- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Why Coinbase (COIN) Is Up 9.3% After Webuy Global Integrates Coinbase Commerce for Crypto Payments - And What's Next

Reviewed by Simply Wall St

- In June 2025, Webuy Global integrated Coinbase Commerce, allowing global customers to use a wide range of cryptocurrencies, including stablecoin USDC, for travel bookings and products.

- This partnership highlights how stablecoin payments can improve cross-border transactions, lessen foreign exchange risks, and extend the practical use of digital assets in the travel sector.

- We'll examine how Coinbase's expanding payment integrations, such as the Webuy Global partnership, may influence its long-term investment outlook.

Coinbase Global Investment Narrative Recap

To be a Coinbase shareholder, you need to believe in the mainstream adoption of cryptocurrencies and the company’s ability to expand its services beyond trading. The Webuy Global integration underscores Coinbase’s drive to embed stablecoin payments into cross-border commerce, but this event does not materially alter the immediate catalysts for the business, with short-term results still heavily reliant on trading volumes and regulatory clarity. The biggest risk remains market volatility, which can directly impact transaction-based revenues. Among recent announcements, the acquisition of Deribit stands out, as it aligns with Coinbase’s focus on expanding its presence in derivatives. Derivatives trading is an important growth lever and supports diversification, but comes with lower fee structures and profitability pressures, which investors should factor into their view of short- to medium-term earnings drivers. On the other hand, investors should be aware that new stablecoin partnerships are expanding quickly, but ...

Read the full narrative on Coinbase Global (it's free!)

Coinbase Global's narrative projects $8.0 billion in revenue and $2.0 billion in earnings by 2028. This requires 8.3% yearly revenue growth and a $0.6 billion decrease in earnings from $2.6 billion today.

Exploring Other Perspectives

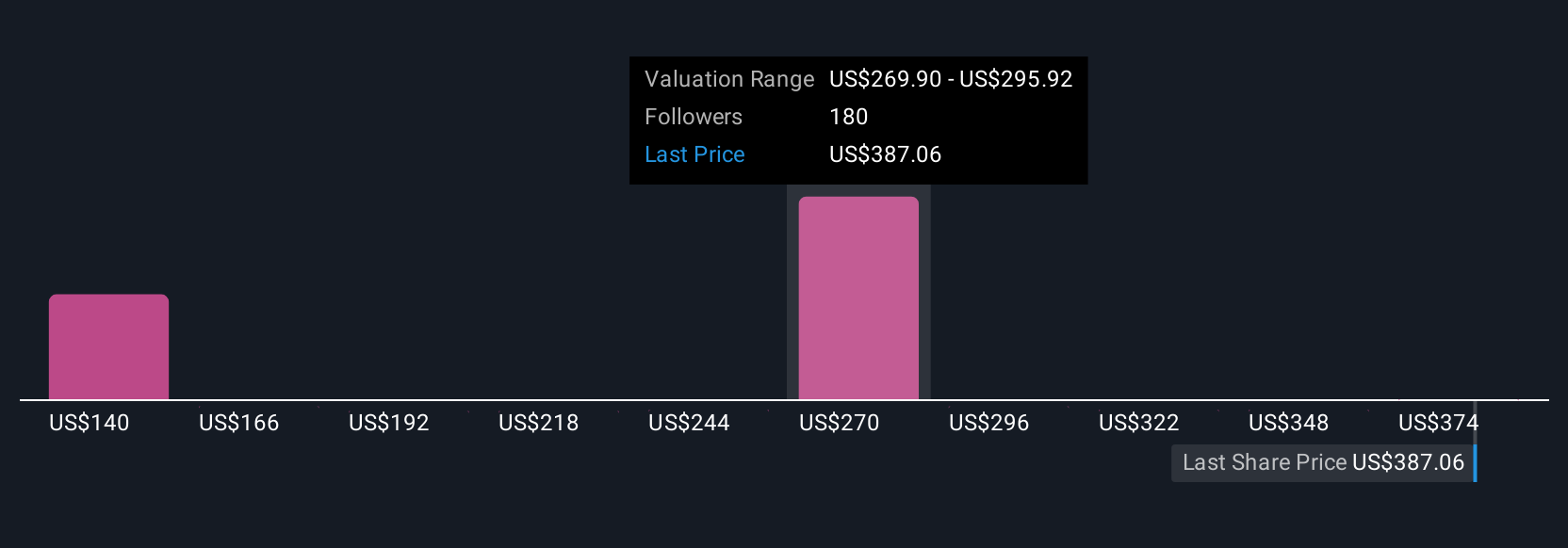

Twenty-five members of the Simply Wall St Community estimate Coinbase’s fair value between US$140 and US$400 per share. With regulatory developments a key catalyst, investor opinions can vary widely, so explore multiple viewpoints.

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

No Opportunity In Coinbase Global?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives