- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Is CME Group’s Recent Run Sustainable After Higher Trading Volumes in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your CME Group shares, or whether now is the time to jump in? You are not alone. CME Group has had an intriguing run lately. Just last week, the stock slipped 2.4%, but that follows a solid climb of 12.8% year-to-date and an impressive 20.7% surge over the past twelve months. Long-term holders have fared even better, with a nearly 97% total return over five years. These are not numbers you see every day, and they indicate that the market’s perception of CME Group’s risk and growth prospects has shifted upward, especially amid recent changes in global market volatility and trading volumes, an area where CME Group is a key player.

The big question for investors right now is whether CME Group is a bargain, or whether its market run has left it looking expensive. According to our valuation framework, which uses six checks to spot undervalued stocks, CME Group scores just a 1 out of 6. That means it is currently undervalued in only one area, so the overall picture is not indicating ‘deep value.’ However, that is not the whole story, and different valuation methods can provide very different perspectives on a company’s potential.

Let us step through the major approaches for valuing CME Group, piece by piece, before taking a closer look at what might be the most reliable way to assess its future rewards and risks.

CME Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CME Group Excess Returns Analysis

The Excess Returns model looks at a company’s ability to generate returns on invested capital above its cost of equity. Essentially, it tells us how profitably CME Group is deploying shareholder money compared to what investors would require as a minimum return. This lens is particularly insightful for financial companies because it highlights how efficiently capital is put to work and sustained over time.

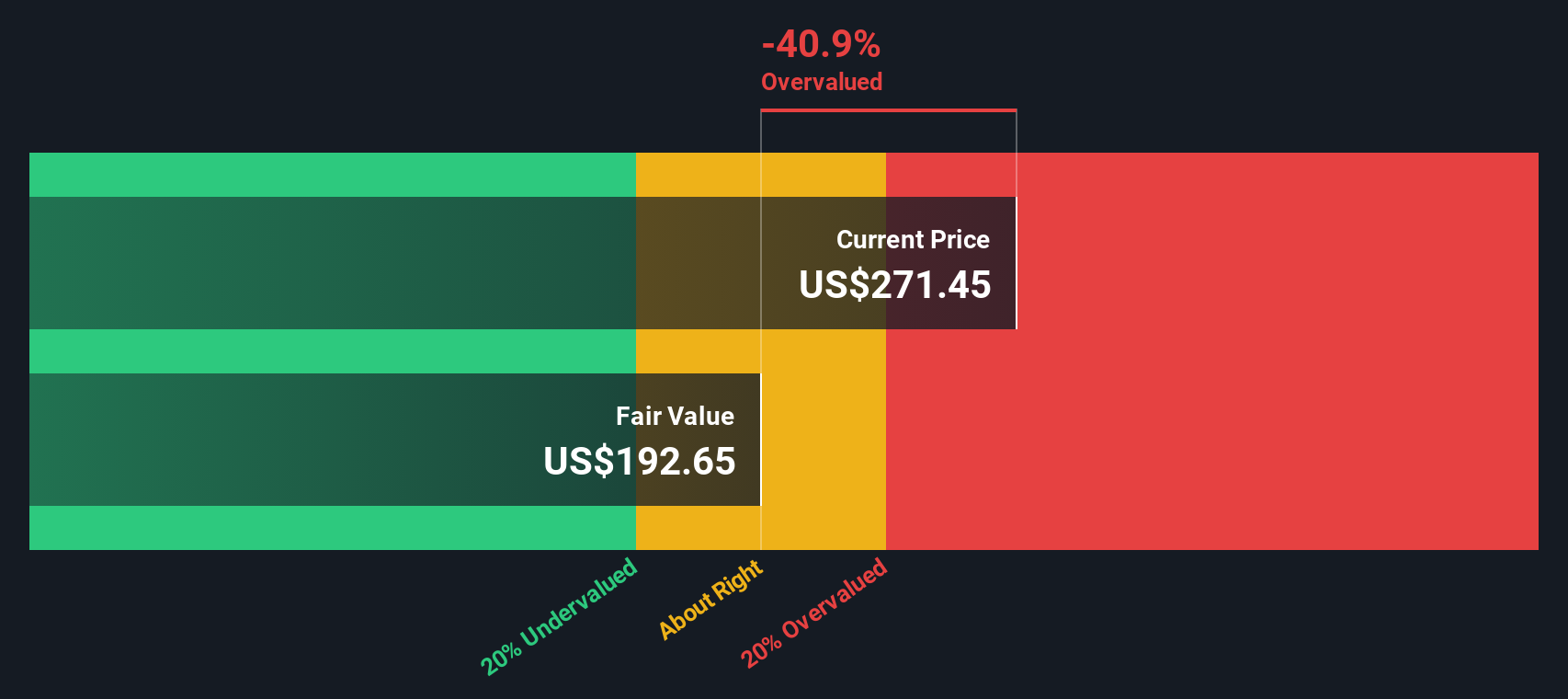

For CME Group, analysts estimate a Book Value of $77.13 per share and project a Stable EPS (Earnings Per Share) of $12.28, based on a blend of future Return on Equity estimates from eight analysts. The market’s required Cost of Equity is $6.42 per share, and CME Group is expected to achieve a consistent Excess Return of $5.85 per share. The average Return on Equity sits at a robust 15.56 percent, while the Stable Book Value is forecast at $78.88 per share, combining data from five analysts.

Using this approach, the intrinsic value of CME Group is estimated at $194.44 per share. With CME Group’s current share price about 35 percent above this mark, the Excess Returns model indicates the stock is significantly overvalued based on its long-run profit potential.

Result: OVERVALUED

Our Excess Returns analysis suggests CME Group may be overvalued by 35.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CME Group Price vs Earnings

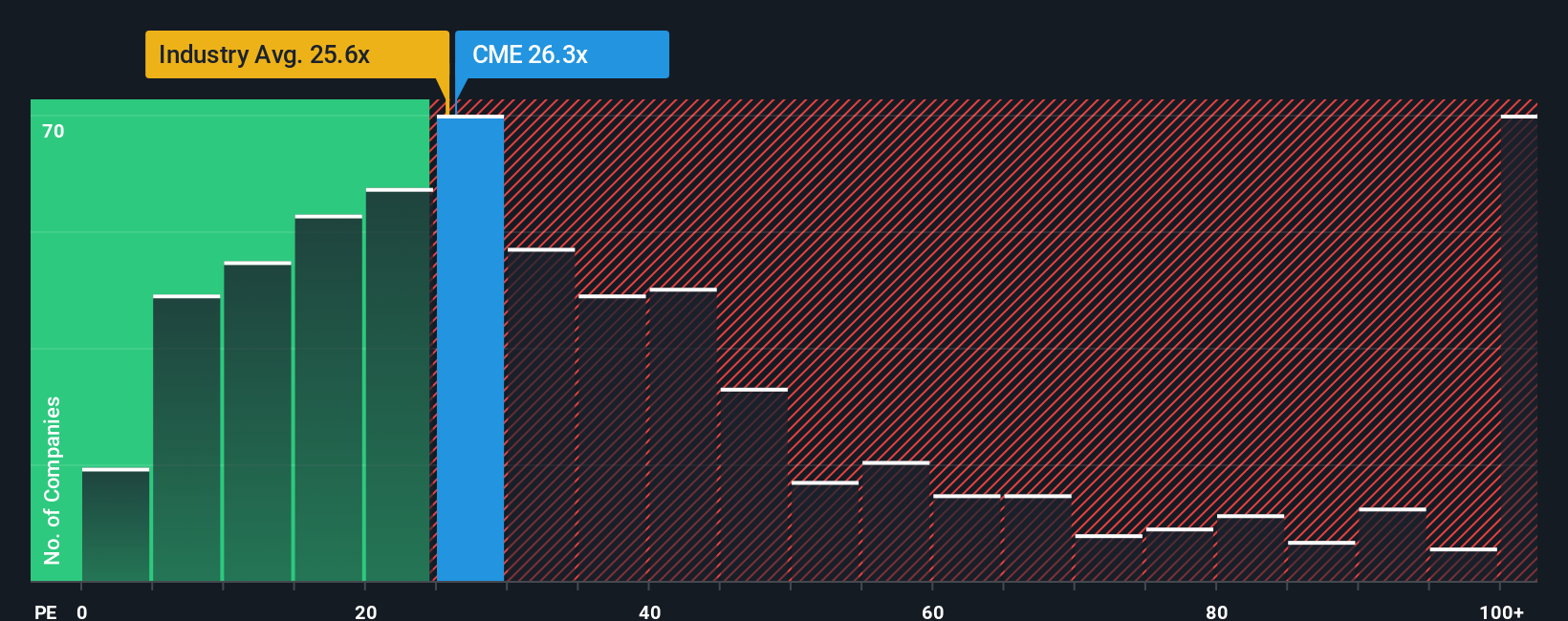

For profitable companies like CME Group, the Price-to-Earnings (PE) ratio is a widely trusted valuation metric. The PE ratio gives a quick sense of how much investors are willing to pay for each dollar of current earnings, which makes it especially relevant when earnings are steady or growing.

Growth expectations and risk play a big part in what a “normal” or “fair” PE ratio should be. Companies expected to grow faster or with more stable profit streams can justify higher multiples. Those with higher risk or uncertain outlooks typically trade at lower ratios.

CME Group currently trades at a PE ratio of 25.4x. That is not far off the broader Capital Markets industry average of 25.1x and well below the peer average of 33.6x. At first glance, it might seem reasonably valued, but quick comparisons can miss important context about the company's unique strengths or risk profile.

That is where Simply Wall St’s “Fair Ratio” comes in. It is a tailored metric designed to reflect what a stock’s multiple should be, considering factors such as CME Group’s earnings growth, profit margins, industry trends, size, and risk. This approach moves beyond a simple peer or industry match, helping investors avoid one-size-fits-all thinking and account for the qualities that make CME Group stand out.

Simply Wall St calculates a Fair PE Ratio for CME Group of 17.7x, which is noticeably lower than its current 25.4x multiple. This suggests the stock is trading at a premium relative to what is justified by its forecast growth and fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CME Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a powerful investing tool that lets you tell the story behind a company by combining your perspective on revenue growth, future earnings, margins, and what you believe should be the fair value.

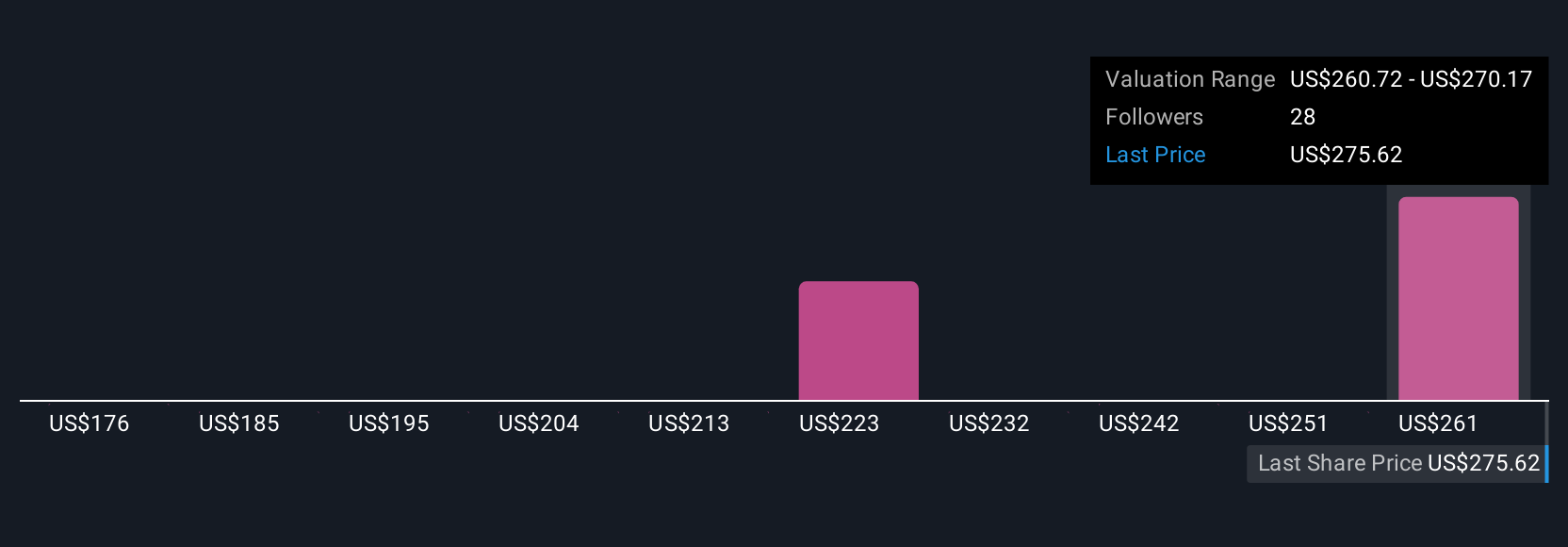

This approach links the qualitative and quantitative, connecting the company's big-picture story with your financial assumptions and arriving at a valuation that reflects your view, not just the market’s consensus. Narratives make investment decisions more accessible by surfacing these stories and forecasts directly on Simply Wall St’s Community page, where millions of investors share their views in real time.

With Narratives, you can quickly see how your fair value compares to the latest price, making it much easier to decide whether a stock is a buy, hold, or sell. Since Narratives update dynamically as new data emerges, your decision stays relevant as events unfold. For example, on CME Group, some investors see robust long-term catalysts and set a fair value as high as $313.0, while others are more cautious and put it closer to $212.0, based on differing expectations for growth and industry change.

Do you think there's more to the story for CME Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives