- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase (COIN): Assessing Valuation Following Launch of Stablecoin-Focused Business Platform for Enterprises

Reviewed by Kshitija Bhandaru

Coinbase Global (COIN) has just launched Coinbase Business, a dedicated platform designed to help small and medium-sized businesses manage stablecoin payments, earn yield, and integrate crypto more easily. The rollout includes instant global payouts and USDC settlements, all with no gas or card processing fees. This provides a new alternative to traditional cross-border payment systems.

See our latest analysis for Coinbase Global.

Coinbase’s launch of its new business platform comes shortly after a series of high-profile moves, from a major acquisition bid for BVNK to fresh strategic partnerships and regulatory headlines. Despite bouts of volatility, the underlying story is momentum: the stock is up more than 30% year to date in share price terms, and long-term investors have seen a 406% total shareholder return over the last three years as digital asset adoption accelerates.

If the pace of innovation at Coinbase has you curious about what else is out there, now is the perfect moment to explore fast growing stocks with high insider ownership.

With the stock surging more than 30% this year, investors now face a key question: is Coinbase still trading below its true value, or has the market already priced in every catalyst for future growth?

Most Popular Narrative: 10% Undervalued

Coinbase’s most widely followed narrative points to fair value at $374.67 per share, which is notably higher than the recent closing price of $336.02. Current optimism centers on new business lines and how quickly Coinbase can convert innovation into earnings power.

The company's leadership in building trusted, compliant infrastructure has resulted in partnerships with major financial institutions (e.g., BlackRock, PNC, JPMorgan, Stripe, Shopify). This positions Coinbase as the preferred onramp for institutions entering the digital asset space and is seen as likely to drive institutional trading volumes and custody revenues higher over time.

Want to know the recipe for this narrative's premium valuation? It hinges on blockbuster profit projections, industry-high margins, and a bold assumption about the future earnings multiple. See what’s behind these numbers and find out what’s fueling this eye-catching target.

Result: Fair Value of $374.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cybersecurity threats and declining trading volumes remain significant risks that could shift the outlook for Coinbase's future growth and valuation.

Find out about the key risks to this Coinbase Global narrative.

Another View: What Do the Ratios Say?

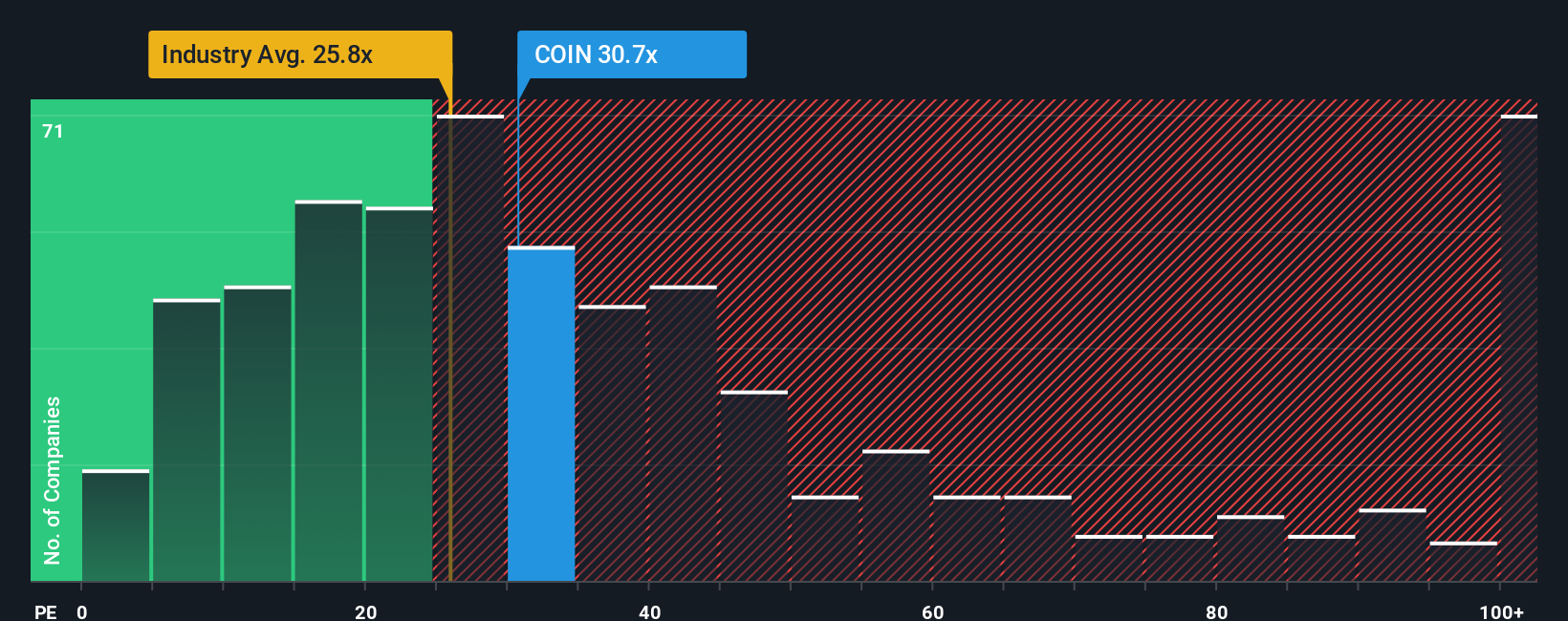

While the narrative model suggests Coinbase is undervalued, a look at its price-to-earnings ratio tells a different story. At 30.2x, Coinbase trades above both the industry average of 25.9x and its fair ratio of 19.9x. This premium signals investors are expecting more growth, but it could add valuation risk if future results disappoint. Is the optimism baked in, or just getting started?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coinbase Global Narrative

If the narrative model doesn’t line up with your perspective, or you’re keen to chart your own path, it takes just a few minutes to dig into the data and construct a story of your own. Do it your way.

A great starting point for your Coinbase Global research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t limit your opportunities to just one stock. The market is full of possibilities, and smart investors seize every chance to get ahead. Start your research now with these curated stock ideas:

- Grow your portfolio with stability and income by checking out these 18 dividend stocks with yields > 3%, which deliver reliable yields and strong fundamentals.

- Catch the next tech wave when you review these 24 AI penny stocks, featuring leaders in artificial intelligence shaping entire industries.

- Spot potential undervalued gems and maximize your gains through these 877 undervalued stocks based on cash flows, focusing on stocks with attractive valuations based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives