- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

Did dLocal’s (DLO) Alchemy Pay Partnership Just Shift Its Crypto Payments Investment Narrative?

Reviewed by Sasha Jovanovic

- Alchemy Pay announced a partnership with dLocal to integrate dLocal’s local payment infrastructure and enable instant bank transfers in Argentina, supporting faster fiat-crypto conversions and expanding payment solutions across Latin America.

- This move highlights increasing demand for seamless, localized crypto payments within emerging markets, as fintech companies seek to bridge traditional and digital financial systems.

- We’ll examine how dLocal’s integration of crypto-to-fiat capabilities through Alchemy Pay may reshape its investment narrative and future growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

DLocal Investment Narrative Recap

Shareholders in DLocal need to believe in sustained digitization of payments in emerging markets and the company’s ability to broaden and diversify its client base. The recent partnership with Alchemy Pay aims to expand crypto-to-fiat payment solutions in Latin America, but it does not directly change the immediate story around customer concentration risk, which remains the most important short-term issue, nor does it materially affect the current main growth catalysts.

The September alliance with Western Union is especially relevant, as it builds on DLocal’s push to extend its local payments reach across Latin America and offer more value to global merchants. This combination of new partnerships and product innovation continues to reinforce one of DLocal’s critical long-term growth drivers.

On the other hand, investors should be acutely aware of how heavily DLocal relies on revenue from its top merchants, as...

Read the full narrative on DLocal (it's free!)

DLocal's narrative projects $1.7 billion revenue and $346.3 million earnings by 2028. This requires 25.7% yearly revenue growth and a $200.4 million earnings increase from $145.9 million today.

Uncover how DLocal's forecasts yield a $15.94 fair value, a 5% upside to its current price.

Exploring Other Perspectives

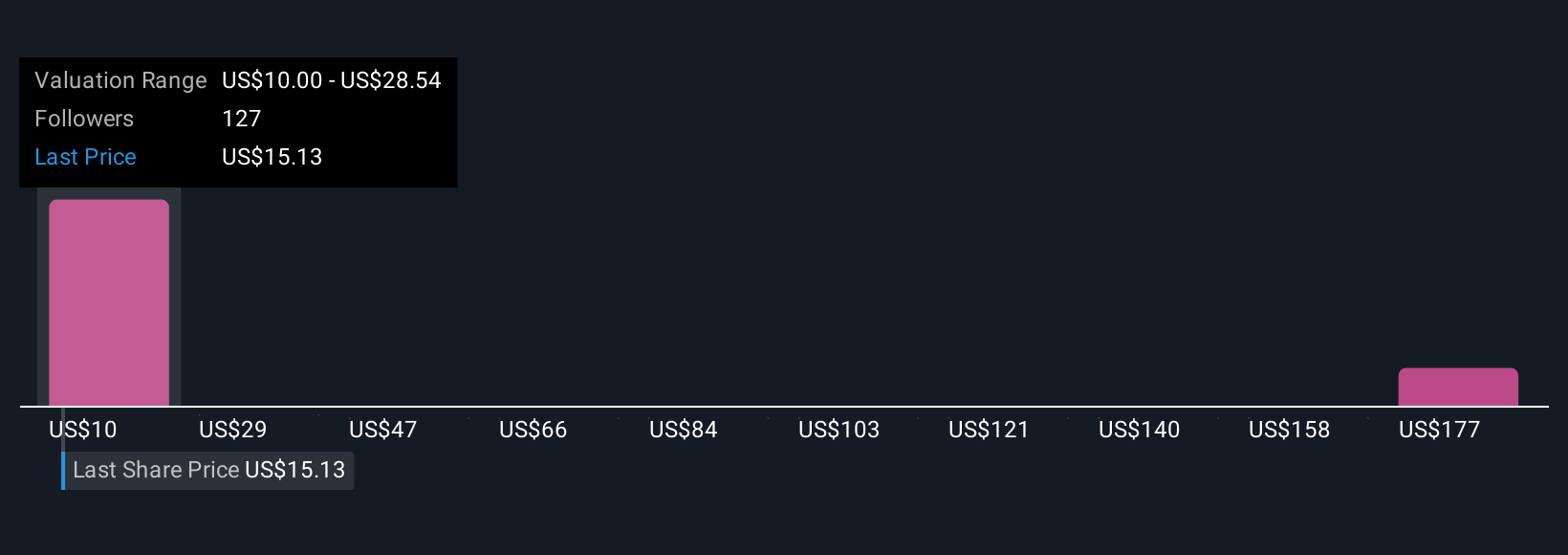

Twenty-one community-sourced fair values for DLocal range widely from US$10 to US$195.39, highlighting highly divergent views. Amid this diversity, DLocal’s concentrated merchant exposure could quickly affect outlooks if major clients scale back, so consider several opinions before deciding.

Explore 21 other fair value estimates on DLocal - why the stock might be a potential multi-bagger!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026