- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

Assessing Capital Southwest Shares After a 12% Drop and Latest Regulatory Buzz

Reviewed by Bailey Pemberton

Trying to figure out what to do with your Capital Southwest shares, or whether now is the right time to get in? You are definitely not alone. This is a stock that has kept investors on their toes, especially after some recent price swings. Over the last month, shares dropped nearly 12%, which caught some folks off guard, considering that the three- and five-year returns have been truly impressive at 61.9% and 155.5% respectively. After a bumpy month, though, things have settled a bit in the past week with a modest 1.0% uptick, and the stock closed recently at $20.39.

Behind the scenes, much of this movement can be traced back to a mix of sector sentiment and fresh headlines. Capital Southwest is best known as a business development company, and changes in the economic outlook or credit markets tend to ripple through the whole sector. Most recently, there has been buzz about regulatory adjustments that could affect lending activity, and some optimism around potential deal flow that often comes with market fluctuations like these. That has helped to steady investors’ nerves somewhat, even as the stock’s long-term run shows it may be more resilient than the latest dip suggests.

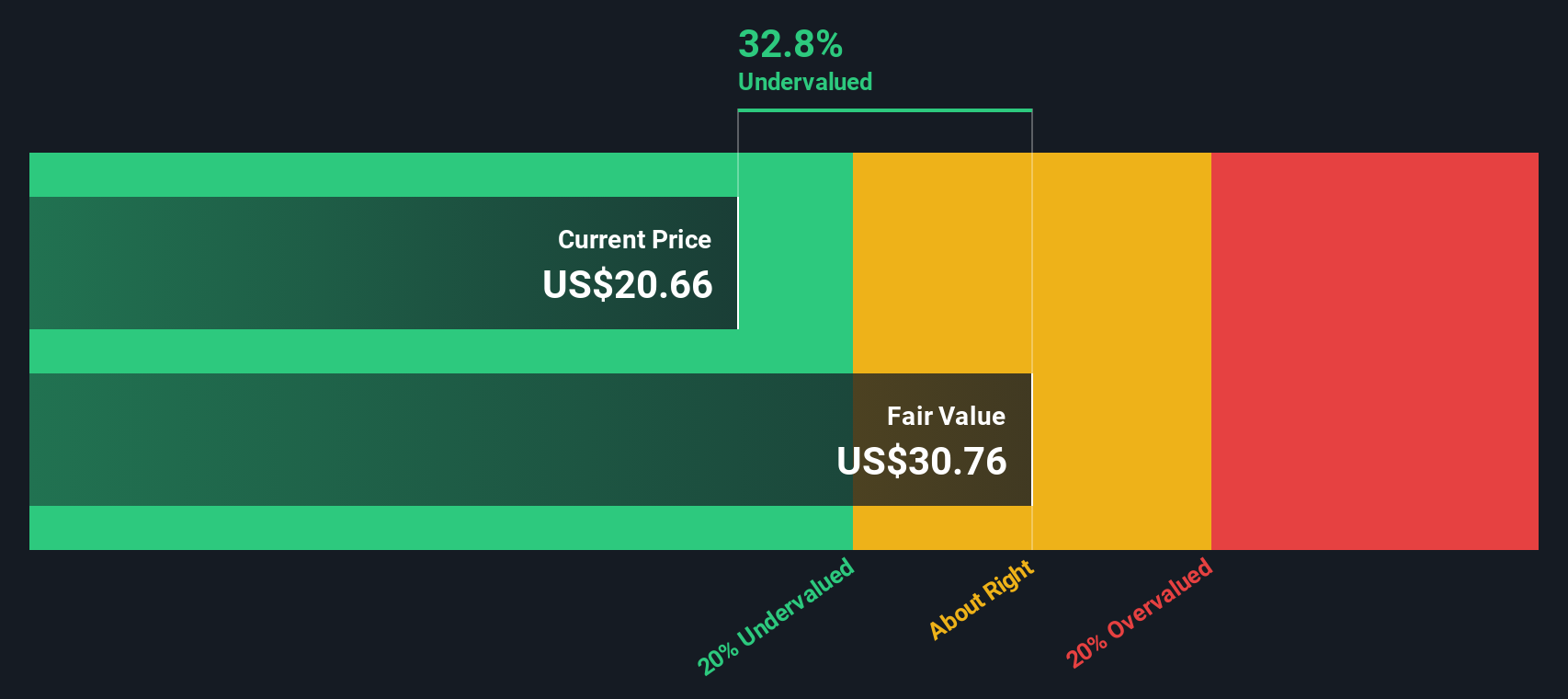

So, where does that leave us with valuation? Based on six popular metrics, Capital Southwest comes in strong with a value score of 5, which means it is checking almost every box when it comes to undervaluation. If you care about not overpaying for growth, this is an eye-catching figure.

But knowing where the company stands on paper is just one part of the puzzle. Next, let’s break down how Capital Southwest stacks up across the main valuation methods investors rely on, and consider whether there might be a smarter, more holistic way to understand what this company is really worth.

Why Capital Southwest is lagging behind its peers

Approach 1: Capital Southwest Excess Returns Analysis

The Excess Returns valuation approach looks beyond simple earnings multiples and instead evaluates how efficiently a company transforms its capital into profits that exceed its cost of equity. For Capital Southwest, this model factors in both the company’s ability to grow shareholder equity and generate ongoing returns above its required cost of capital.

By the numbers, Capital Southwest posts a Book Value of $16.59 per share and a Stable EPS of $2.37 per share, based on forecasts from four analysts. Its calculated Cost of Equity stands at $1.62 per share, while the company is delivering an Excess Return of $0.75 per share. The Average Return on Equity, a key signpost of management performance, is a notable 14.28%. The Stable Book Value, reflecting a five-year median, also comes in at $16.59 per share, which points to a consistent foundation for the business.

Based on the Excess Returns model, Capital Southwest’s estimated intrinsic value is $27.82 per share, which is 26.7% above the current market price. This suggests the stock remains significantly undervalued relative to the returns it is able to generate above its cost of capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests Capital Southwest is undervalued by 26.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

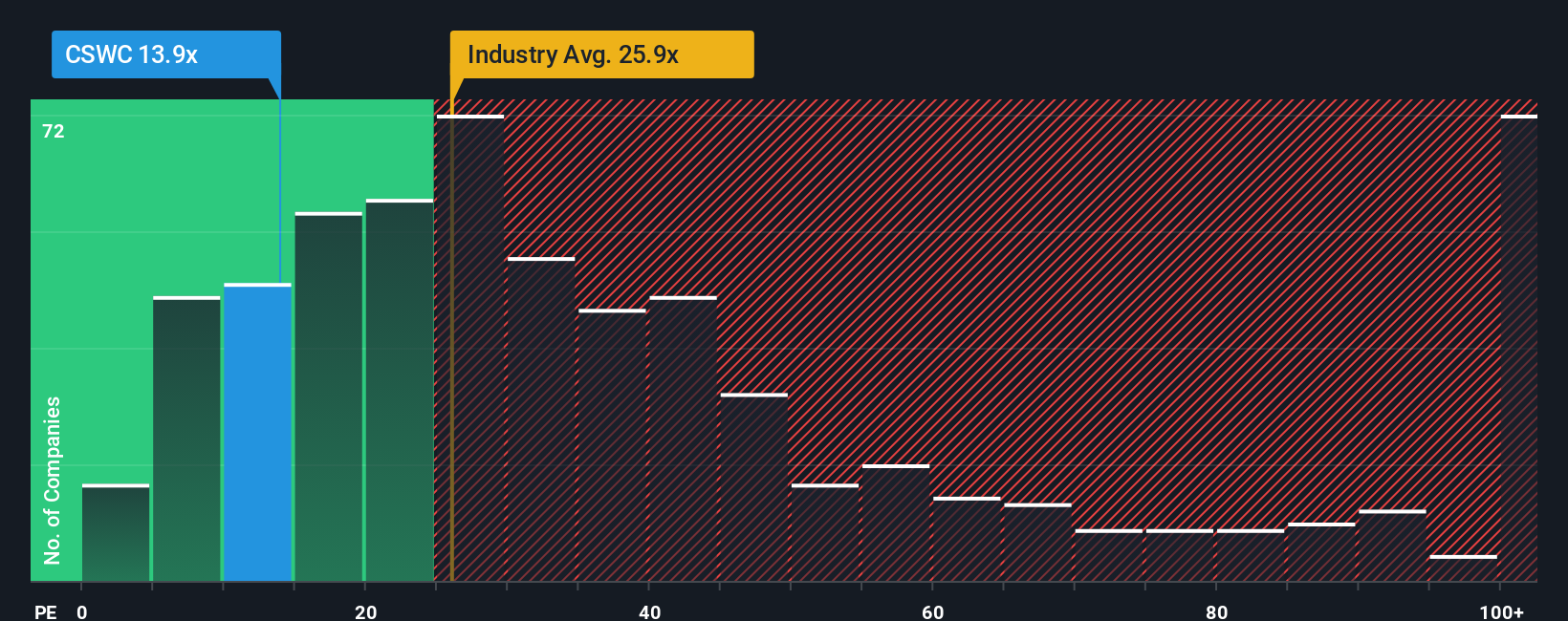

Approach 2: Capital Southwest Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies, as it directly relates a company's share price to its earnings. This measure allows investors to quickly compare how much they are paying for each dollar of profit, making it especially useful for steady, income-generating businesses like Capital Southwest.

In general, a "normal" or "fair" PE ratio depends on what the market expects in terms of growth and how much risk is attached to those earnings. Companies with higher growth prospects or lower risk typically trade at higher PE ratios, while slower-growing or riskier businesses might command a discount.

Currently, Capital Southwest sports a PE ratio of 13.7x. This stands well below both its industry average of 25.7x and its peer group’s average of 24.6x. At first glance, this suggests the stock might be undervalued. However, Simply Wall St’s Fair Ratio for Capital Southwest is 15.2x, a figure that adjusts for the company’s specific growth outlook, profit margins, risk factors, and market cap. The Fair Ratio offers a more nuanced benchmark than simple industry or peer comparisons, since it tailors expectations to Capital Southwest’s unique characteristics rather than relying on broad averages.

Comparing the Fair Ratio of 15.2x to the actual PE of 13.7x, the stock appears modestly undervalued on this measure, but not by a huge margin. Investors could see this as a reasonable entry point, with some upside potential if the company continues to deliver steady earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

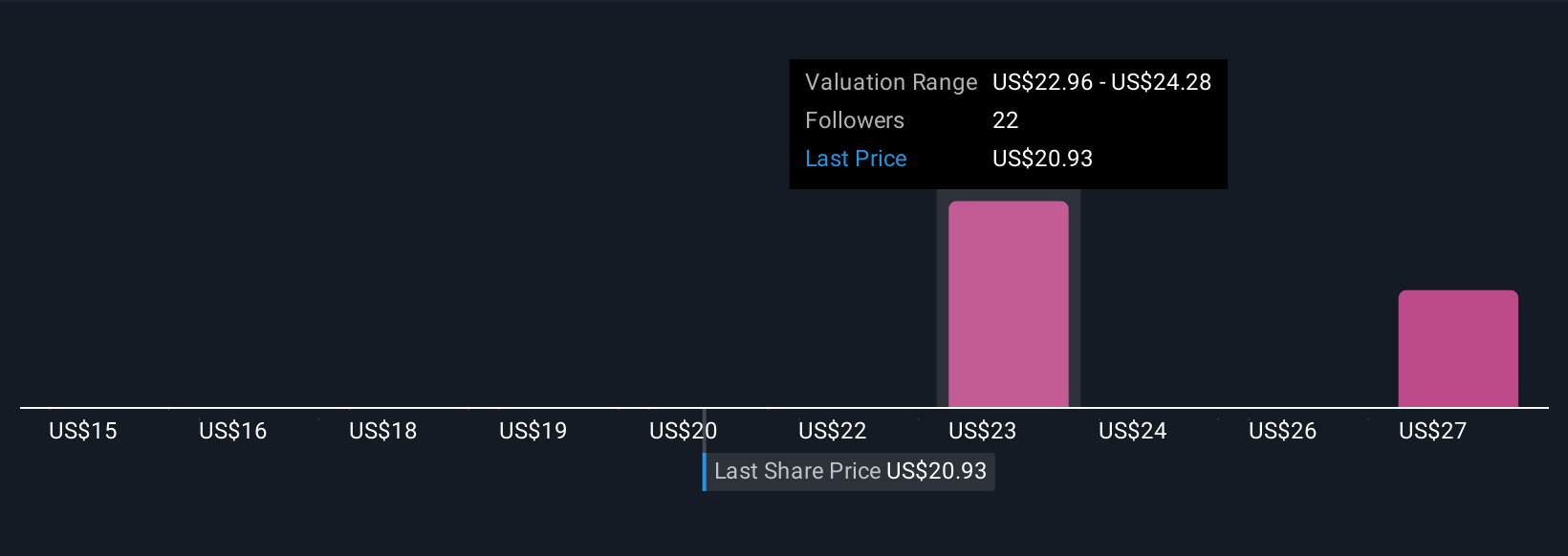

Upgrade Your Decision Making: Choose your Capital Southwest Narrative

Earlier, we mentioned that there's a more holistic way to think about valuation, so let's introduce you to Narratives. A Narrative is your personal investment story for a company—a clear, structured summary of how you see its future, including what you expect for revenue, earnings, and profit margins, and the fair value those forecasts imply.

Narratives help investors connect the company's story, such as new lending opportunities or sector risks, with a real financial forecast and an explicit fair value. This approach makes decisions about buying or selling much clearer. Narratives are easy to create and update, and on Simply Wall St’s Community page, millions of investors share and refine them. This allows you to see multiple perspectives on the same stock.

When news or earnings updates arrive, Narratives automatically adjust forecasts and fair value estimates, so your insights are always up to date. For example, with Capital Southwest, one investor’s Narrative might account for robust private equity relationships and regulatory tailwinds, resulting in a fair value as high as $27.00 per share. Meanwhile, another investor concerned about margin compression and earnings risks may estimate a fair value closer to $21.00.

With Narratives, you gain a dynamic, user-friendly way to see your investment logic in action and compare it with others. This empowers stronger, more confident decisions.

Do you think there's more to the story for Capital Southwest? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

Specializes in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives