- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

Will DLocal’s (DLO) Leadership Shift and Growth Guidance Redefine Its Long-Term Value Proposition?

Reviewed by Simply Wall St

- DLocal recently reported second-quarter and first-half 2025 earnings with revenue for the quarter rising to US$256.46 million and the company updating full-year guidance to anticipate 30%-40% annual growth, while also announcing the appointment of Guillermo López Pérez as Chief Financial Officer.

- The combination of robust revenue figures, improved multi-period profitability, and top leadership changes highlights a period of strong operational progress and ongoing focus on governance at DLocal.

- To assess the impact of these updates, we'll examine how sustained revenue momentum and a new CFO may influence DLocal's investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DLocal Investment Narrative Recap

For DLocal shareholders, the core belief centers on the company’s ability to drive strong, sustainable revenue growth from facilitating digital payments in emerging markets while managing exposure to volatile macroeconomic and regulatory conditions. The recent Q2 2025 results, with quarterly revenue of US$256.46 million and updated full-year revenue growth guidance of 30%-40%, reinforce revenue momentum as the main near-term catalyst, but these numbers have not materially reduced the most significant risk: dependence on a concentrated base of major merchants, which can create earnings volatility if any large client scales back operations.

Among the latest announcements, DLocal’s revenue guidance upgrade directly ties to its investment appeal as rapid top-line growth could help counterbalance pressures from margin compression or potential customer churn. Sustained execution on this front could gradually support diversification and reduce overreliance on key accounts, though core risks around concentration are not fully addressed by higher sales alone. Contrast this with the ongoing risk that rising regulatory, currency, and trade challenges in emerging markets could have a direct impact on net margins and earnings stability, something all investors should keep in mind as...

Read the full narrative on DLocal (it's free!)

DLocal's outlook anticipates $1.7 billion in revenue and $344.6 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 25.2% and an increase in earnings of about $198.7 million from the current $145.9 million.

Uncover how DLocal's forecasts yield a $13.90 fair value, a 4% downside to its current price.

Exploring Other Perspectives

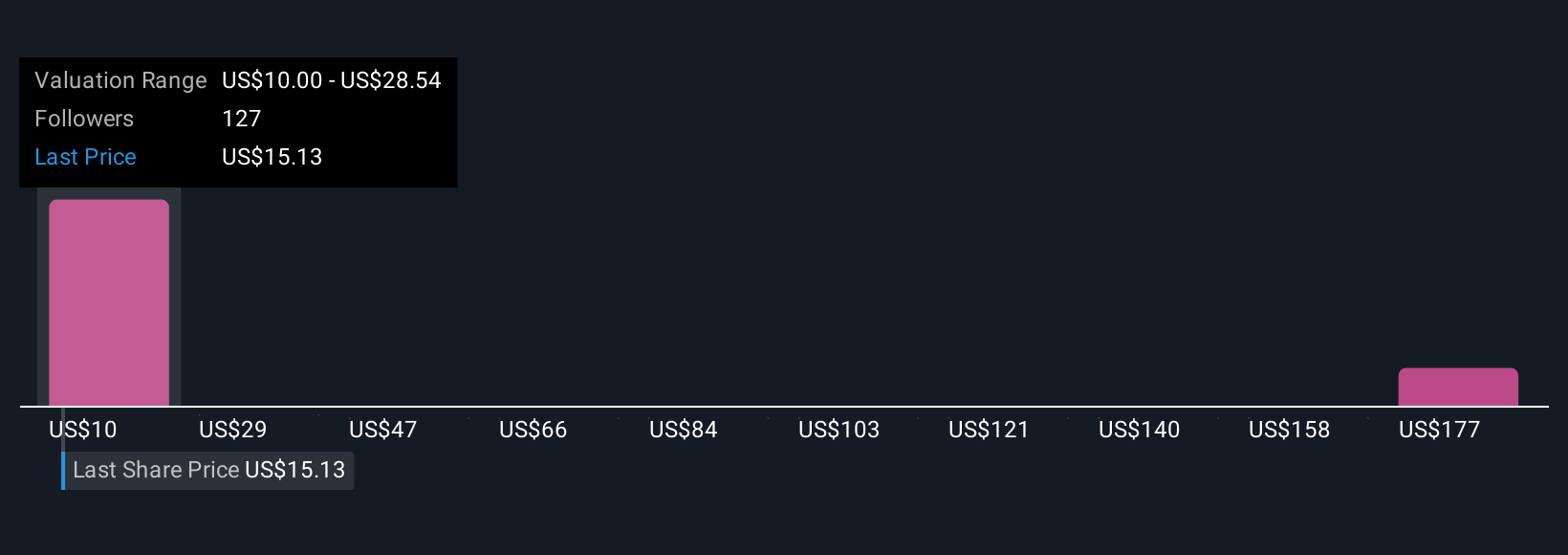

Fifteen members of the Simply Wall St Community put DLocal’s fair value between US$10 and US$195.39, highlighting dramatically different outlooks from investors. With worries about customer concentration still front and center, these varied opinions show how assessing growth versus risk remains central to understanding the company’s future.

Explore 15 other fair value estimates on DLocal - why the stock might be a potential multi-bagger!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives