- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACTG

Unpleasant Surprises Could Be In Store For Acacia Research Corporation's (NASDAQ:ACTG) Shares

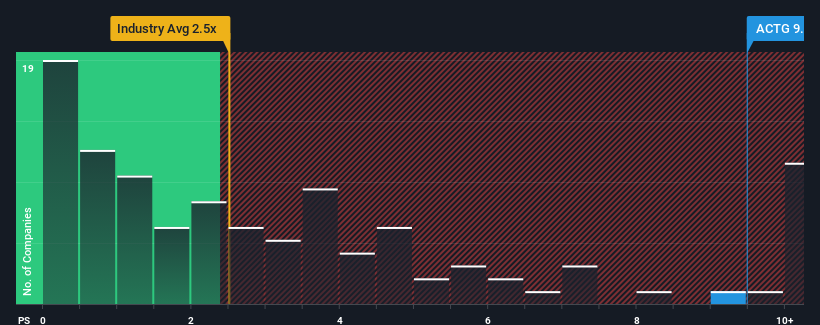

When you see that almost half of the companies in the Diversified Financial industry in the United States have price-to-sales ratios (or "P/S") below 2.5x, Acacia Research Corporation (NASDAQ:ACTG) looks to be giving off strong sell signals with its 9.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Acacia Research

How Has Acacia Research Performed Recently?

Acacia Research hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Acacia Research will help you uncover what's on the horizon.How Is Acacia Research's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Acacia Research's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's top line. Even so, admirably revenue has lifted 76% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 25% over the next year. Meanwhile, the broader industry is forecast to expand by 1.4%, which paints a poor picture.

With this information, we find it concerning that Acacia Research is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Acacia Research's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Acacia Research you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ACTG

Acacia Research

Operates as an acquirer and operator of businesses across industrial, energy, and technology sectors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives