- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm Holdings (AFRM): Examining Valuation After Return to Profitability and Surging Revenue Growth

Reviewed by Simply Wall St

If you have been tracking Affirm Holdings (AFRM), the company’s latest earnings announcement might just make you rethink your outlook. Affirm reported a jump in annual revenue and, more notably, turned a profit after a year of significant net losses. This earnings turnaround, with growth that outpaced expectations, has put Affirm right back into the spotlight for investors considering where the company’s value could go from here.

The news sent a wave through the market, and it comes on the heels of sizable momentum for Affirm. The stock has more than doubled over the past year and is up 39% over the past 3 months, reflecting growing confidence in the company's ability to scale revenue and deliver positive financial results. Even a recent loss of Walmart’s OnePay business did not slow the positive reaction, suggesting that investors see broader potential. Following these strong numbers, attention is now shifting to how much more Affirm can grow, or if its current price already bakes in these wins.

After such a run-up and a sharp improvement in financial health, the big question is whether Affirm shares still offer value at today’s price, or if the market has already factored in all the future growth investors might hope for.

Most Popular Narrative: 8.9% Undervalued

The prevailing view among analysts is that Affirm Holdings is currently undervalued by almost 9 percent, supported by a robust outlook for future growth and expansion potential.

Adoption by a growing base of merchants and consumers, combined with expansion into new geographies (notably the imminent U.K. entry via Shopify), positions Affirm to capture larger volumes as e-commerce and embedded finance become increasingly central to global retail. This trend may drive top-line revenue growth.

Ready to discover why analysts think Affirm’s upside might just be beginning? The most popular narrative is built on a foundation of ambitious growth projections, including rapidly scaling earnings, a profit margin set to drastically improve, and a bold valuation multiple that grabs attention. Curious which underlying figures are powering this bullish fair value call? Find out what makes this stock’s future so hotly debated among the pros.

Result: Fair Value of $93.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened competition from tech giants and the loss of key merchant partners could quickly dampen Affirm’s growth story if momentum slows.

Find out about the key risks to this Affirm Holdings narrative.Another View: Peeling Back the Multiples

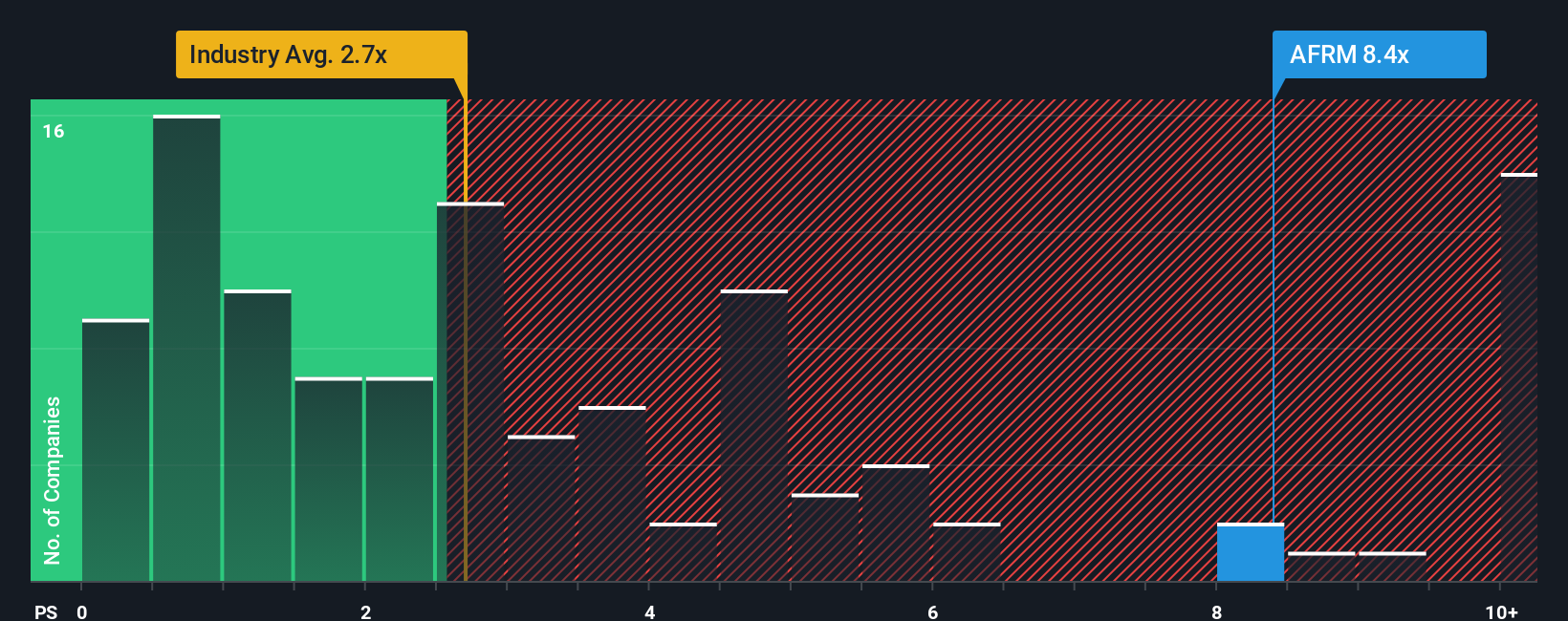

While analysts see Affirm as undervalued based on future growth, a second look using its price-to-sales ratio tells a different story. By this measure, Affirm appears expensive relative to US industry peers. Does this suggest the market’s optimism is already priced in, or is there more to the story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Affirm Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Affirm Holdings Narrative

If you want to dig deeper or put your own perspective on where Affirm goes next, you can build your own narrative in just a few minutes, and then Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investment strategy and seize today’s most compelling trends. Let Simply Wall Street’s curated screeners help you uncover stocks that match your ambitions. Don’t settle for missing out on tomorrow’s top performers.

- Accelerate your hunt for tomorrow’s technology leaders with AI penny stocks. These stocks are reshaping innovation through artificial intelligence breakthroughs.

- Boost your portfolio’s passive income by chasing dividend stocks with yields > 3% and seeking out companies offering yields above 3 percent.

- Zero in on real bargains by targeting undervalued stocks based on cash flows to capture stocks the market may have overlooked based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives