- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

Credit Acceptance (CACC) Valuation in Focus After Strong Q3 Results and Leadership Transition

Reviewed by Simply Wall St

Credit Acceptance (CACC) just released its third quarter results, revealing higher revenue and net income compared to last year. The announcement also came with news of an upcoming change in company leadership.

See our latest analysis for Credit Acceptance.

After a solid stretch of buybacks and new leadership news, Credit Acceptance’s momentum has cooled with a 30-day share price return of -11.77%. Still, despite some recent pressure, its five-year total shareholder return stands at an impressive 34.82%. This highlights how much longer-term holders have benefited even as near-term sentiment has shifted.

If executive shake-ups and shifting trends have you wondering what else is out there, this could be a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With strong revenue growth, but recent share price stumbles and fresh executive leadership ahead, investors face a key question: Is Credit Acceptance trading at an attractive value right now, or has the market already factored in future gains?

Most Popular Narrative: 5.4% Undervalued

With Credit Acceptance closing at $422.35 and the narrative fair value estimate at $446.25, this widely followed outlook puts the shares modestly below its valuation mark, setting the stage for a closer look at underlying growth drivers.

The recent investments in technology modernization, including a revamped loan origination system and accelerated feature development, should improve customer and dealer experiences, drive operating efficiency, and support net margin improvement through cost reductions. Adoption of more advanced data analytics and ongoing scorecard updates are expected to enhance risk assessment and loan performance over coming vintages, reducing future default rates and stabilizing or expanding net margins and earnings.

Want to see the full playbook behind this modest upside? The foundation of the narrative is a future defined by bold growth forecasts, cost discipline, and a shrinking share count. Discover which key assumptions power this price target and whether they align with the real risk-reward for long-term holders.

Result: Fair Value of $446.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing credit risk from underperforming loan vintages and sustained competition could put pressure on both future earnings and Credit Acceptance's return on equity.

Find out about the key risks to this Credit Acceptance narrative.

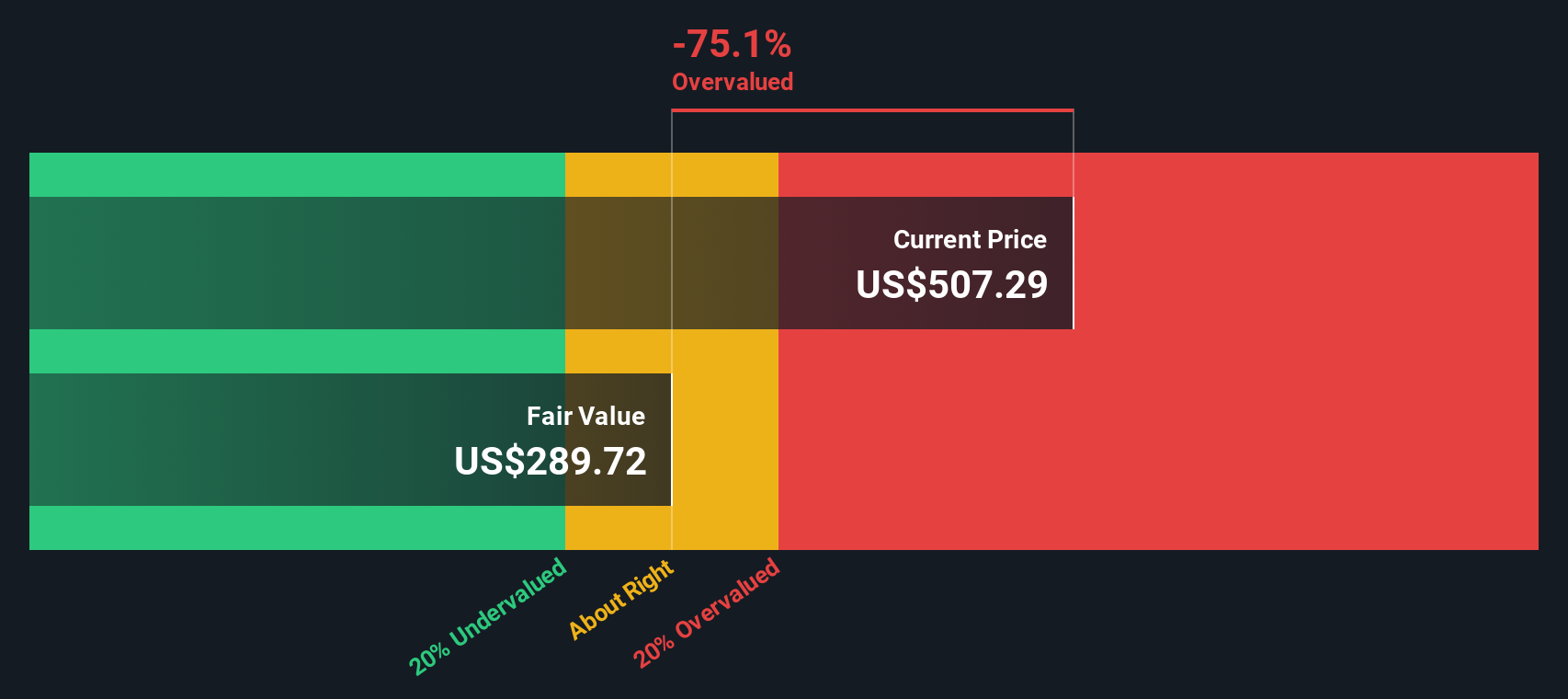

Another View: Our DCF Model Weighs In

While many investors focus on the optimistic narrative fair value, our SWS DCF model paints a very different picture. According to its cash flow forecasts, Credit Acceptance appears overvalued at recent prices. This sharp disagreement between fair value estimates raises the stakes. Are market expectations too high, or is there overlooked growth to come?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Credit Acceptance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Credit Acceptance Narrative

Prefer to carve your own path or dig deeper into the numbers? It takes just a few minutes to craft your personal view of Credit Acceptance, so go ahead and Do it your way.

A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by seeking out opportunities others overlook. Don’t miss your chance to find stocks with unbeatable potential using these hand-picked investment screens:

- Boost your passive income by reviewing these 16 dividend stocks with yields > 3% offering reliable yields above 3%, ideal for those who appreciate steady, long-term returns.

- Capitalize on artificial intelligence disruption and uncover tomorrow’s technology leaders among these 25 AI penny stocks poised for exponential growth in the AI space.

- Spot stocks trading below their intrinsic value and get ahead of the market by evaluating these 876 undervalued stocks based on cash flows backed by robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives