- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Is Carlyle Group’s (CG) Cautious Credit Outlook Shaping Investor Perceptions on Portfolio Resilience?

Reviewed by Sasha Jovanovic

- Carlyle Group CEO Harvey Schwartz recently warned of ongoing credit market volatility and late-cycle economic risks, noting that companies within Carlyle’s portfolio continue to experience growth and stable employment.

- Schwartz’s emphasis on the heightened sensitivity of markets to disruptive news during late-cycle conditions highlights a cautious outlook, even as underlying portfolio fundamentals remain supportive.

- We’ll examine how the CEO’s caution on credit market volatility shapes the future investment narrative for Carlyle Group.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Carlyle Group Investment Narrative Recap

To be a shareholder in Carlyle Group, you need to believe in its ability to generate recurring fee revenues and earnings growth by expanding its global asset base, launching new products, and capturing continued demand for alternative investments. The recent caution from CEO Harvey Schwartz regarding late-cycle credit volatility highlights a real but not yet material risk to current catalysts, such as fundraising growth, since portfolio fundamentals remain supportive for now.

Among Carlyle's recent announcements, the upcoming release of Q3 2025 results on October 31 stands out as highly relevant for investors watching earnings as a catalyst. With management emphasizing resilience despite credit market worries, the financials update may offer important details on how well fee and performance income are holding up, or if risks are beginning to weigh on near-term returns.

Yet, in contrast to stable recent performance, persistent volatility in credit markets is a risk investors should be aware of, as it can...

Read the full narrative on Carlyle Group (it's free!)

Carlyle Group's outlook foresees $5.1 billion in revenue and $1.7 billion in earnings by 2028. This projection is based on a 2.6% annual revenue decline and a $0.4 billion increase in earnings from the current $1.3 billion.

Uncover how Carlyle Group's forecasts yield a $69.06 fair value, a 19% upside to its current price.

Exploring Other Perspectives

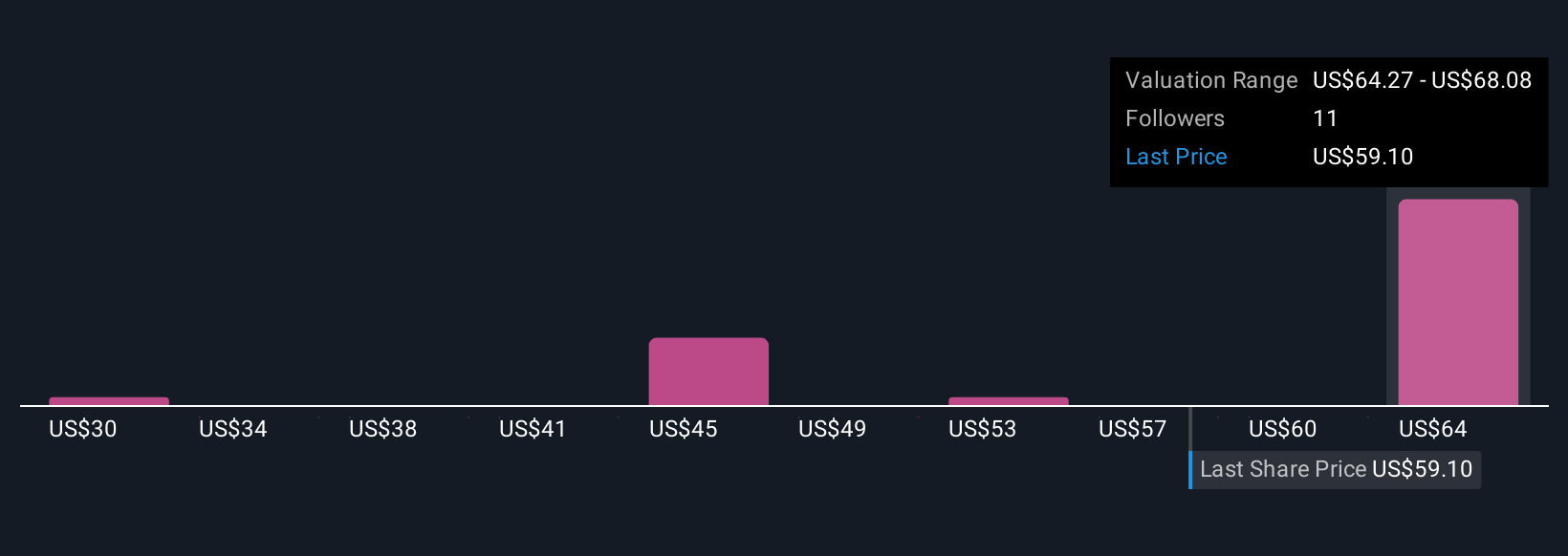

Four members of the Simply Wall St Community estimate fair value from US$49.03 to US$69.06, revealing widely different views. With ongoing concerns about credit cycle disruption, your perspective could look very different from the next reader’s.

Explore 4 other fair value estimates on Carlyle Group - why the stock might be worth as much as 19% more than the current price!

Build Your Own Carlyle Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlyle Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carlyle Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlyle Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives