- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm Holdings (AFRM) Reports Turnaround From Net Loss To US$52M Profit

Reviewed by Simply Wall St

Affirm Holdings (AFRM) recently reported notable earnings as the company transitioned from a net loss to a net income for the fiscal year ending June 2025, with substantial increases in sales and revenue. This financial turnaround was complemented by key partnerships with Stripe and Google Pay, alongside index inclusions in major Russell growth benchmarks. These factors likely contributed to the company's impressive 54% share price increase over the last quarter. These developments occurred amid a slightly declining tech sector, with major indexes like the Nasdaq experiencing a 1% drop, highlighting the resilience and appeal of Affirm's growth trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments for Affirm Holdings (AFRM), including its transition to net income and strategic partnerships with Stripe and Google Pay, alongside its inclusion in major Russell growth benchmarks, significantly contribute to the company's growth narrative. The impressive 54% increase in share price over the past quarter amidst a declining tech sector highlights Affirm's resilience. Over a longer-term period of three years, Affirm's total return was a substantial 245.38%, which suggests a robust performance against broader market movements, as it exceeded the US market's 17.2% return and the US Diversified Financial industry return of 12.1% over the past year.

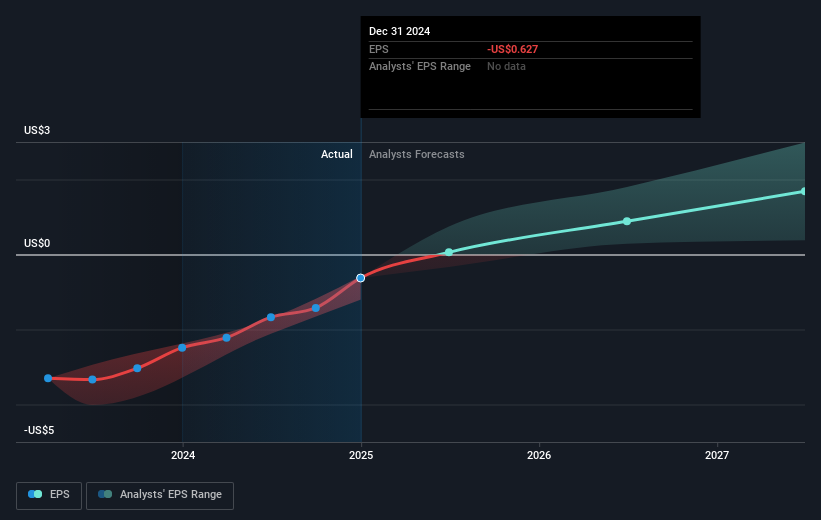

The recent financial and strategic milestones are likely to influence future revenue and earnings forecasts. Affirm's revenue of US$3.01 billion, against the backdrop of international expansion and AI-driven credit risk measures, sets a strong foundation for continued growth. Analysts forecast revenue to grow annually by 23.2% with expected earnings of US$386.2 million by 2028. The current share price of US$79.99, slightly above the consensus analyst price target of US$77.18, indicates a minimal 1.7% difference, implying that analysts consider the stock fairly valued at present. Investors should assess whether future earnings growth aligns with the expectations embedded in the current price target, ensuring that individual assumptions about the business's prospects are factored into their evaluation.

Click to explore a detailed breakdown of our findings in Affirm Holdings' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion