- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Evaluating CME Group (CME) Valuation After a Period of Flat Share Price Movement

Reviewed by Kshitija Bhandaru

Fresh data on CME Group (CME) stock performance is in, sparking discussion about its recent moves. With shares staying mostly flat over the past month, investors are weighing what is driving sentiment and where value might be found next.

See our latest analysis for CME Group.

Zooming out, CME Group’s share price has moved with little fanfare lately. Looking at the past year, its 12-month total shareholder return comes in only slightly positive. Short-term momentum remains muted, yet the company’s results and valuation keep it on investors’ radar for potential shifts ahead.

If you’re weighing where the next opportunity could emerge, why not broaden your investing lens and discover fast growing stocks with high insider ownership

With steady earnings and only a modest discount to analyst price targets, investors are left to wonder whether CME Group’s upside is already reflected in the current price or if there could be an overlooked buying opportunity ahead.

Most Popular Narrative: 5.9% Undervalued

Compared to CME Group's last close price, the most widely followed narrative estimates fair value slightly above market, suggesting upside potential if projections hold true.

Heightened global macroeconomic uncertainty, record sovereign debt issuance, persistent geopolitical tensions, and ongoing trade disputes are fueling sustained demand for risk management and hedging solutions. This is evidenced by record contract volumes and open interest, and this trend is likely to support continued revenue and fee growth.

Earnings growth. Margin expansion. A bullish recipe. Yet, the real surprise is how the narrative justifies such a high multiple for future profits. What is the secret ingredient driving this forecast up? Click to uncover the quantitative engines powering the premium valuation.

Result: Fair Value of $282.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged periods of market calm or rapid shifts toward decentralized finance could dampen trading volumes and present challenges to CME Group's growth outlook.

Find out about the key risks to this CME Group narrative.

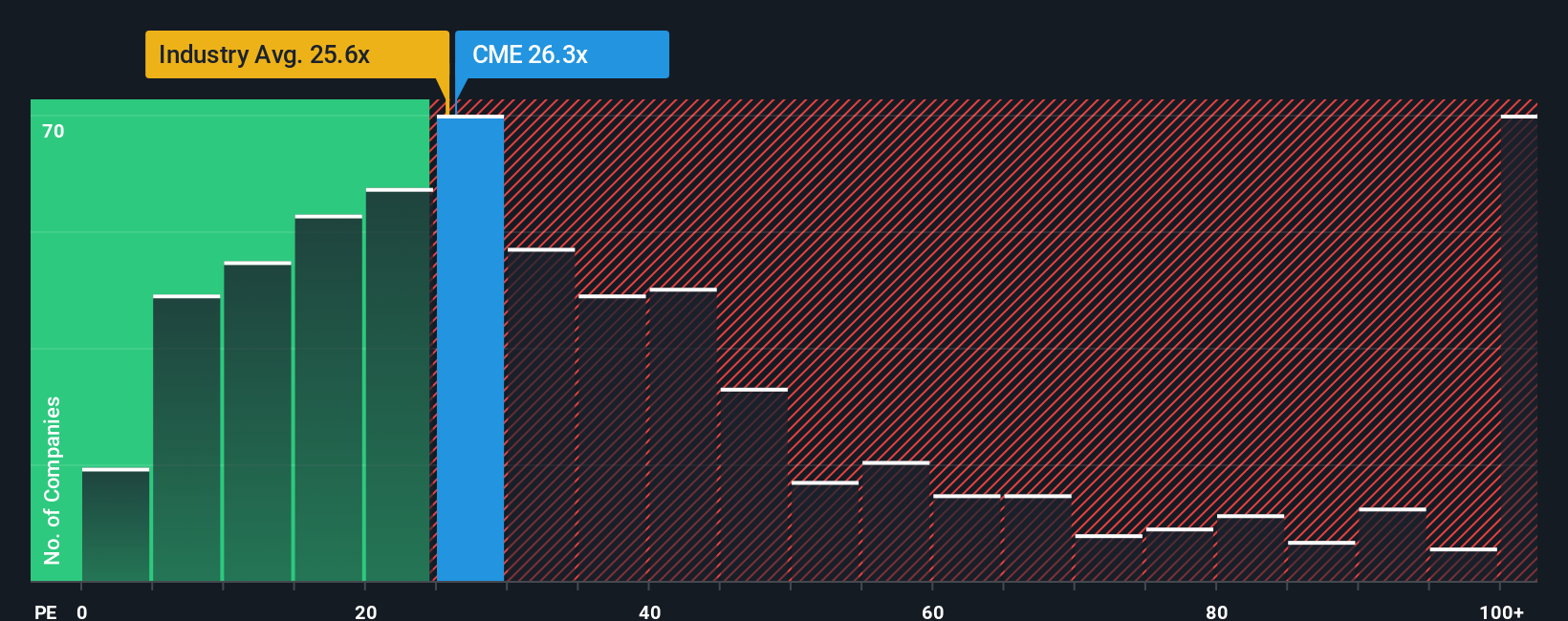

Another View: Market Ratios Tell a Different Story

While the first valuation leans optimistic, a look at the price-to-earnings ratio paints a more cautionary picture. CME trades at 25.7 times earnings, which is cheaper than industry peers at 35.2x and the wider capital markets group at 26.2x, yet notably higher than its fair ratio of 17.7x. This gap suggests the market expects stronger growth ahead, but could also mean there is less room for error. Does the premium price reflect real opportunity, or is the risk building quietly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CME Group Narrative

If you see things differently or want to dig deeper on your own, you can pull the data and shape your own outlook in just a few minutes, too, right here: Do it your way

A great starting point for your CME Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by hunting for fresh opportunities beyond the obvious. Don’t let the next breakthrough pass you by. Your next portfolio winner could be just a click away.

- Unlock powerful long-term yield potential when you investigate these 19 dividend stocks with yields > 3%, which delivers reliable payouts above 3% annually.

- Capture the momentum in artificial intelligence by targeting market leaders through these 24 AI penny stocks, shaping tomorrow’s most dynamic sectors.

- Capitalize on overlooked gems by zeroing in on these 904 undervalued stocks based on cash flows, offering proven financial strength and attractive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives