- United States

- /

- Capital Markets

- /

- BATS:CBOE

Cboe Global Markets (CBOE): Evaluating Valuation After Crypto Futures Launch and Record Q2 Revenues

Reviewed by Kshitija Bhandaru

If you have been following Cboe Global Markets (CBOE), you know it has not been standing still this year. The company just announced plans to introduce bitcoin and ether Continuous futures to its U.S. futures exchange, a move that could change the game for traders interested in digital assets. With these products, Cboe is trying to offer a streamlined way for investors to get long-term exposure to cryptocurrencies within a well-regulated, transparent framework.

This news comes on the heels of the SEC’s green light for Cboe to list and trade commodity-based trust shares, opening fresh opportunities in the fast-moving crypto and digital assets sector. In the background, Cboe posted record Q2 revenues and continues to deliver growth across several business lines including options and global FX. The scale of its year-to-date share price gain, up 19 percent, points to growing confidence. However, momentum has cooled in the past month after a period of steady outperformance since last summer. Other headlines, such as the departure of a senior executive to Citigroup, have kept the stock in focus. The long-term view remains shaped by product innovation and earnings momentum.

Now that Cboe’s stock has clocked a strong year, the real question is whether the market’s enthusiasm about its expansion into digital assets leaves room for further upside, or if future growth is already priced in.

Most Popular Narrative: 5.8% Undervalued

Analysts see Cboe Global Markets as trading at a modest discount to its fair value, based on projected earnings and an 8.1% discount rate.

Cboe is experiencing broad-based growth across derivatives, data, and global spot markets, positioning it to benefit from ongoing increases in electronic trading volume and automation. These trends are likely to drive higher transaction-based revenue and support further top-line growth.

Want to discover the ambitious logic powering this valuation call? This forecast is grounded in a bold mix of growth engines and future margin assumptions hidden just beneath the surface. Curious which critical financial levers plug into the analysts' target? The full narrative reveals the numbers and reasoning that drive this fair value. Don't miss the details powering the story.

Result: Fair Value of $247.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant reliance on S&P index options and rapid changes in digital trading technology could present challenges to Cboe's projected growth trajectory in coming years.

Find out about the key risks to this Cboe Global Markets narrative.Another View: Our DCF Model Shows a Different Story

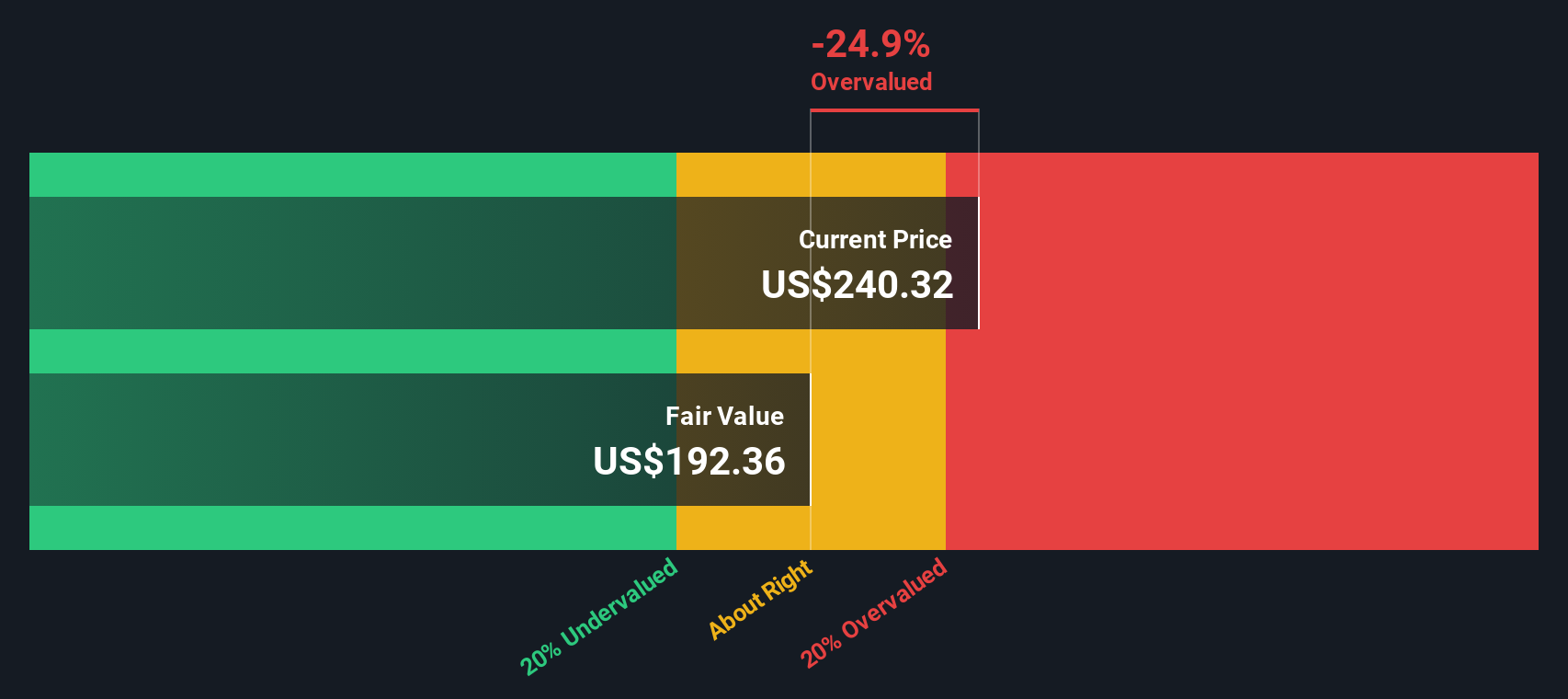

The SWS DCF model, which focuses on the present value of future cash flows, suggests Cboe may actually be overvalued at current prices. Does this highlight risks others are missing, or is it just being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cboe Global Markets Narrative

If you’re eager to challenge these conclusions or want to dig into the numbers firsthand, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your portfolio to just one opportunity? The market is full of hidden gems waiting to be found. Seize the chance to gain the edge with powerful research tools curated for smart investors.

- Accelerate your hunt for fast-growth opportunities by tapping into the world of breakthrough technology businesses with AI penny stocks.

- Unlock value treasures others overlook and target high-potential companies trading at attractive prices using our undervalued stocks based on cash flows.

- Grow your passive income strategy and find businesses offering high, reliable yields by exploring dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives