- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

The Bull Case For Euronet Worldwide (EEFT) Could Change Following Surge In Short Interest – Learn Why

Reviewed by Sasha Jovanovic

- Earlier this week, Euronet Worldwide saw its short interest as a percent of float rise to 13.21%, significantly outpacing the industry average of 6.37% and reflecting a rise of 4.02% over the prior report.

- This sharp increase in short selling activity may signal heightened bearish sentiment among investors when compared to industry peers.

- We will assess how the increased short interest may impact views on Euronet Worldwide’s outlook and potential business risks.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Euronet Worldwide Investment Narrative Recap

To be a shareholder in Euronet Worldwide, you need confidence in the company’s ability to successfully pivot from its legacy ATM and cash-based segments toward digital payments and software-based solutions. The recent surge in short interest to 13.21%, well above industry norms, may suggest a more cautious near-term stance from some market participants, but it does not appear to materially affect the core long-term catalyst: growth in digital payments and recurring software revenue. However, it does bring more attention to business risks, especially if negative sentiment persists.

One of Euronet’s recent announcements, the partnership with Visa for near-instant transfers through Visa Direct, stands out in this context. This move supports the company’s reliance on digital transaction flows as a key growth engine, reinforcing the catalyst that underpins its outlook even as competitive and regulatory risks remain prominent.

By contrast, what’s less visible for many is the specific impact that rapid regulatory changes can have in key remittance corridors, which is crucial information investors should be aware of...

Read the full narrative on Euronet Worldwide (it's free!)

Euronet Worldwide's outlook anticipates $5.2 billion in revenue and $476.3 million in earnings by 2028. This reflects an 8.2% annual revenue growth rate and a $143.6 million increase in earnings from the current $332.7 million.

Uncover how Euronet Worldwide's forecasts yield a $117.43 fair value, a 60% upside to its current price.

Exploring Other Perspectives

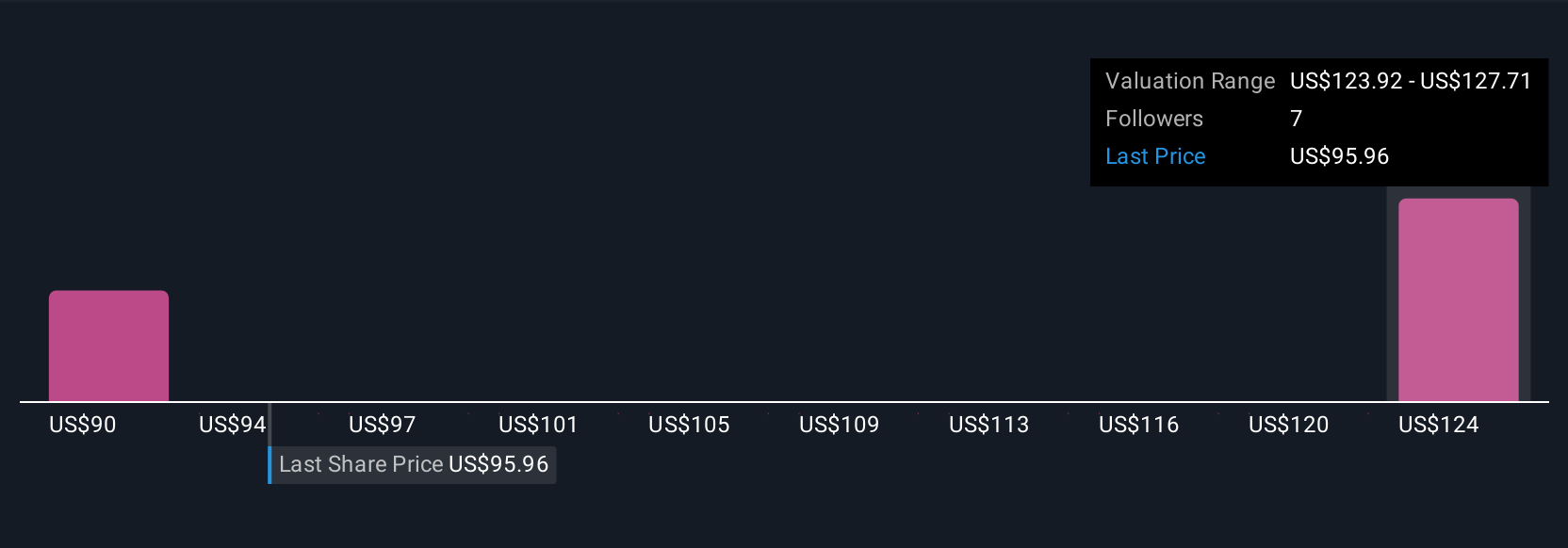

Three fair value estimates from the Simply Wall St Community for Euronet range from US$93.64 to US$117.43 per share. While these figures offer varied insights, accelerating competition and regulatory pressures continue to shape the company’s wider outlook and risk profile, explore these diverse opinions to weigh your own view.

Explore 3 other fair value estimates on Euronet Worldwide - why the stock might be worth just $93.64!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronet Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.