- United States

- /

- Mortgage REITs

- /

- NasdaqGS:AGNC

Is It Too Late To Consider AGNC Investment After Its Strong 2024 Price Recovery?

Reviewed by Bailey Pemberton

- If you are wondering whether AGNC Investment is still a smart income play at today's price, or if most of the upside has already been taken, this breakdown is for you.

- After closing around $10.38, the stock has quietly climbed 11.9% year to date and is up 25.4% over the last year, despite some short term noise, with a 1.3% gain over 30 days and a small 0.8% dip in the last week.

- Recent headlines have focused on shifting interest rate expectations and the ripple effects across mortgage REITs, with AGNC frequently cited as a bellwether for how income focused investors are repositioning. At the same time, market commentators have highlighted the tug of war between dividend appeal and interest rate risk, which helps explain why sentiment around AGNC has become more cautiously optimistic.

- Right now, AGNC scores a 4/6 valuation check rating, suggesting the market may not be fully pricing in its fundamentals. In the sections ahead, we will unpack what that means across different valuation approaches and hint at an even better way to think about value by the end of the article.

Approach 1: AGNC Investment Excess Returns Analysis

The Excess Returns model looks at how efficiently AGNC Investment turns shareholder capital into profits, after charging a fair cost for that equity. Instead of focusing on cash flows, it gauges whether the company is generating returns above what investors reasonably demand.

AGNC currently has a Book Value of $8.83 per share and a Stable EPS of $1.69 per share, based on weighted future Return on Equity estimates from 4 analysts. With an Average Return on Equity of 18.28% against a Cost of Equity of $0.85 per share, the model estimates an Excess Return of $0.84 per share. That excess is applied to a projected Stable Book Value of $9.26 per share, again sourced from analyst forecasts, to estimate what the stock should be worth if those value adding returns persist.

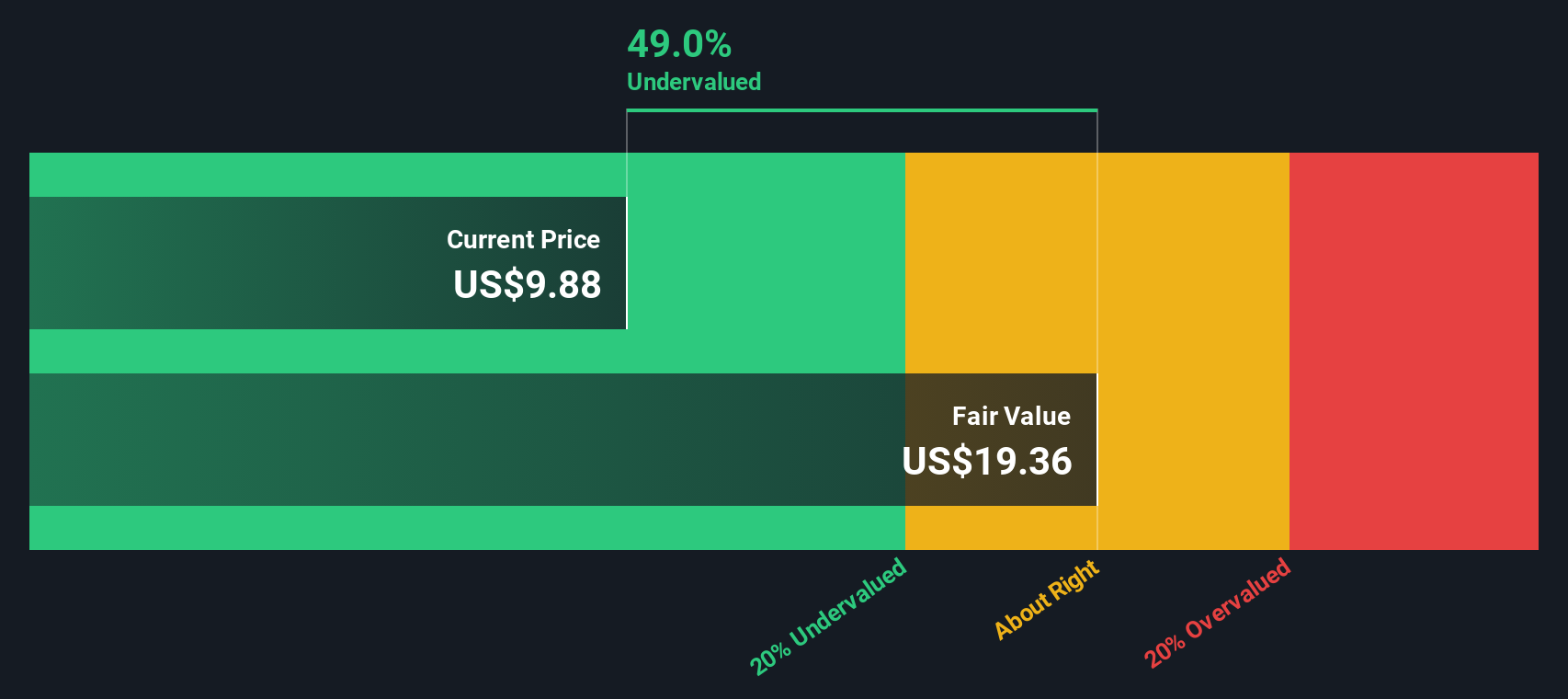

On this basis, the Excess Returns valuation implies an intrinsic value of about $23.51 per share, suggesting AGNC is roughly 55.8% undervalued versus its current market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests AGNC Investment is undervalued by 55.8%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: AGNC Investment Price vs Earnings

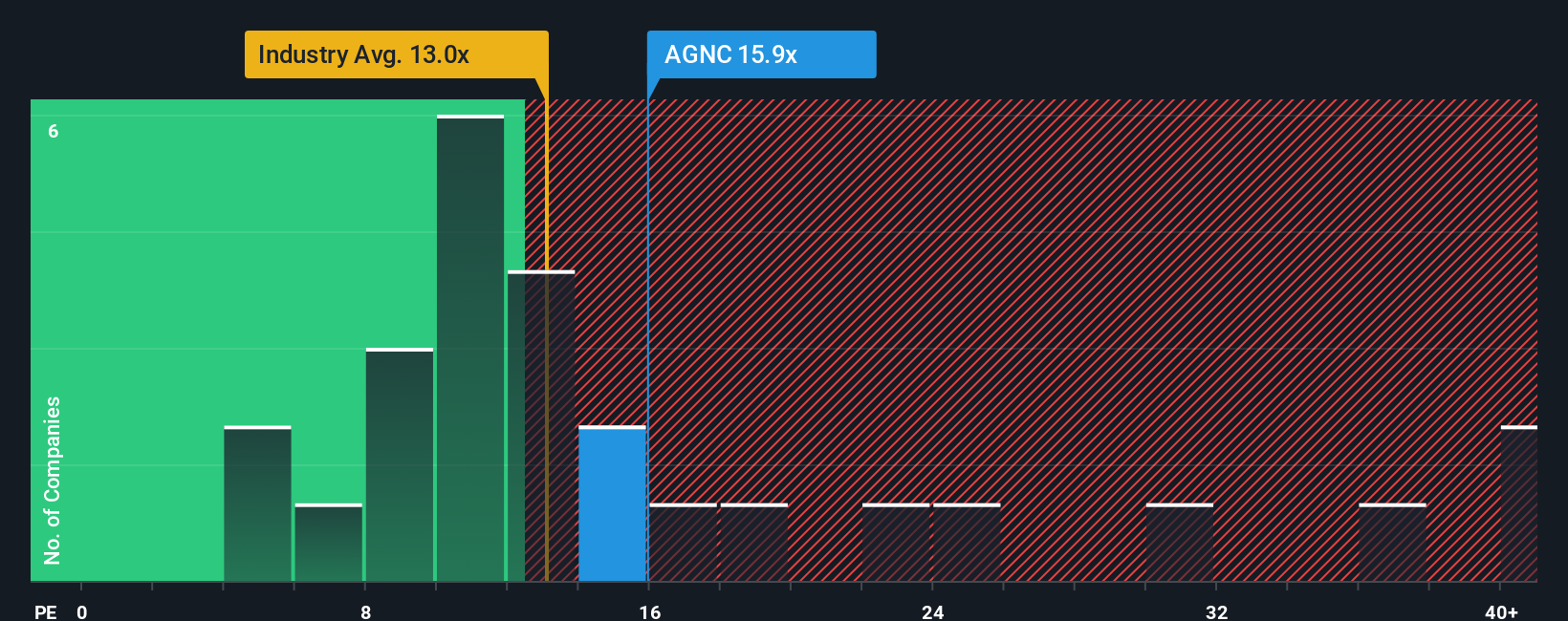

For a profitable business like AGNC Investment, the price to earnings (PE) ratio is a practical way to gauge how much investors are willing to pay for each dollar of earnings. In general, companies with stronger, more reliable growth and lower perceived risk can justify a higher PE, while slower growth or higher uncertainty should translate into a lower, more conservative multiple.

AGNC currently trades on a PE of 16.21x, which sits above the Mortgage REITs industry average of 13.04x and a touch below the broader peer group average of 17.20x. Simply Wall St also calculates a proprietary “Fair Ratio” of 19.23x, which estimates the PE AGNC should trade on after accounting for its earnings growth outlook, risk profile, profit margins, industry positioning and market cap.

Because the Fair Ratio blends these fundamentals rather than relying purely on rough peer or industry comparisons, it can offer a more tailored view of value for AGNC specifically. With the stock at 16.21x compared with a Fair Ratio of 19.23x, AGNC appears modestly undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AGNC Investment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of AGNC Investment's story with a concrete forecast and a fair value estimate. A Narrative is your own clear, written perspective on the business, linked directly to numbers like future revenue, earnings, margins and the fair value you think the stock is worth, so the story and the spreadsheet always line up. On Simply Wall St's Community page, where millions of investors share ideas, Narratives make it easy to see whether your fair value is above or below AGNC's current share price, helping you decide if it looks like a buy, hold or sell today. Because Narratives update automatically when new news, earnings or guidance arrives, your valuation view stays current without you having to rebuild every model from scratch. For example, one AGNC Narrative might assume strong mortgage market tailwinds and assign a fair value near the most bullish target of about $11.00, while a more cautious Narrative focusing on rate volatility could land closer to the bearish end around $8.25, and seeing both helps you decide which story you believe and how to act.

Do you think there's more to the story for AGNC Investment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGNC

AGNC Investment

Provides private capital to housing market in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026