- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

How CME Group’s (CME) Strong Q2 Earnings and Completed Buyback Could Shape Investor Expectations

Reviewed by Simply Wall St

- CME Group recently reported its second quarter 2025 financial results, with revenue reaching US$1.69 billion and net income of US$1.03 billion, both higher than the same period last year, alongside completion of a share repurchase program announced in December 2024 for US$8.18 million.

- Shareholder returns over the past five years have been substantial, driven by consistent earnings per share growth and steady dividend payments, reflecting the company’s emphasis on rewarding its investors.

- We’ll review how CME’s solid financial performance and completed buyback contribute to its investment narrative focused on earnings growth and client expansion.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CME Group Investment Narrative Recap

To be a shareholder in CME Group, you need to believe in the persistence of global market volatility and the ongoing demand for risk management solutions, which fuel derivative trading volumes and fee growth. The latest share buyback completion and strong quarterly results are positive signals, but they do not materially alter the short-term catalyst, the resilience of market trading activity, or the major risk, which remains a slowdown in volatility that could curb volume growth.

Among recent updates, CME Group’s Q2 2025 results stand out: revenue of US$1.69 billion and net income of US$1.03 billion reflect robust performance with continued year-on-year increases. This earnings strength supports the company’s investment case and aligns with expectations of further revenue growth tied to macroeconomic uncertainty and increased demand for hedging.

However, investors should note that, in contrast, there are emerging risks to trading activity that could affect CME’s future growth if market volatility subsides or...

Read the full narrative on CME Group (it's free!)

CME Group's narrative projects $7.2 billion revenue and $4.2 billion earnings by 2028. This requires 3.7% yearly revenue growth and a $0.5 billion earnings increase from $3.7 billion currently.

Uncover how CME Group's forecasts yield a $281.50 fair value, in line with its current price.

Exploring Other Perspectives

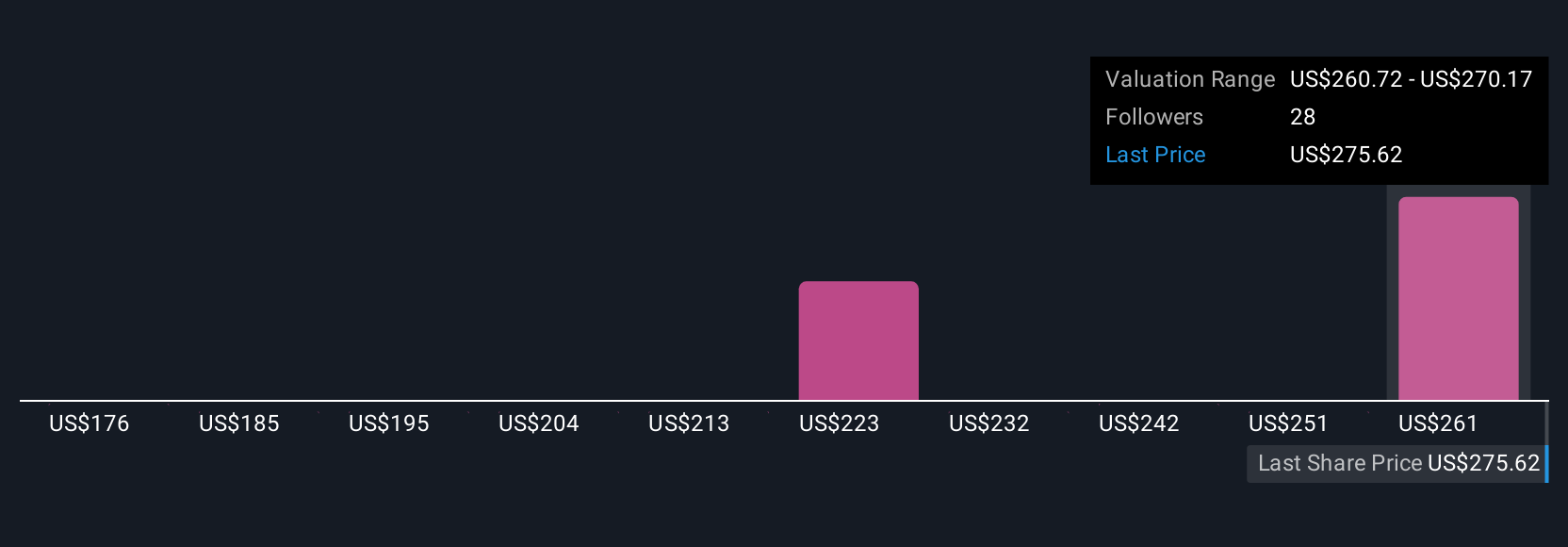

Five perspectives from the Simply Wall St Community put CME Group’s fair value between US$175.71 and US$281.50. While market participants see growth catalysts in robust trading volumes, you should consider how quickly market conditions and trading activity can change, exploring more than one viewpoint may help you stay informed.

Explore 5 other fair value estimates on CME Group - why the stock might be worth as much as $281.50!

Build Your Own CME Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CME Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CME Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CME Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives