- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IZEA

3 US Penny Stocks With Market Caps Under $70M To Consider

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a rebound, with investor attention shifting towards earnings reports and the Federal Reserve's policy decisions. Amidst these broader market movements, penny stocks remain an intriguing segment for investors seeking potential growth opportunities in smaller or newer companies. Although the term "penny stock" might seem outdated, it still signifies a relevant investment area where strong financial health can lead to significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.22M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.49M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2874 | $10.58M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $49.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.03 | $60.21M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $23.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8893 | $80.06M | ★★★★★☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

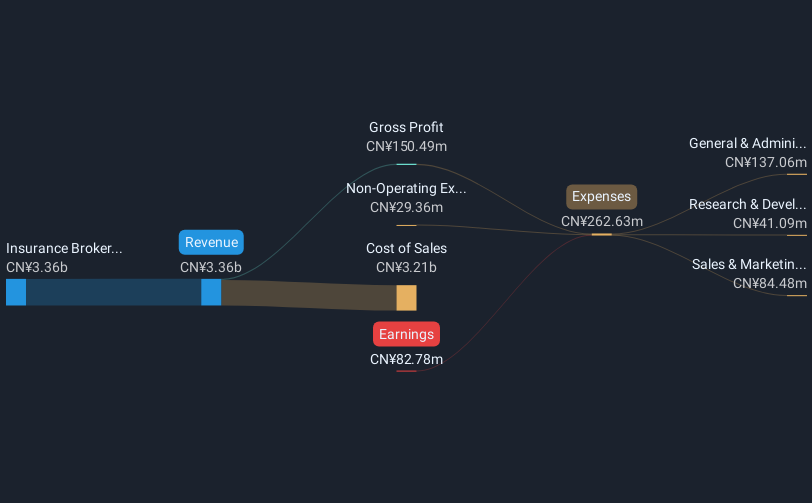

Cheche Group (NasdaqCM:CCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cheche Group Inc. operates an auto insurance technology platform and has a market cap of approximately $69.30 million.

Operations: The company generates revenue primarily from its Insurance Brokers segment, totaling CN¥3.36 billion.

Market Cap: $69.3M

Cheche Group, with a market cap of US$69.30 million, operates an auto insurance technology platform and has shown signs of financial improvement despite challenges. The company reported third-quarter revenue of CN¥850.52 million and a net income turnaround to CN¥4.05 million from a previous loss, indicating potential recovery momentum. However, it faces compliance issues with Nasdaq's minimum bid price requirement but retains sufficient cash to cover liabilities and more than its total debt. Revenue growth is modest at 4.7%, while earnings are forecasted to grow significantly annually, suggesting potential value for risk-tolerant investors amidst volatility concerns and an inexperienced management team.

- Unlock comprehensive insights into our analysis of Cheche Group stock in this financial health report.

- Assess Cheche Group's future earnings estimates with our detailed growth reports.

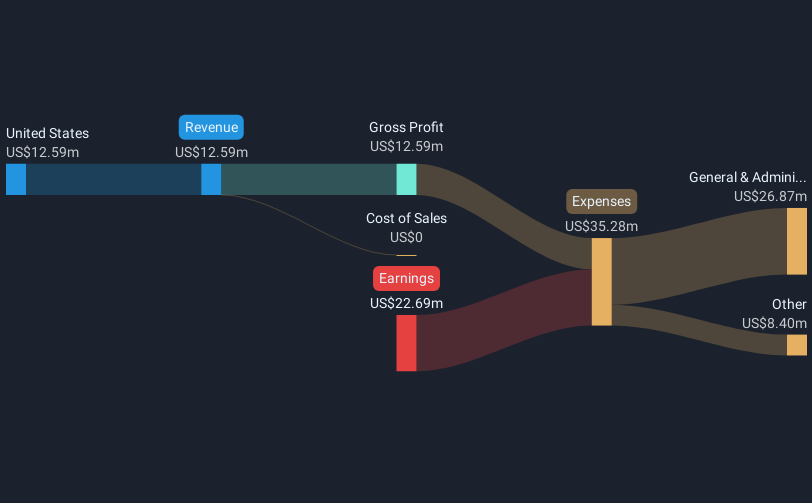

Dominari Holdings (NasdaqCM:DOMH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dominari Holdings Inc., with a market cap of $11.05 million, operates through its subsidiaries in wealth management, investment banking, sales and trading, and asset management.

Operations: The company's revenue is primarily generated from the United States, amounting to $12.59 million.

Market Cap: $11.05M

Dominari Holdings Inc., with a market cap of US$11.05 million, is unprofitable but has shown revenue growth, reporting US$4.04 million in sales for Q3 2024 compared to US$0.963 million the previous year. Despite this, net losses increased to US$4.21 million from US$3.54 million year-over-year, highlighting ongoing financial challenges. The company maintains a strong balance sheet with short-term assets of US$24.8M exceeding liabilities and remains debt-free for five years, though it faces cash runway constraints under one year if current free cash flow trends persist. Recent board changes and shelf registration filings suggest strategic adjustments underway.

- Dive into the specifics of Dominari Holdings here with our thorough balance sheet health report.

- Gain insights into Dominari Holdings' historical outcomes by reviewing our past performance report.

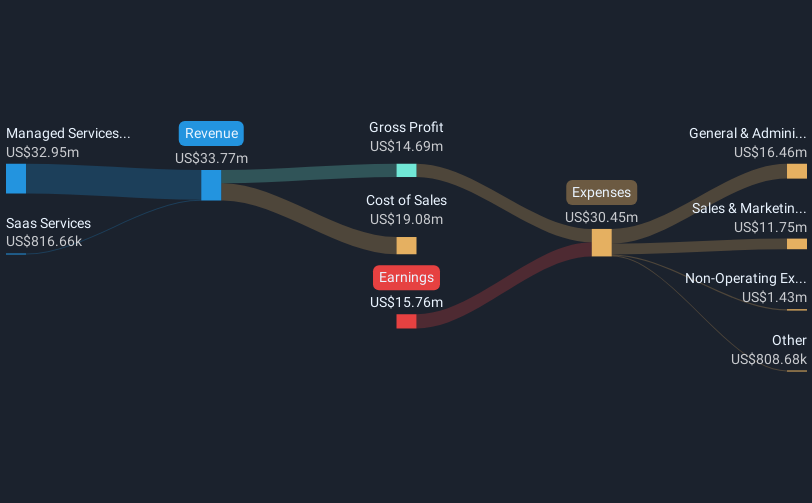

IZEA Worldwide (NasdaqCM:IZEA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IZEA Worldwide, Inc. operates by providing software and professional services that connect brands with content creators across North America, the Asia Pacific, and internationally, with a market cap of $45.13 million.

Operations: IZEA Worldwide generates revenue through two main segments: SaaS Services, contributing $0.82 million, and Managed Services, accounting for $32.95 million.

Market Cap: $45.13M

IZEA Worldwide, Inc., with a market cap of US$45.13 million, is unprofitable but maintains a solid financial position with short-term assets of US$62.7 million exceeding both its short and long-term liabilities. Despite reporting Q3 2024 sales of US$8.83 million, the company faced a net loss of US$8.77 million, partly due to a goodwill impairment charge of over $4 million. The management team is relatively new with an average tenure of 1.3 years; however, the board is seasoned with an average tenure exceeding 11 years. IZEA's revenue growth is forecasted at approximately 33% annually, supported by sufficient cash reserves for more than three years without debt concerns and recent strategic initiatives like shelf registration filings and potential acquisitions indicating future growth prospects.

- Take a closer look at IZEA Worldwide's potential here in our financial health report.

- Evaluate IZEA Worldwide's prospects by accessing our earnings growth report.

Where To Now?

- Take a closer look at our US Penny Stocks list of 713 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IZEA

IZEA Worldwide

Provides software and professional services to connect brands and content creators in North America, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives