- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

How Should Investors View Coinbase as Shares Jump 61% Amid Regulatory Shift?

Reviewed by Bailey Pemberton

If you are wrestling with what to do next about Coinbase Global stock, you are not alone. Plenty of investors are trying to figure out whether now is the moment to buy, hold, or take profits on a company that continues to capture headlines and drive conversations in the world of digital assets. Over the past year, Coinbase shares have soared an impressive 61.0%, and year to date, they are up nearly 25%. Still, anyone who has been around long enough knows that those gains come with no shortage of volatility. Just look at this past week, where the stock slipped 4.7%, extending a modest 30-day decline of 3.5%.

This rollercoaster ride does not happen in a vacuum. Recent news has highlighted regulatory clarity making its way through Washington, alongside growing acceptance of established crypto firms by traditional financial institutions. Both trends have helped change the way investors perceive the risks and rewards of Coinbase stock. On the flip side, some of the latest trading volume data from major crypto exchanges has stoked caution, reminding everyone that revenue swings can be sharp.

All of this adds up to a tricky puzzle about valuation. Based on our six-point system for finding undervalued companies, Coinbase Global only checks the box in one category, for a valuation score of 1. That may leave some investors with mixed feelings about whether the stock is actually a deal at current levels. Next, let’s dig into the details of these valuation methods. Stick around for a look at one potentially more insightful way to judge Coinbase’s true worth, beyond the numbers alone.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

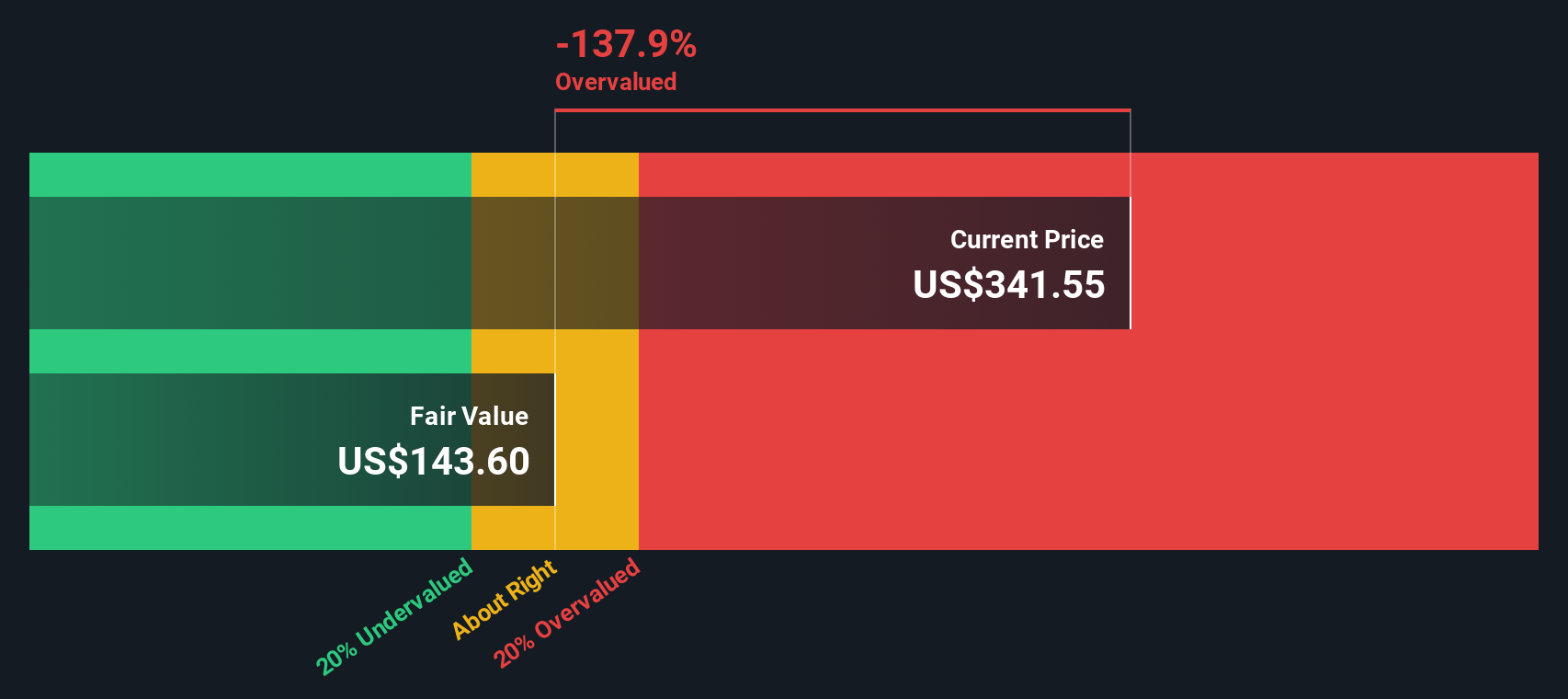

The Excess Returns valuation model measures how much value a company creates above the cost of its equity capital. It is especially useful for assessing companies in rapidly changing industries, as it focuses on the actual returns generated on invested capital versus the required rates of return expected by shareholders. For Coinbase Global, this model highlights whether the business is deploying its resources efficiently to create lasting shareholder value.

According to the latest data, Coinbase's Book Value stands at $47.17 per share, while its Stable Earnings Per Share (EPS), as estimated from a blend of six analyst forecasts, is $9.22. Against this, the calculated Cost of Equity comes to $4.82 per share, meaning the company is generating an Excess Return, or surplus over its required cost, of $4.40 per share. Coinbase’s Average Return on Equity is a robust 15.64%, and its Stable Book Value is projected to rise to $58.96 per share, based on estimates from three analysts.

Despite these strong return metrics, the model suggests Coinbase stock is trading at a 120.4% premium to its estimated intrinsic value. This significant overvaluation implies investors may be paying well above what the company’s fundamentals justify at the moment.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 120.4%. Find undervalued stocks or create your own screener to find better value opportunities.

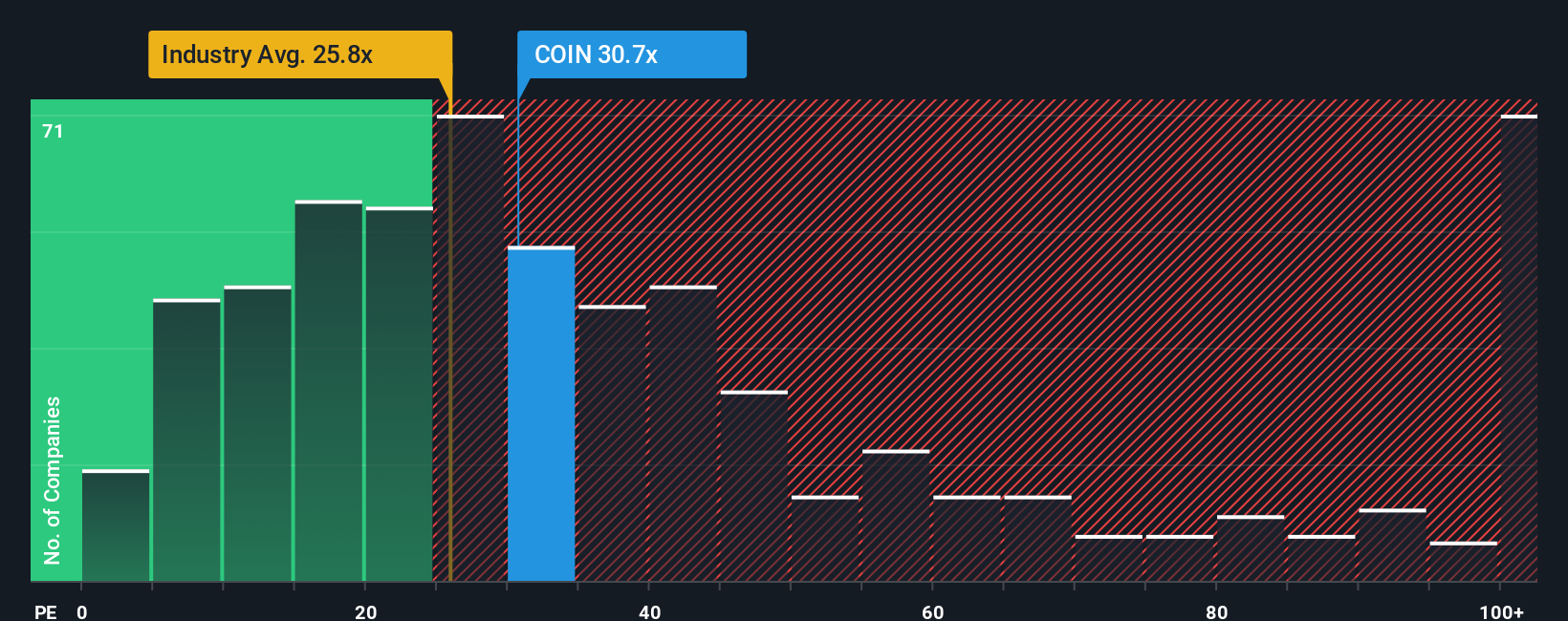

Approach 2: Coinbase Global Price vs Earnings

The Price-to-Earnings (PE) ratio is often the favored metric for profitable companies, as it shows how much investors are willing to pay for each dollar of the company's earnings. For businesses like Coinbase Global that generate consistent profits, the PE ratio provides a clear and direct way to value those earnings in the context of current market sentiment.

Of course, what qualifies as a "normal" or "fair" PE ratio is shaped by factors such as growth expectations and perceived risks. Higher growth prospects often justify a higher PE, while increased risks or uncertain earnings typically lead to a lower ratio. This is why comparing Coinbase’s PE to a variety of benchmarks is important for context.

Coinbase currently trades at a 28.8x earnings multiple. This is above the Capital Markets industry average of 25.9x but below the peer average of 33.0x. More importantly, Simply Wall St’s proprietary “Fair Ratio,” which adjusts for company-specific factors like growth, profit margins, risk, industry, and market cap, sits at 19.9x. The Fair Ratio goes deeper than industry comparisons or peer groups. It offers a tailored benchmark for what Coinbase’s multiples should be when you factor in the nuances of its business profile.

Since Coinbase’s actual PE ratio is substantially above its Fair Ratio, this approach suggests that the stock is currently overvalued relative to its current fundamentals and growth outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

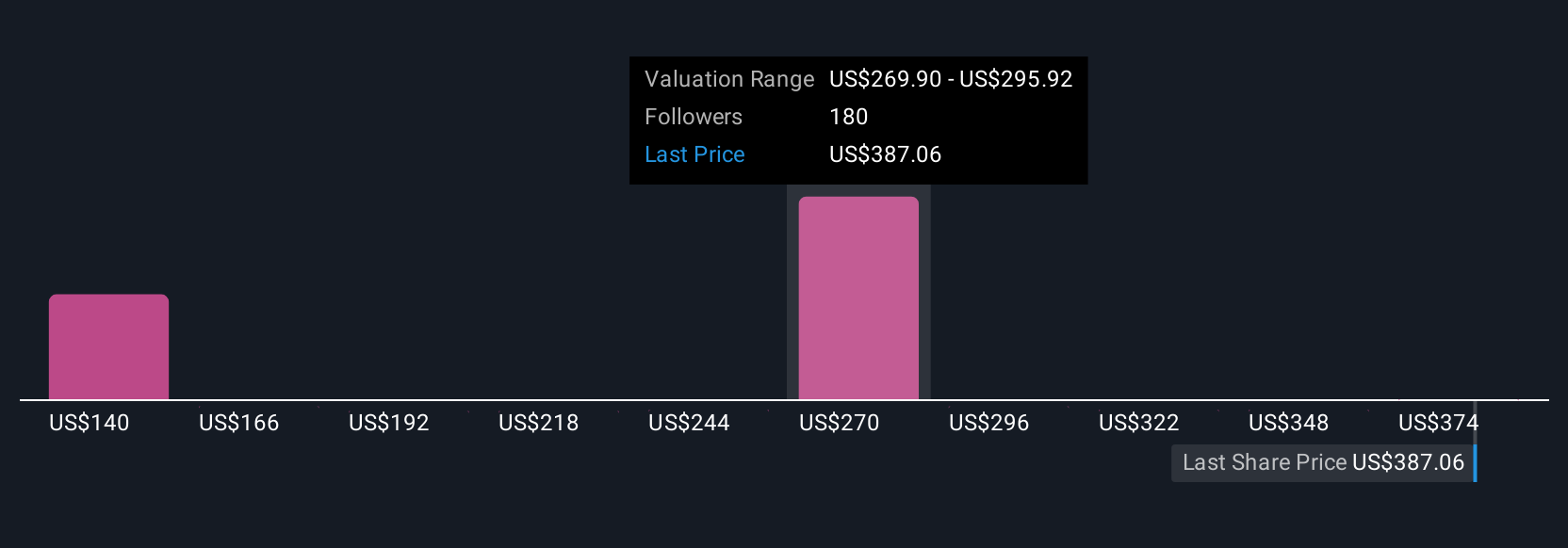

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, an investment tool that connects your perspective on a company's future to a concrete financial forecast and a resulting fair value.

With Narratives, you create or choose a story for Coinbase Global, outlining your beliefs about where revenue, earnings, and profit margins are headed, and see exactly how those assumptions drive your estimated fair value for the stock.

This approach goes beyond the numbers by illustrating how the reasons behind your forecast, such as market expansion, fee pressures, or new regulations, link directly to your valuation. This provides a clear bridge between each assumption and your investment thesis.

Narratives are straightforward to use and are available to everyone on Simply Wall St's Community page, where millions of investors share their outlooks, update them as news or earnings are released, and compare their fair value estimates with the current market price to help guide buy or sell decisions.

For example, one investor’s Narrative for Coinbase might focus on rising blockchain adoption and forecast rapid revenue growth, leading to a fair value above $500. A more cautious investor could highlight cybersecurity risks and falling trading volumes, resulting in a fair value closer to $185. This empowers you to find or build the Narrative that best matches your convictions.

Do you think there's more to the story for Coinbase Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives