- United States

- /

- Consumer Finance

- /

- NasdaqGS:ECPG

Encore Capital’s Planned Debt Redemption Could Be a Game Changer for ECPG

Reviewed by Sasha Jovanovic

- Earlier this month, Encore Capital Group announced a conditional plan to redeem €100.0 million of its Senior Secured Floating Rate Notes due 2028, contingent on securing satisfactory funding before the specified redemption date.

- This move reflects active capital management and follows Encore's recent financial results, which surpassed expectations due to stronger collections and higher profitability.

- We'll examine how Encore's decision to redeem part of its debt could influence its investment narrative, especially in light of its recent profitability improvements.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Encore Capital Group Investment Narrative Recap

To be a shareholder in Encore Capital Group, you need to believe in the company’s ability to capitalize on sustained U.S. consumer financial stress and continue purchasing charged-off debt at attractive prices. The recent plan to redeem €100.0 million of senior secured notes reflects disciplined capital management but does not materially alter the central near-term catalyst of robust debt supply or the key risk tied to Encore’s funding costs and exposure to capital markets conditions.

Among recent announcements, Encore’s issuance of $500 million in senior secured notes due 2031 stands out in relation to the latest debt redemption plan. This move bolstered Encore’s funding flexibility and supports the company’s bid to lower interest costs and improve its debt profile, directly connecting to the identified catalyst of having ample liquidity to pursue market opportunities and offset the risks associated with rising borrowing expenses.

Yet, investors should not overlook the fact that if credit market conditions tighten suddenly, the company’s reliance on external funding could ...

Read the full narrative on Encore Capital Group (it's free!)

Encore Capital Group's narrative projects $2.1 billion revenue and $838.0 million earnings by 2028. This requires 11.8% yearly revenue growth and a $927.1 million increase in earnings from -$89.1 million.

Uncover how Encore Capital Group's forecasts yield a $60.25 fair value, a 22% upside to its current price.

Exploring Other Perspectives

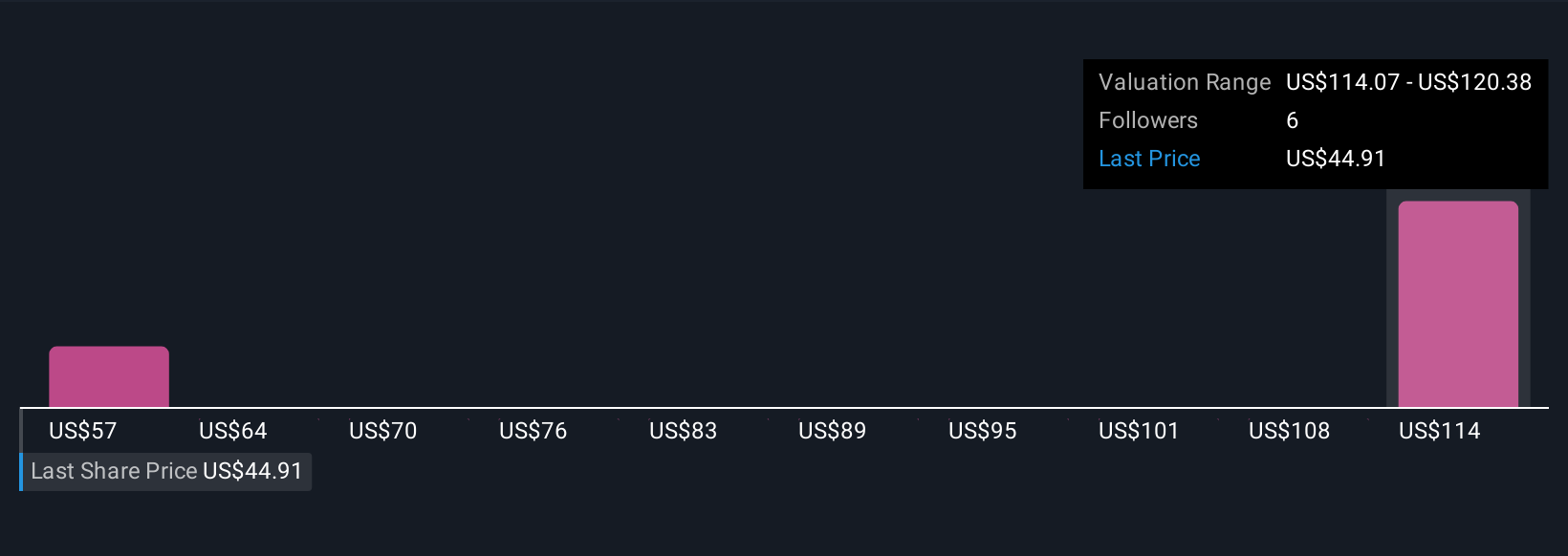

Simply Wall St Community fair value estimates for Encore Capital Group span from US$60.25 to US$120.38, based on two separate analyses. While opinions differ widely, the spotlight on Encore’s interest expense risk underscores the diverse ways future performance could be shaped, explore additional views to inform your outlook.

Explore 2 other fair value estimates on Encore Capital Group - why the stock might be worth just $60.25!

Build Your Own Encore Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encore Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encore Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encore Capital Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encore Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ECPG

Encore Capital Group

A specialty finance company, provides debt recovery solutions and other related services for consumers across financial assets worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives