- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

How Investors May Respond To DLocal (DLO) Launching Biometric Pix Checkout Integration In Brazil

Reviewed by Sasha Jovanovic

- dLocal recently launched Pix with Biometrics in Brazil, allowing shoppers to authenticate Pix payments via face or fingerprint directly at merchant checkout without being redirected to their banking app.

- This move deepens dLocal’s integration with Brazil’s instant payments ecosystem, aiming to simplify mobile checkout flows and potentially lift merchant conversion and transaction frequency.

- We’ll now examine how this frictionless Pix biometric authentication capability could influence dLocal’s broader investment narrative and long-term growth drivers.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

DLocal Investment Narrative Recap

To own dLocal, you need to believe it can remain a preferred payments partner for global merchants in emerging markets while defending margins as take rates face pressure and regulation stays fluid. The new Pix with Biometrics flow supports the near term catalyst of product expansion around instant payments, but it does not materially change the key risk that a handful of large customers still drive a significant share of revenue.

The most relevant recent announcement here is dLocal’s commitment to roll out every new Pix feature from Brazil’s Central Bank to its global merchant base, alongside its broader SmartPix offering. Together, these Pix initiatives strengthen dLocal’s position in Brazil’s booming instant payments ecosystem, which sits at the heart of its product led growth story and its push to deepen share of wallet with existing multinational clients.

Yet while Brazil looks like a payments success story, investors should also be aware of growing regulatory and tax complexity across dLocal’s key markets, including...

Read the full narrative on DLocal (it's free!)

DLocal's narrative projects $1.7 billion revenue and $346.3 million earnings by 2028. This requires 25.7% yearly revenue growth and about a $200 million earnings increase from $145.9 million today.

Uncover how DLocal's forecasts yield a $17.28 fair value, a 31% upside to its current price.

Exploring Other Perspectives

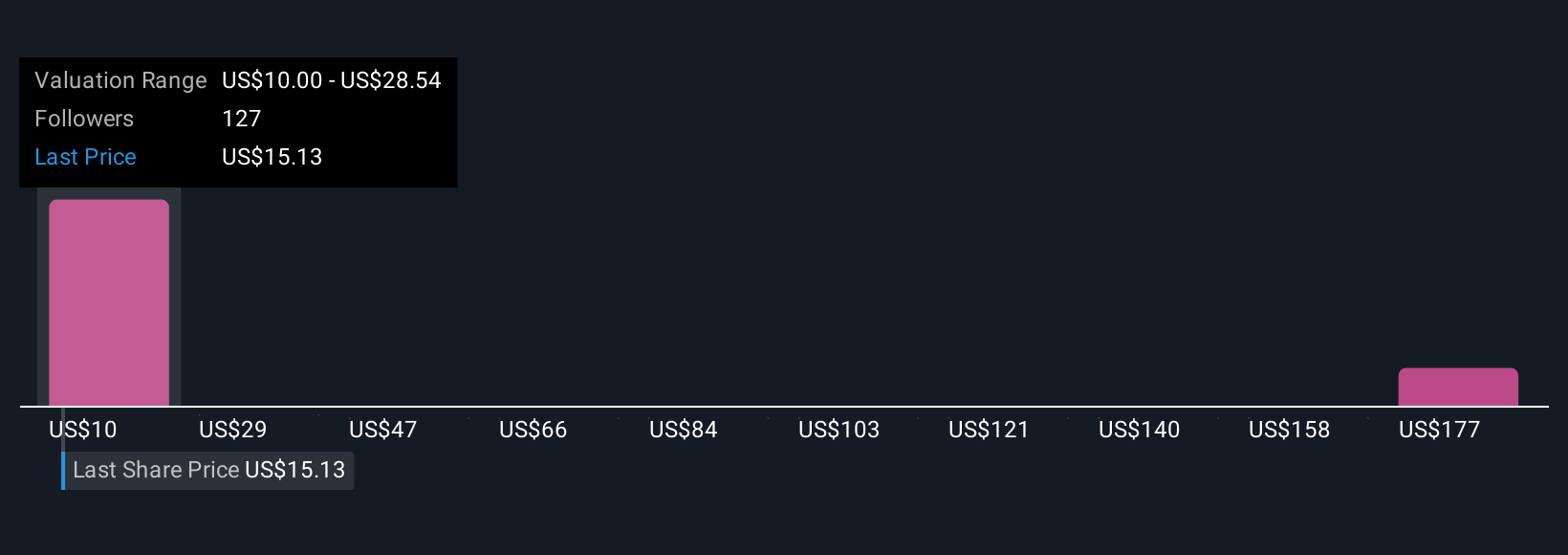

Twenty three fair value estimates from the Simply Wall St Community span from US$10 to US$195.39, showing just how far apart opinions can be on dLocal. Set against this, the company’s push into Pix biometrics highlights how product breadth in instant payments could matter more than any single growth forecast, so it makes sense to weigh several different viewpoints before deciding how this fits your portfolio.

Explore 23 other fair value estimates on DLocal - why the stock might be worth 24% less than the current price!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026