- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM) Valuation Check After New Five-Year Amazon Partnership Extension Boosts Investor Interest

Reviewed by Simply Wall St

Affirm Holdings (AFRM) just locked in a fresh five year extension with Amazon, a move that immediately lifted the stock and, more importantly, extends Affirm’s reach across Amazon’s massive checkout funnel.

See our latest analysis for Affirm Holdings.

That Amazon extension comes on top of earlier tailwinds, such as Pacsun joining Affirm’s network and solid revenue and earnings beats. These factors help explain why the stock’s year to date share price return of 15.25 percent and three year total shareholder return of 657.52 percent still signal strong, if volatile, momentum despite a recent 90 day share price pullback.

If this kind of payments driven growth story has your attention, it could be worth exploring other high potential names using our high growth tech and AI stocks as a next step in your research.

With shares still trading at a notable discount to Wall Street targets despite rapid revenue and profit growth, investors now face a pivotal question: Is Affirm misunderstood value, or is the market already pricing in years of expansion?

Most Popular Narrative: 22.3% Undervalued

With Affirm Holdings last closing at $72.04 against a narrative fair value in the low $90s, the story assumes investors are still underappreciating future earnings power.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.5x on those 2028 earnings, down from 532.4x today. This future PE is greater than the current PE for the US Diversified Financial industry at 16.4x.

Curious what kind of revenue surge, margin lift, and earnings reset could earn a premium multiple like that, even after compression from today? Read on.

Result: Fair Value of $92.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained upside also hinges on avoiding setbacks, such as losing a major enterprise partner or seeing BNPL competition compress margins faster than expected.

Find out about the key risks to this Affirm Holdings narrative.

Another View: Rich on Earnings Metrics

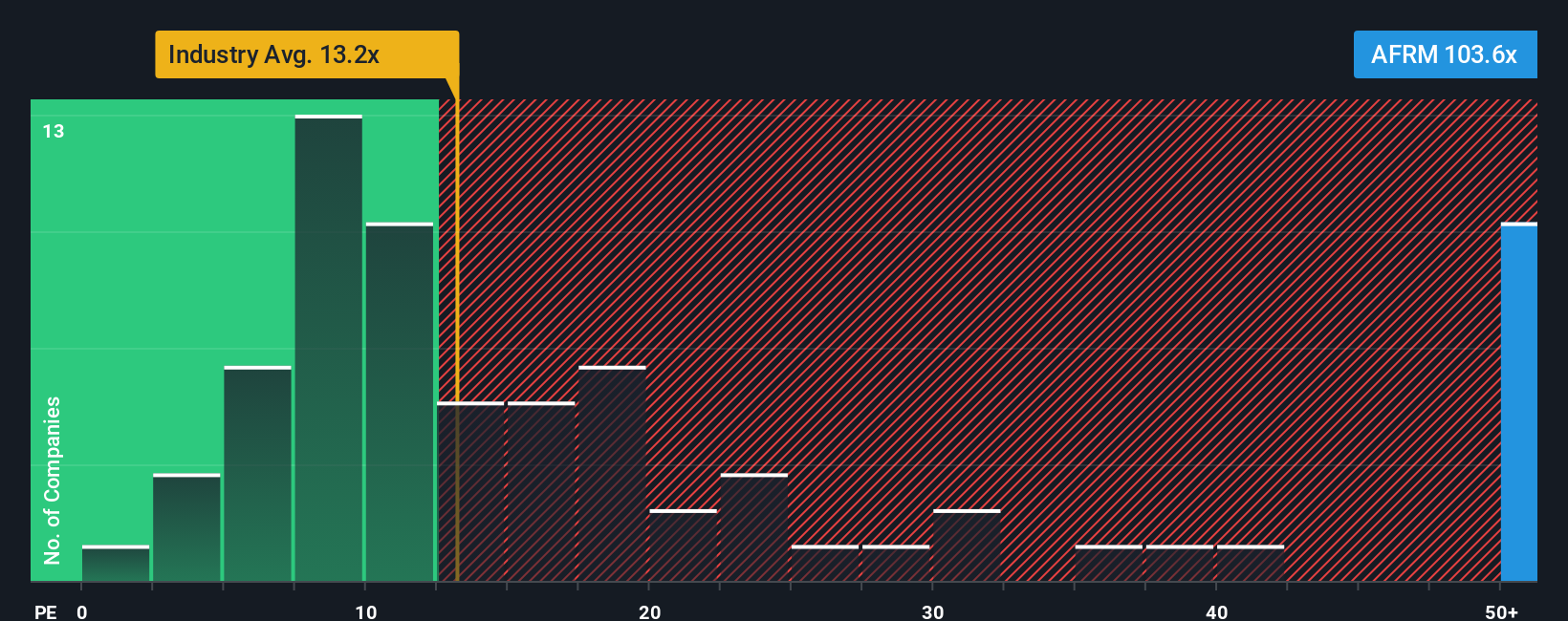

While the narrative fair value suggests upside, earnings based metrics flag a very different picture. At roughly 102 times earnings versus a 13.6 times industry average and a 30.8 times fair ratio, Affirm screens expensive, raising the risk that any stumble could trigger a sharp de rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop your research with Affirm alone, powerful screeners can reveal fresh, high conviction ideas that match your strategy before the rest of the market notices.

- Explore overlooked value by targeting companies trading below intrinsic worth using these 912 undervalued stocks based on cash flows as one way to identify potential bargains.

- Focus on structural trends in next generation medicine by filtering for innovators at the intersection of healthcare and machine learning through these 29 healthcare AI stocks.

- Identify income potential and stability by screening for firms offering consistent payouts with these 13 dividend stocks with yields > 3% helping you review yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion