- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

How Capital Southwest’s (CSWC) New Supplemental Dividend Shapes Its Shareholder Commitment Narrative

Reviewed by Sasha Jovanovic

- Capital Southwest Corporation has announced a supplemental quarterly dividend of US$0.06 per share for the quarter ending March 31, 2026, in addition to affirming monthly dividends of US$0.1934 per share for January and February 2026, with respective ex-dividend and payment dates.

- The announcement of both supplemental and regular dividends highlights the company’s ongoing commitment to shareholder distributions, a move that often signals operational confidence and financial reliability.

- We'll consider how Capital Southwest's commitment to supplemental and regular dividends influences its investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Capital Southwest Investment Narrative Recap

To invest in Capital Southwest is to believe in the sustained opportunity of the lower middle market, the resilience of fee and dividend income through market cycles, and a disciplined approach to lending amidst increasing competition and tight spreads. The recent announcement of both supplemental and regular dividends underscores the company’s intent to maintain attractive shareholder distributions, but does not materially change the outlook for the most important short-term catalyst, expanded lending opportunity from private equity flows, or the primary risk, which remains ongoing spread compression due to competition and pricing pressure.

Among recent updates, the affirmation and scheduling of regular monthly dividends of US$0.1934 per share for January and February 2026 is especially relevant. This demonstrates a continuity in Capital Southwest’s approach to recurring, predictable payouts, reinforcing reliability at a time when dividend sustainability depends in part on healthy portfolio yields and the ability to harvest capital gains amidst a competitive deal environment. The more pressing question is whether heavy reliance on gains from equity co-investments to support these distributions could expose investors to concentrated risk if market dynamics shift...

Read the full narrative on Capital Southwest (it's free!)

Capital Southwest's narrative projects $283.9 million in revenue and $196.4 million in earnings by 2028. This requires 10.7% yearly revenue growth and a $113.9 million increase in earnings from $82.5 million today.

Uncover how Capital Southwest's forecasts yield a $24.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

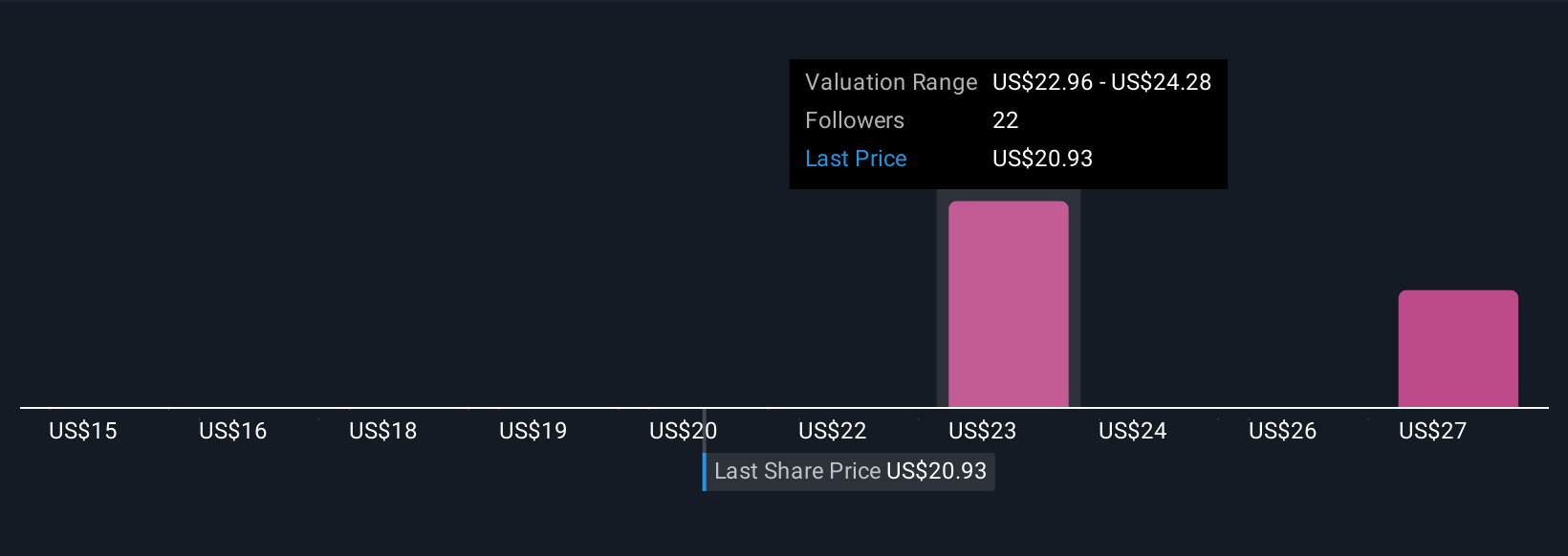

Six members of the Simply Wall St Community have issued fair value estimates for Capital Southwest in a wide range from US$18.95 to US$28.26 per share. With views spanning nearly US$10 per share, these opinions contrast the ongoing sector risk of spread compression, inviting you to consider multiple paths for the company’s future.

Explore 6 other fair value estimates on Capital Southwest - why the stock might be worth as much as 31% more than the current price!

Build Your Own Capital Southwest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Southwest research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Capital Southwest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Southwest's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

Specializes in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.