- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM) Valuation in Focus After High-Profile Fanatics and Business Partnerships Expand BNPL Reach

Reviewed by Simply Wall St

Affirm Holdings (AFRM) saw its shares climb 6% following news of several new business partnerships, most notably with sports platform Fanatics. These collaborations put Affirm’s flexible pay-over-time options in front of millions of potential customers during the busiest shopping months.

See our latest analysis for Affirm Holdings.

Affirm’s recent rally follows a streak of high-profile partnerships with Fanatics, FreshBooks, and Clio, all of which have broadened its reach and put its buy now, pay later options in front of new audiences. Momentum is still strong. Despite some volatility this month, Affirm’s 1-year total shareholder return is a striking 64%, with a 3-year total shareholder return nearing 250% that highlights the company’s rapid growth and ongoing relevance in the evolving payments landscape.

If Affirm’s sector momentum has you exploring, now is a great moment to see what’s trending in the world of fast-growing stocks with high insider ownership. Discover fast growing stocks with high insider ownership.

With shares riding high and Affirm’s growth story in the spotlight, the big question remains: is the current price a bargain for future gains, or has the market already factored in the company’s momentum?

Most Popular Narrative: 25% Undervalued

Affirm Holdings' most widely followed narrative estimates fair value at $96.48, which is notably above the last close price of $72.08. This suggests a potential opportunity as optimism grows around Affirm's long-term prospects and recent operational strength.

The extension of Affirm’s partnership with Apple Pay is seen as a growth catalyst, enabling broader in-store adoption and reinforcing Affirm’s position within the Buy Now, Pay Later (BNPL) ecosystem. Recent earnings reports showed exceptional gross merchandise volume (GMV) growth and operational execution, with guidance for fiscal 2026 surpassing investor expectations.

What is driving the bullish narrative? Hint: it is not just partnerships making headlines. Discover the powerful growth assumptions and future profitability targets that underpin this compelling fair value. The story behind the number may surprise you.

Result: Fair Value of $96.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some risks remain, including the potential loss of a major merchant partner or increased competition. These factors could quickly alter Affirm's growth trajectory.

Find out about the key risks to this Affirm Holdings narrative.

Another View: What Do Market Multiples Say?

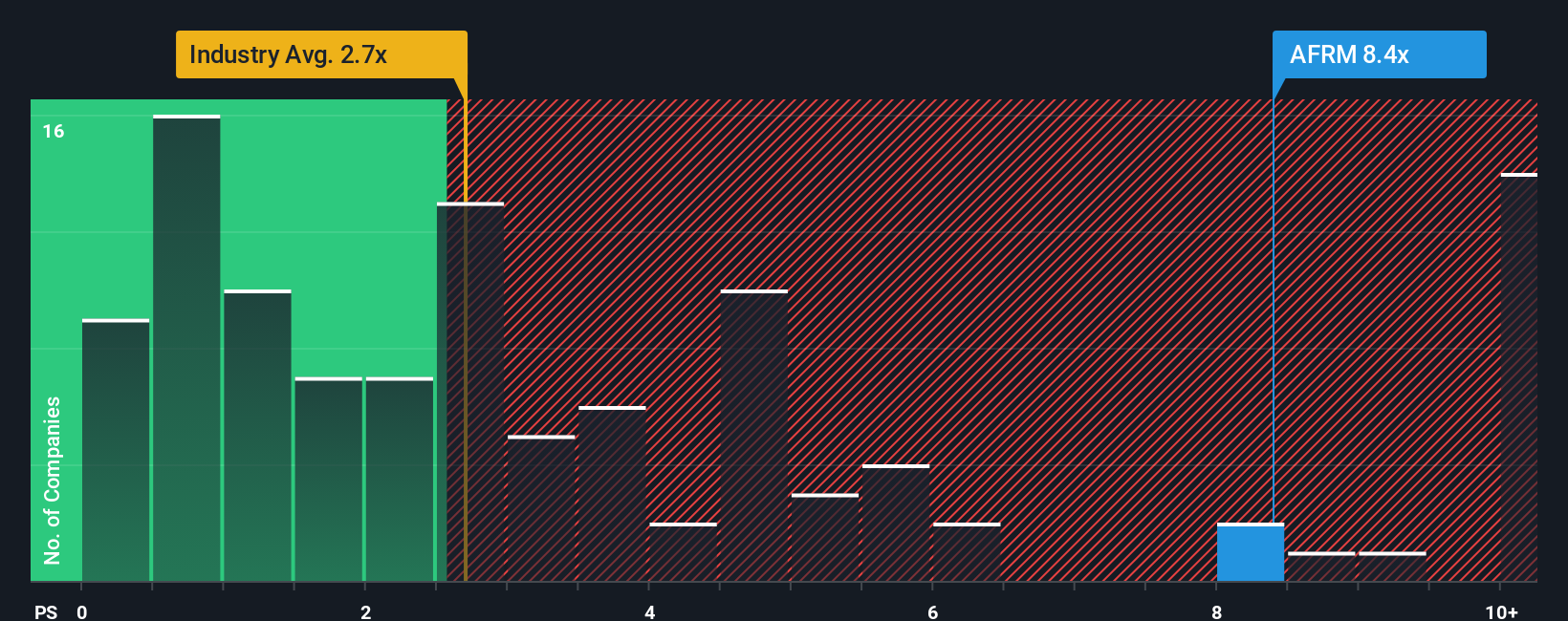

While analyst targets and growth narratives suggest Affirm is undervalued, a look at its price-to-sales ratio tells a more cautious story. Affirm trades at 7.3 times sales, considerably higher than the industry average of 2.5 and its peer average of 3.9. The fair ratio, where the market could eventually settle, is 4.3. This gap highlights a valuation risk if growth slows or sentiment shifts. Is optimism already priced in, or does Affirm have room to grow into this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you want to dive deeper and form your own perspective, the tools are here for you. You can build a custom narrative in just a few minutes. Do it your way

A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities can show up where you least expect, so why stop at just one company? Leverage Simply Wall Street’s powerful screeners to spot your next winning move before the crowd catches on.

- Uncover growth potential by checking out these 873 undervalued stocks based on cash flows which is poised for a turnaround and often flies under the radar while the broader market focuses elsewhere.

- Cement passive income streams as you browse these 17 dividend stocks with yields > 3% offering yields above 3%, providing your portfolio with a steady boost with every payout.

- Stay ahead of the innovation curve by scanning these 24 AI penny stocks that are transforming industries with breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives