- United States

- /

- Consumer Finance

- /

- NasdaqGS:ECPG

Should Encore Capital Group (NASDAQ:ECPG) Be Disappointed With Their 59% Profit?

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd like to see the share price move up more than the market average. But Encore Capital Group, Inc. (NASDAQ:ECPG) has fallen short of that second goal, with a share price rise of 59% over five years, which is below the market return. Looking at the last year alone, the stock is up 17%.

See our latest analysis for Encore Capital Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

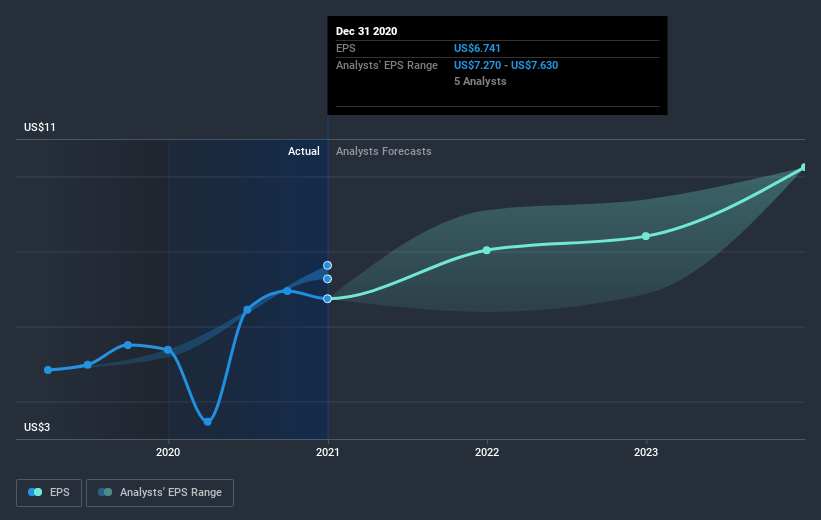

During five years of share price growth, Encore Capital Group achieved compound earnings per share (EPS) growth of 20% per year. The EPS growth is more impressive than the yearly share price gain of 10% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 6.17 also suggests market apprehension.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Encore Capital Group has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Encore Capital Group will grow revenue in the future.

A Different Perspective

Encore Capital Group provided a TSR of 17% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 10% per year over five year. It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Encore Capital Group you should be aware of, and 1 of them is potentially serious.

We will like Encore Capital Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Encore Capital Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Encore Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ECPG

Encore Capital Group

A specialty finance company, provides debt recovery solutions and other related services for consumers across financial assets worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives