- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

A Piece Of The Puzzle Missing From Euronet Worldwide, Inc.'s (NASDAQ:EEFT) Share Price

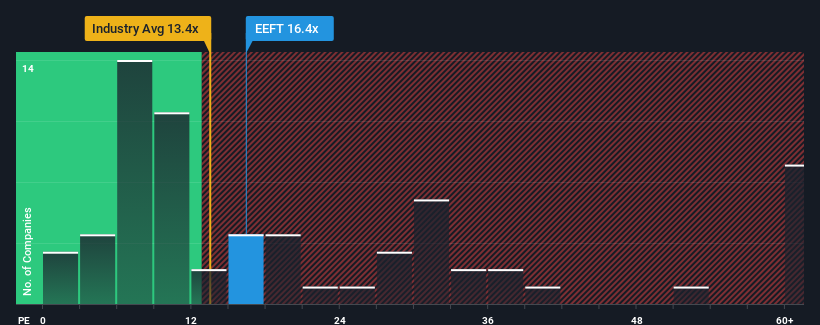

There wouldn't be many who think Euronet Worldwide, Inc.'s (NASDAQ:EEFT) price-to-earnings (or "P/E") ratio of 16.4x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Euronet Worldwide has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Euronet Worldwide

Is There Some Growth For Euronet Worldwide?

The only time you'd be comfortable seeing a P/E like Euronet Worldwide's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% each year, which is noticeably less attractive.

With this information, we find it interesting that Euronet Worldwide is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Euronet Worldwide's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Euronet Worldwide's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Euronet Worldwide with six simple checks.

Of course, you might also be able to find a better stock than Euronet Worldwide. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Euronet Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives