- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Does the Recent CME Group Rally Leave Room for Future Growth in 2025?

Reviewed by Bailey Pemberton

If you have CME Group on your radar, you are not alone. The stock has offered both consistency and compelling growth, whether you are weighing a first buy or considering holding on. At the last close of $264.67, CME has posted a 13.7% gain in 2024 so far, and an impressive 23.2% bump over the last year. Taking the longer view, those who owned CME stock five years ago have enjoyed a 91.5% run, outpacing many blue-chip names. Recent short-term turbulence, with shares slipping 2.1% over the last week, reminds us just how quickly market sentiment can shift as investors react to broader market developments and changes in risk appetite rather than company-specific drama.

With numbers like these, the obvious question is whether CME Group’s current price reflects its real value, or if there is more room for upside. It actually lands right in the middle of the pack by traditional valuation screens, clocking a value score of 2 out of 6, meaning it only meets two of the common ways analysts measure stocks as “undervalued.” But how should we really judge the stock in this changing landscape? Next, let’s break down the classic valuation methods one by one, then explore a smarter approach to understanding CME Group’s potential.

CME Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CME Group Excess Returns Analysis

The Excess Returns valuation model estimates a company's worth by focusing on how much profit it generates over and above the expected cost of its shareholders’ equity. It is especially useful for established businesses like CME Group that consistently produce returns higher than the cost of capital, which suggests a quality moat in their business model.

For CME Group, the model starts with a book value of $77.13 per share and assumes a stable earnings per share (EPS) of $12.25, based on weighted future Return on Equity estimates from eight analysts. With a cost of equity at $6.45 per share, CME delivers an excess return of $5.80 per share. The company's average return on equity stands at a solid 15.54%, indicating robust profitability. Stable book value estimates are $78.84 per share, drawn from a panel of five analysts.

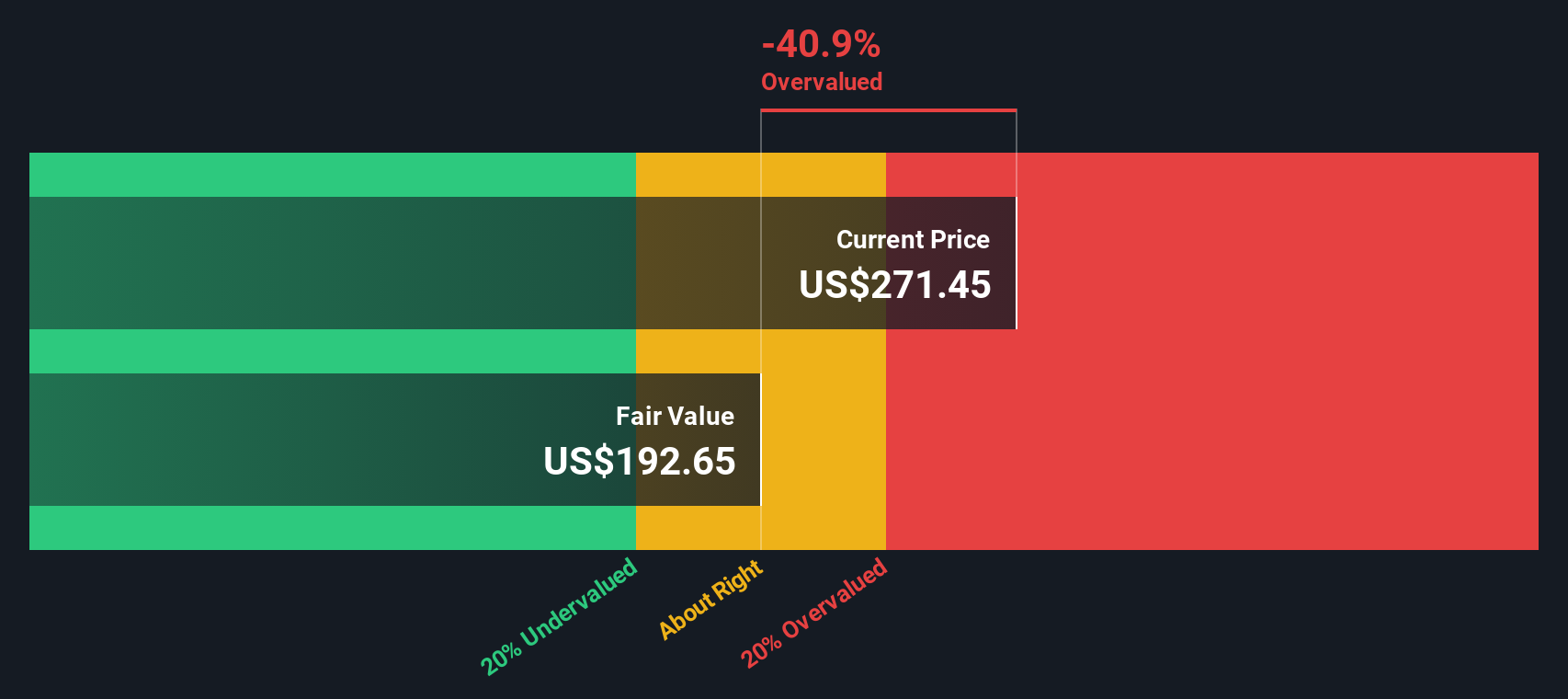

Translating these figures into an intrinsic value, the Excess Returns model arrives at an estimate of $192.37 per share. This places CME Group currently at a 37.6% premium to its intrinsic value, signaling that, by this approach, shares are noticeably overvalued at present market levels.

Result: OVERVALUED

Our Excess Returns analysis suggests CME Group may be overvalued by 37.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CME Group Price vs Earnings

The price-to-earnings (PE) ratio is widely used to value consistently profitable companies like CME Group because it directly connects stock price with how much the company earns each year. For established firms posting steady profits, the PE multiple remains the go-to yardstick, especially when the business model is not highly cyclical.

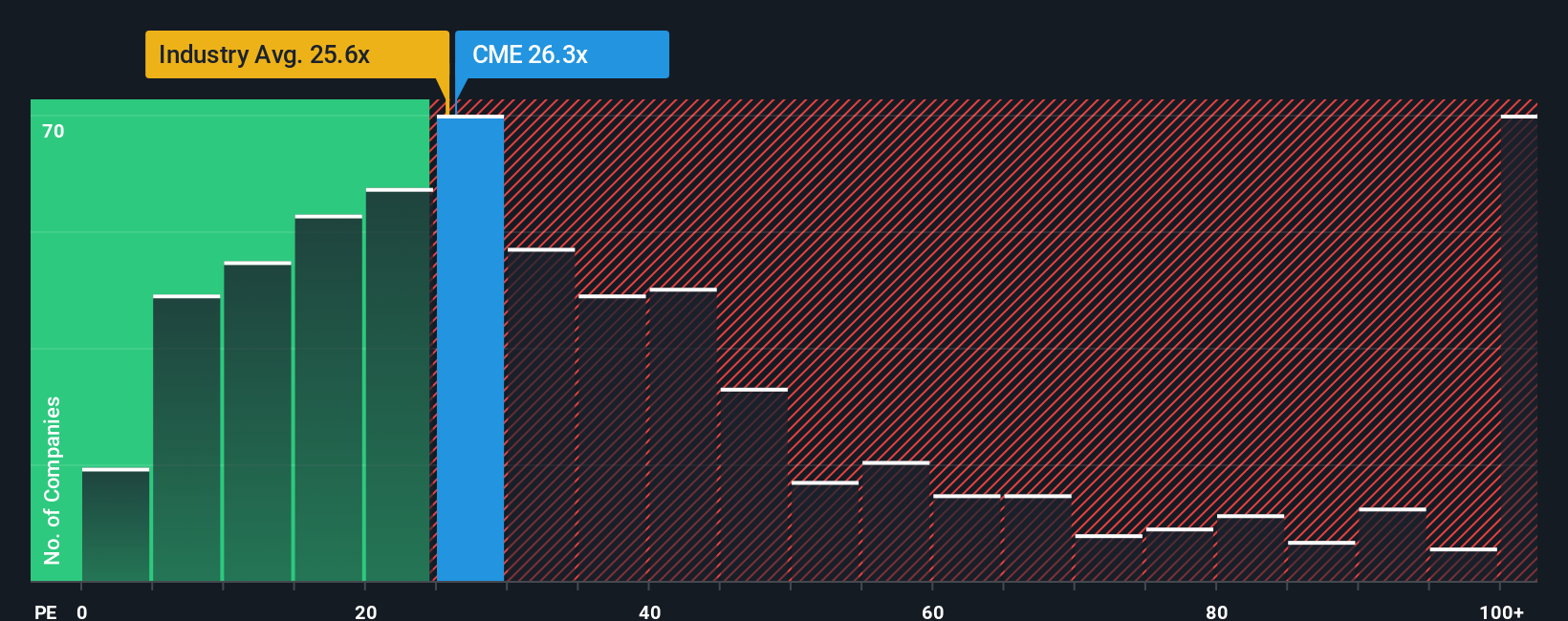

What is considered a fair PE ratio is shaped by how quickly a company is expected to grow, as well as the perceived risk around those future earnings. Higher expected growth usually justifies a higher PE, while increased risk typically brings it down. For CME Group, the current PE ratio stands at 25.6x, closely tracking the Capital Markets industry average of 27.1x, but below the peer group average of 35.6x.

To make sense of these numbers in context, Simply Wall St’s “Fair Ratio” uses a more tailored approach. Rather than only comparing with broad industry metrics or similar companies, the Fair Ratio factors in elements such as CME’s precise earnings growth outlook, profit margins, market capitalization and risk profile. In this case, CME Group’s Fair Ratio stands at 17.7x. This is substantially below the current PE ratio, signaling that, all things considered, investors are paying a premium for shares compared to what would be expected on a risk- and growth-adjusted basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CME Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, combining what you believe about its business, industry drivers, and risks with your assumptions about its revenue, earnings, and margins.

Instead of only relying on broad valuation models, Narratives connect the dots between a company’s underlying story, its financial forecasts, and a fair value estimate. On Simply Wall St’s Community page, millions of investors share and update their own Narratives, making it an accessible tool for all investors to personalize decision making with real data and fresh perspectives.

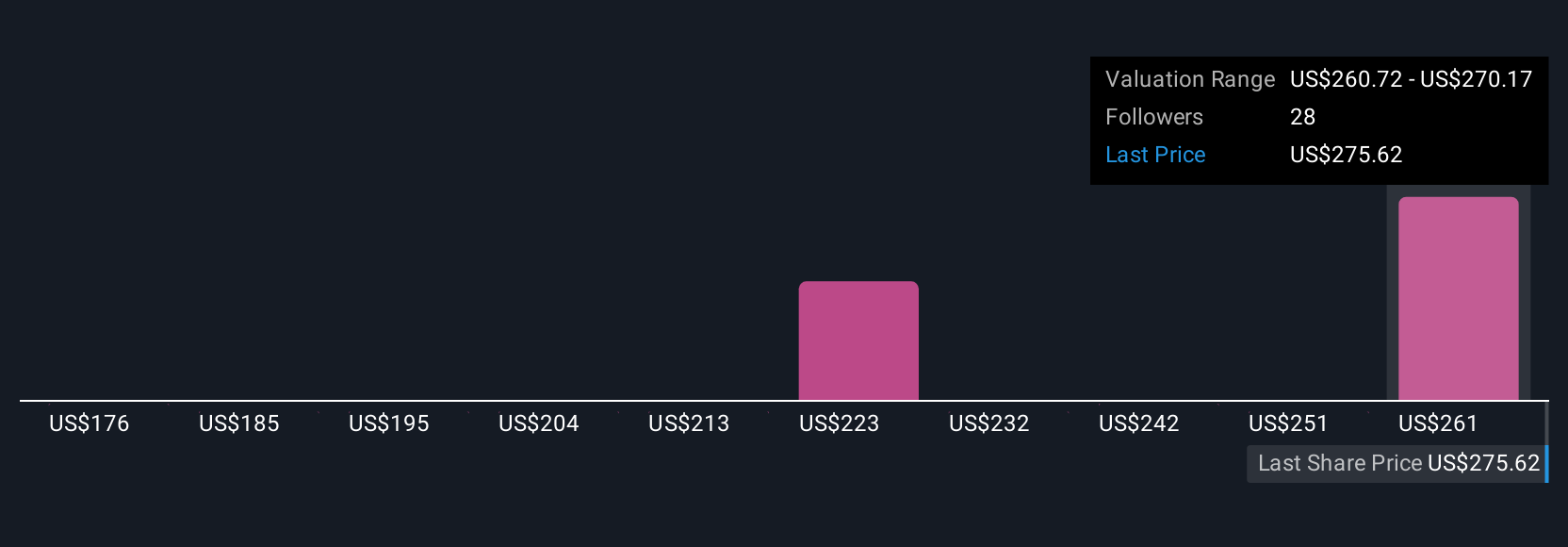

The power of Narratives is that they help you decide when to buy or sell by comparing different fair value estimates to the current price, all while dynamically updating when there is new information like earnings or industry developments. For example, among CME Group Narratives, some investors expect international expansion and rising retail demand could justify a price as high as $313 per share, while others highlight competitive and regulatory risks and see the fair value closer to $212.

Do you think there's more to the story for CME Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives