- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

What Carlyle Group (CG)'s Bid for Nash Industries Reveals About Its India Expansion Strategy

Reviewed by Sasha Jovanovic

- In September 2025, reports emerged that Singapore’s Temasek, along with The Carlyle Group and ChrysCapital, was competing to acquire a 25%-30% minority stake in India's Nash Industries, with the company seeking to raise between US$120 million and US$150 million from private equity investors.

- This marks Nash Industries’ first institutional fundraising and reflects increasing private equity interest in India's auto components and precision engineering sectors.

- We'll explore how widespread analyst optimism, highlighted by recent ratings upgrades, may influence Carlyle Group's long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Carlyle Group Investment Narrative Recap

Investors in Carlyle Group are typically focused on the firm's ability to keep expanding its assets under management through diversification, global growth, and a steady flow of new investment opportunities. The ongoing discussion about Carlyle’s potential stake in Nash Industries aligns with this strategy, but does not materially alter the current short-term catalyst: strong fundraising momentum and recurring fee growth; the largest risk remains heightened competition, which could pressure margins. Among recent announcements, the latest Q2 earnings report stands out, with revenue and profitability showing significant year-over-year increases. This financial performance provides critical context for large-scale investments, such as the Nash Industries opportunity, as it highlights the firm’s capacity to deploy capital while supporting ongoing growth catalysts. However, investors should also be aware that, in contrast, intensifying competition in private equity may put pressure on Carlyle's fee income and profitability...

Read the full narrative on Carlyle Group (it's free!)

Carlyle Group's narrative projects $5.1 billion in revenue and $1.7 billion in earnings by 2028. This requires a 2.6% annual revenue decline and a $0.4 billion earnings increase from $1.3 billion today.

Uncover how Carlyle Group's forecasts yield a $68.08 fair value, a 7% upside to its current price.

Exploring Other Perspectives

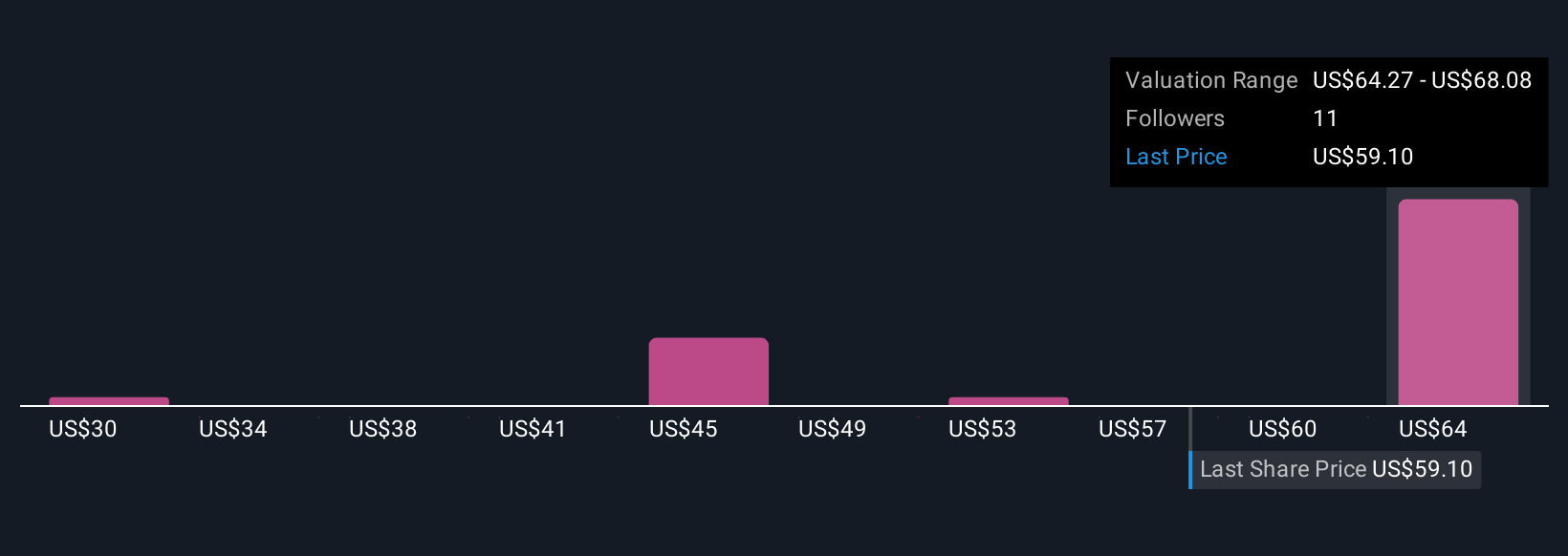

Simply Wall St Community fair value estimates for Carlyle range broadly from US$30 to US$68.08, featuring 4 distinct perspectives. While many see potential, increasing competition among private equity firms suggests outcomes may diverge, explore the variety of opinions to inform your own view.

Explore 4 other fair value estimates on Carlyle Group - why the stock might be worth as much as 7% more than the current price!

Build Your Own Carlyle Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlyle Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carlyle Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlyle Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives