- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm Holdings (AFRM): Evaluating Valuation After Expanding Apple Pay and Major Merchant Partnerships

Reviewed by Kshitija Bhandaru

If you’re holding or eyeing Affirm Holdings (AFRM), the latest flurry of partnership announcements should have your attention. In just the past week, Affirm revealed deals with ServiceTitan and Vagaro, bringing flexible pay-over-time options to thousands of home repair contractors and close to 100,000 wellness and fitness businesses. Just as significant, its integration with Apple Pay now lets U.S. iPhone users access Affirm’s buy now, pay later options directly at brick and mortar checkouts, putting the brand in front of millions of everyday shoppers.

These developments add fresh momentum to what has already been an eventful year for Affirm Holdings. After a choppy start and tough competition in the BNPL landscape, the company has posted a 106% gain over the past twelve months, with nearly half that return accumulating since January. While Affirm’s rapid merchant expansion and new features stand out, investors have also watched the stock move sharply higher, suggesting both renewed optimism and a shift in how the market views future risks for the business.

After this remarkable run and series of partnerships, the question remains whether the market is leaving room for investors to capture further upside, or if these developments are already fully reflected in Affirm’s valuation.

Most Popular Narrative: 3% Undervalued

The prevailing narrative views Affirm Holdings as slightly undervalued, with bullish sentiment tied to merchant adoption, product innovation, and a resilient earnings outlook.

Rapid growth and strong engagement with Affirm Card, an actively invested product moving toward high attach rates and greater offline usage, expands Affirm's addressable market beyond online retail, diversifies revenue streams, and drives higher frequency of transactions. This should accelerate GMV and contribute to margin improvement.

What is powering Affirm's narrative-defining valuation? The answer lies in ambitious assumptions about revenue climbs, margin leaps, and explosive future earnings. Will these bold estimates materialize, or are expectations set too high? Imagine this: a step-change in profitability, razor-thin margin for error, and growth rates that would make most fintechs jealous. Curious about the exact numbers analysts are banking on to call Affirm undervalued? This valuation story holds all the answers.

Result: Fair Value of $95.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a loss of major merchant partners or a surge in competition could quickly reshape the outlook. This could put Affirm’s momentum and margin assumptions at risk.

Find out about the key risks to this Affirm Holdings narrative.Another View: High Growth, Steep Price

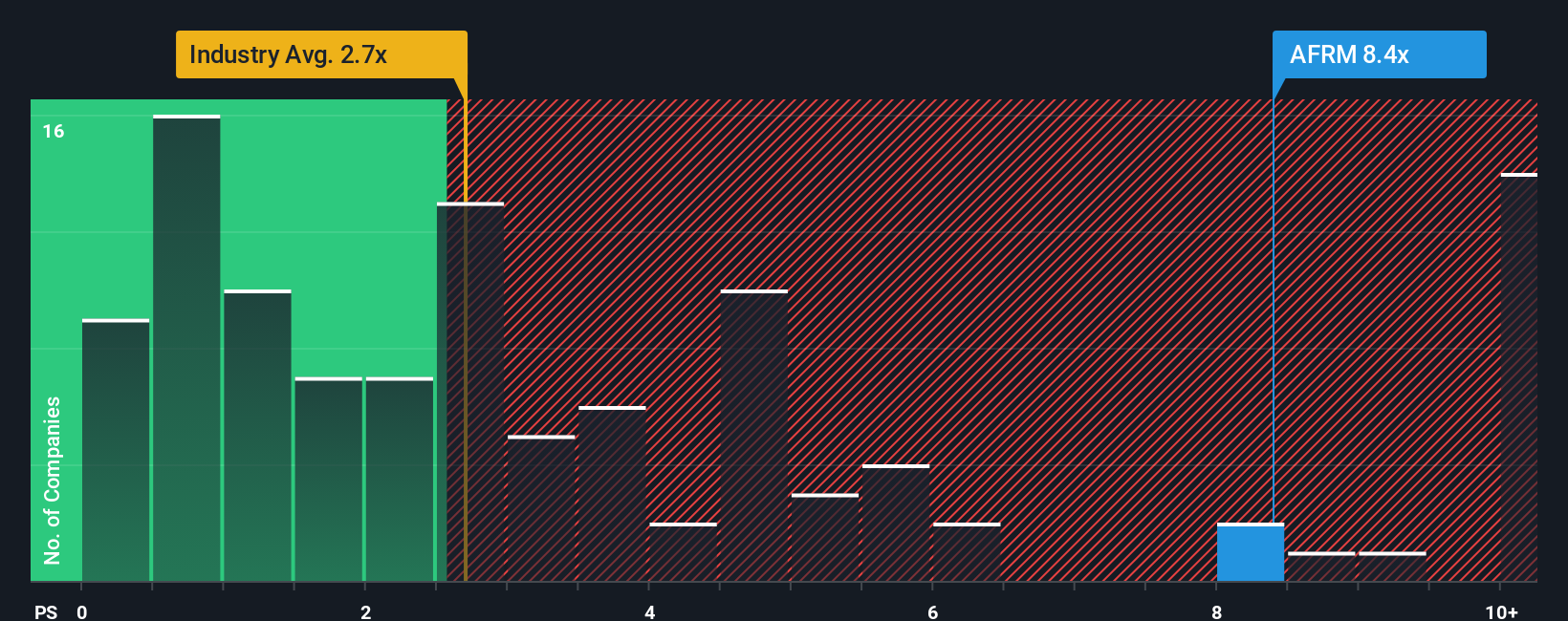

Looking beyond growth projections, an analysis of Affirm Holdings' valuation using its sales ratio compared to the broader financial industry tells another story. This approach suggests the shares are pricey relative to peers. Can the rapid growth justify the premium, or will buyers eventually balk at the cost?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Affirm Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Affirm Holdings Narrative

Not convinced by the consensus, or keen to analyze the numbers on your own terms? You can shape your own view and findings in just minutes by using Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Why stick with just one promising stock? Use the Simply Wall St screener to zero in on unique opportunities and uncover investment angles others might overlook. Act now to make sure you never miss tomorrow’s breakout story.

- Chase top-tier growth by spotting AI-powered disruptors early. Leverage the advantage with AI penny stocks tucked away in the technology sector.

- Strengthen your portfolio with reliable cash flow. Unlock opportunities with dividend stocks with yields > 3% offering yields above 3% to maximize your returns.

- Stay ahead of the curve by tapping into the momentum of digital currencies. Seize your chance in cryptocurrency and blockchain stocks and participate in the evolution of the financial system.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives