Last Update 03 Nov 25

Fair value Decreased 5.30%Analysts have lowered their fair value estimate for Euronet Worldwide from $124 to approximately $117.43, citing reduced revenue growth expectations and a higher discount rate after recent third-quarter updates.

Analyst Commentary

Following Euronet Worldwide's recent third-quarter performance and updated outlook, analysts have offered a mix of supportive and cautious perspectives. These viewpoints address both the company's fundamentals and the broader macroeconomic environment.

Bullish Takeaways

- Some analysts maintain an Outperform rating on Euronet, emphasizing that consumer spending data through September remains resilient and supports continued revenue growth prospects.

- Defensive positioning within the financial technology sector is recommended, with Euronet being included alongside established payment names because of its perceived stability amid economic uncertainty.

- Investors are encouraged by Euronet's consistent participation in industry events and updates, which signal steady engagement with the investment community and transparent communication.

Bearish Takeaways

- Cautious analysts have lowered price targets in response to reduced revenue growth expectations and the macroeconomic headwinds highlighted in the third-quarter report.

- Higher discount rates and significant economic uncertainty have prompted a more conservative stance on valuation, reflecting industry-wide caution.

- Revisions to earnings estimates following recent updates suggest possible challenges in maintaining previous growth rates, particularly in the short term.

- The environment of heightened economic uncertainty continues to weigh on the sector, which could impact investor sentiment and execution risk for Euronet.

Valuation Changes

- Fair Value Estimate has decreased from $124 to approximately $117.43, reflecting a modest downward revision in expected valuation.

- Discount Rate has risen slightly from 8.97% to 9.13%, indicating analysts now perceive greater risk or require a higher return from the stock.

- Revenue Growth Forecast has fallen from 8.31% to 7.11%, pointing to more conservative assumptions about future sales expansion.

- Net Profit Margin is projected to increase from 9.17% to 9.53%, suggesting expectations for improved profitability despite lower revenue growth.

- Future Price to Earnings (P/E) Ratio estimate has risen significantly from 10.99x to 14.65x, highlighting an expectation for higher relative earnings multiples in the forecast period.

Key Takeaways

- Expansion into digital payment processing and global money transfers leverages high-growth regions and increased demand for scalable, software-driven solutions.

- Ongoing shift from cash to digital payments fuels recurring growth, enhanced margins, and validation from strategic alliances with major financial institutions.

- Structural shifts toward digital payments, regulatory and competitive pressures, and innovation gaps threaten Euronet's legacy revenues, margins, and long-term relevance across core business segments.

Catalysts

About Euronet Worldwide- Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

- The acquisition of CoreCard, a scalable and proven credit card processing platform, alongside Euronet's Ren platform, positions the company to rapidly expand digital payments processing and credit issuing capabilities, particularly in large and high-growth regions like Europe and Asia; this is expected to drive substantial increases in revenue and improve operating margins due to the higher profitability of software-based, digital payment solutions.

- Strength in cross-border and international money transfer flows remains a robust engine for growth, as demonstrated by strong performance in Euronet's Money Transfer segment (33% operating income growth year-over-year) and expansion into fast-growing remittance markets, notably with the Kyodai Remittance acquisition in Japan; this leverages increasing globalization and economic migration trends, supporting future transaction and revenue growth.

- The rapid shift from cash to digital and electronic payments worldwide, including the transformation of epay to a primarily digital transaction business (now 70% fully digital), as well as the increasing share of digital and real-time transactions in Money Transfer (digital transactions now comprise 55% of volume in that segment), provides recurring growth opportunities and incremental net margin enhancement as digital products scale and overtake legacy cash-based revenues.

- Strategic wins such as the Ren platform deal with a top 3 U.S. bank and ongoing partnerships with large global financial institutions further validate Euronet's technology and create a strong reference base for additional large-scale contracts, supporting higher future software revenue and increased operating leverage from scalable digital solutions.

- Euronet's ability to cross-sell new high-margin digital offerings, such as CoreCard's revolving credit solutions, through its global payments network and deep relationships with banks, fintechs, and digital wallets-especially in underbanked and emerging markets-offers a path for outsized earnings growth and margin expansion as financial inclusion accelerates adoption of modern payment and credit products.

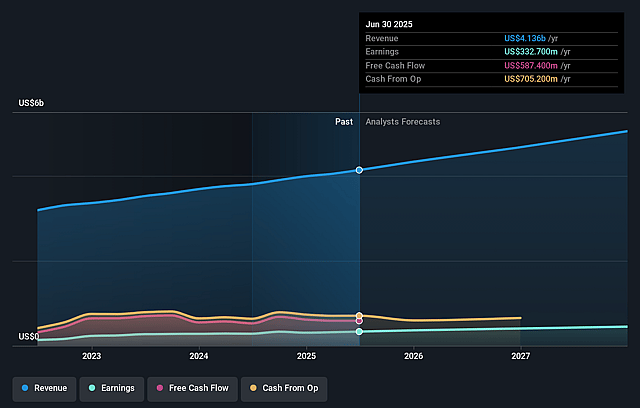

Euronet Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Euronet Worldwide's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 9.1% in 3 years time.

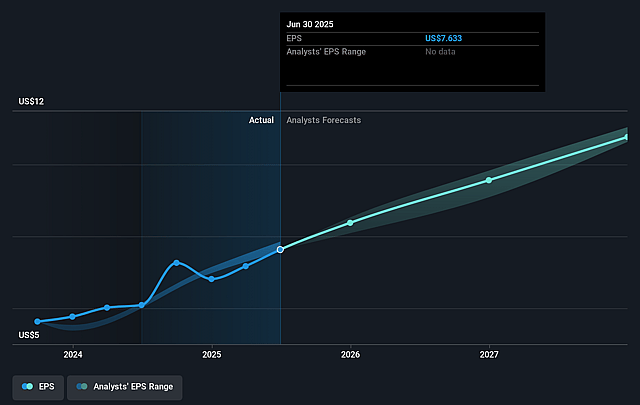

- Analysts expect earnings to reach $476.3 million (and earnings per share of $10.76) by about September 2028, up from $332.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from 10.9x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 6.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.0%, as per the Simply Wall St company report.

Euronet Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift toward cashless societies and digital/mobile payments poses a long-term threat to Euronet's legacy ATM and cash-based segments, which are still a significant contributor to revenue and profit; as these revenue streams decline, the company may face headwinds in maintaining overall top-line growth and high-margin legacy businesses.

- Euronet's Money Transfer business remains exposed to regulatory risks, such as new remittance taxes (e.g., the recent 1% remittance tax affecting 27% of the segment's revenue), anti-money laundering (AML), and KYC compliance requirements-these can compress net margins and introduce earnings volatility, especially as geopolitical and regulatory changes increase in key corridors.

- The proliferation of large tech players and superapps (Apple, Google, PayPal, etc.) in digital payments and cross-border money transfer intensifies competition, risking long-term market share erosion for Euronet and potentially driving price compression, which would directly impact revenue growth and net margins across segments.

- Industry-wide adoption of real-time payment rails and central bank digital currencies (CBDCs) could disintermediate traditional payments and money transfer services, threatening Euronet's transaction-based fee income model with sustained pressure on both revenue and margins.

- Euronet's CoreCard acquisition brings concentration risk from major customers (notably Apple/Goldman Sachs), and the loss or reduction of business from these clients would slow growth in the credit card processing segment; additionally, persistent underinvestment or lag in cutting-edge fintech innovation (versus agile start-ups or incumbents) could further threaten long-term earnings and market relevance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $127.714 for Euronet Worldwide based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $476.3 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 9.0%.

- Given the current share price of $91.34, the analyst price target of $127.71 is 28.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.