of EZCORP’s heavy dependence on gold and jewelry margins, which could shape outcomes quite differently.

Explore 4 other fair value estimates on EZCORP - why the stock might be worth 15% less than the current price!

Build Your Own EZCORP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EZCORP research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EZCORP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EZCORP's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EZCORP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EZPW

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives