- United States

- /

- Capital Markets

- /

- BATS:CBOE

Cboe Global Markets (BATS:CBOE) Declares US$0.63 Dividend For Q2 2025

Reviewed by Simply Wall St

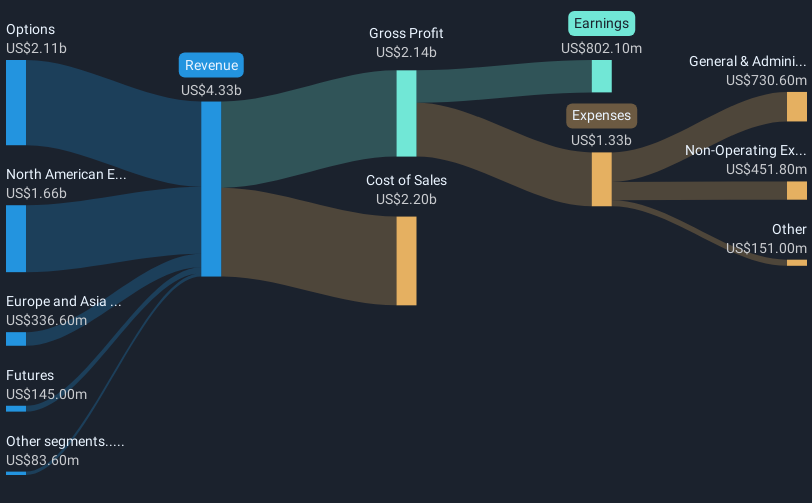

Cboe Global Markets (BATS:CBOE) announced a quarterly cash dividend of $0.63 per share, reinforcing its commitment to shareholder value. Over the last quarter, Cboe's stock increased by 12%, aligning with broader market trends yet outpacing them slightly. Key developments such as strong Q1 earnings, improved revenue guidance, and active share repurchases likely supported this positive movement. The company's leadership changes and new product launches, including Bitcoin Index futures, may have positively influenced investor sentiment, complementing the overall market's mixed performance amid anticipation of central bank decisions and ongoing trade negotiations.

Find companies with promising cash flow potential yet trading below their fair value.

The announcement of Cboe Global Markets' quarterly dividend, coupled with its recent stock price increase of 12%, highlights a robust commitment to enhancing shareholder value. This aligns with Cboe's strategic initiatives, like leadership changes and new product launches such as Bitcoin Index futures, which may contribute to supporting a positive investor sentiment. Over the past five years, Cboe has achieved an impressive total shareholder return of 156.69%, significantly surpassing the US Capital Markets industry's one-year return of 19.4% and the broader market's return of 8.2% over the same period.

While short-term price movements reflect strong performance, the company's share price is trading slightly below the consensus price target of US$221.33, suggesting a nominal upside potential. Recent strategic moves like the launch of Cboe Titanium and expansion towards 24/5 EDGX trading are anticipated to optimize operations and potentially increase market share, which could positively influence revenue and earnings forecasts. Analysts predict Cboe's earnings will grow to US$999.1 million by 2028, despite expectations of an annual revenue decline of 16% over the next three years. These projections assume increased profit margins, reaching 41.1% by 2028, setting a foundation for potentially improved future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives