- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

The Bull Case For Coinbase (COIN) Could Change Following Norges Bank’s $1B Bet And Fresh Crypto Tailwinds

Reviewed by Sasha Jovanovic

- Norges Bank recently invested about US$1.04 billion in Coinbase, coinciding with Q3 2025 results showing US$1.9 billion in revenue and a profit margin near 45%, while the company also faced a €21.5 million anti-money laundering fine in Ireland and pursued new CFTC-related regulatory proposals.

- At the same time, a powerful Bitcoin rally, mixed analyst opinions, insider share sales, and anticipation for Coinbase’s December 17 product reveal have collectively highlighted how tightly the company’s fortunes remain linked to broader crypto sentiment and evolving regulation.

- With strong institutional interest emerging alongside Bitcoin’s surge, we’ll examine how this renewed crypto momentum reshapes Coinbase’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coinbase Global Investment Narrative Recap

To own Coinbase, you need to believe crypto adoption and on-chain finance keep expanding, and that Coinbase can convert that into sustainable, diversified earnings beyond pure trading. The biggest near term catalyst is the December 17 product reveal, which could influence how investors view that diversification story, while the largest current risk remains the company’s tight linkage to crypto volatility rather than this quarter’s Irish fine or individual analyst calls.

Against this backdrop, Norges Bank’s roughly US$1.04 billion stake and Coinbase’s Q3 2025 profit margin near 45% stand out as most relevant, reinforcing that large institutions are engaging even as Bitcoin driven swings and mixed analyst opinions keep sentiment fragile. How this institutional interest interacts with any new CFTC related products and derivatives focused offerings will likely frame how investors think about Coinbase’s ability to grow beyond spot trading as crypto cycles continue.

Yet beneath the Bitcoin rally, investors should also be aware that prolonged periods of lower trading activity could...

Read the full narrative on Coinbase Global (it's free!)

Coinbase Global's narrative projects $8.5 billion revenue and $2.1 billion earnings by 2028. This requires 8.3% yearly revenue growth and a $0.8 billion earnings decrease from $2.9 billion.

Uncover how Coinbase Global's forecasts yield a $383.46 fair value, a 40% upside to its current price.

Exploring Other Perspectives

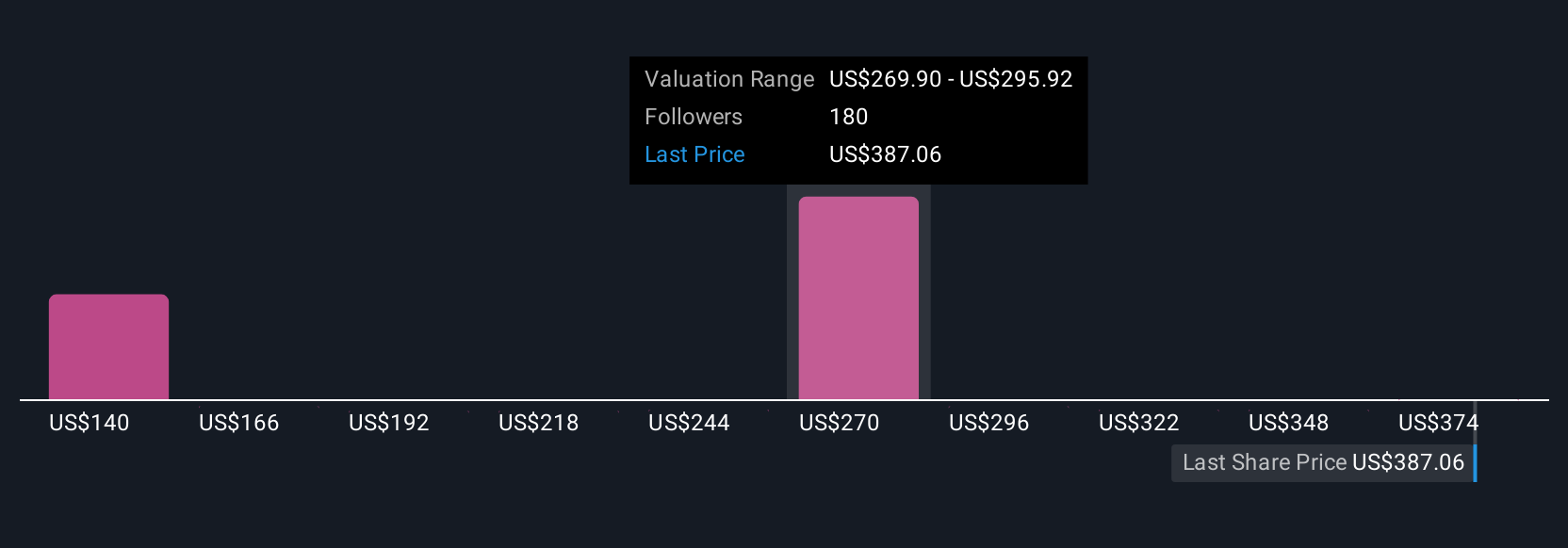

The Simply Wall St Community’s 28 fair value estimates for Coinbase span roughly US$127 to US$510 per share, showing how far apart individual views can be. When you set those side by side with Coinbase’s heavy reliance on trading volumes, it becomes clear why exploring multiple perspectives on future activity and revenue durability really matters.

Explore 28 other fair value estimates on Coinbase Global - why the stock might be worth less than half the current price!

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

No Opportunity In Coinbase Global?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026