- United States

- /

- Capital Markets

- /

- BATS:CBOE

Assessing Cboe Global Markets (CBOE) Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Cboe Global Markets.

After steadily climbing over the past month, Cboe Global Markets’ share price stands at $241.49. Momentum has been supported by a 22.9% year-to-date gain and a 16.3% total shareholder return over the past year, signaling building confidence in its growth story.

If you’re looking to expand your watchlist beyond Cboe, now is the perfect opportunity to discover fast growing stocks with high insider ownership

Yet, with shares hovering near analyst targets after a strong run, the real question is whether Cboe Global Markets is still undervalued or if the market has already priced in all its future growth potential.

Most Popular Narrative: 2.4% Undervalued

Cboe Global Markets' last closing price of $241.49 sits just below the most widely followed fair value estimate of $247.47. This reflects a narrow gap and a market that is finely balanced on its outlook.

Cboe is experiencing broad-based growth across derivatives, data, and global spot markets. The company is positioned to benefit from ongoing increases in electronic trading volume and automation. These trends are likely to drive higher transaction-based revenue and support further top-line growth.

Want to uncover the financial projections fueling this price target? The linchpin is a set of optimistic earnings, margin, and valuation forecasts that might surprise you. What assumptions unlock this upside? Find out what could drive these numbers in ways few expect.

Result: Fair Value of $247.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on key index partnerships and the rise of fintech disruptors could challenge Cboe’s growth if diversification efforts are not successful.

Find out about the key risks to this Cboe Global Markets narrative.

Another View: Discounted Cash Flow Perspective

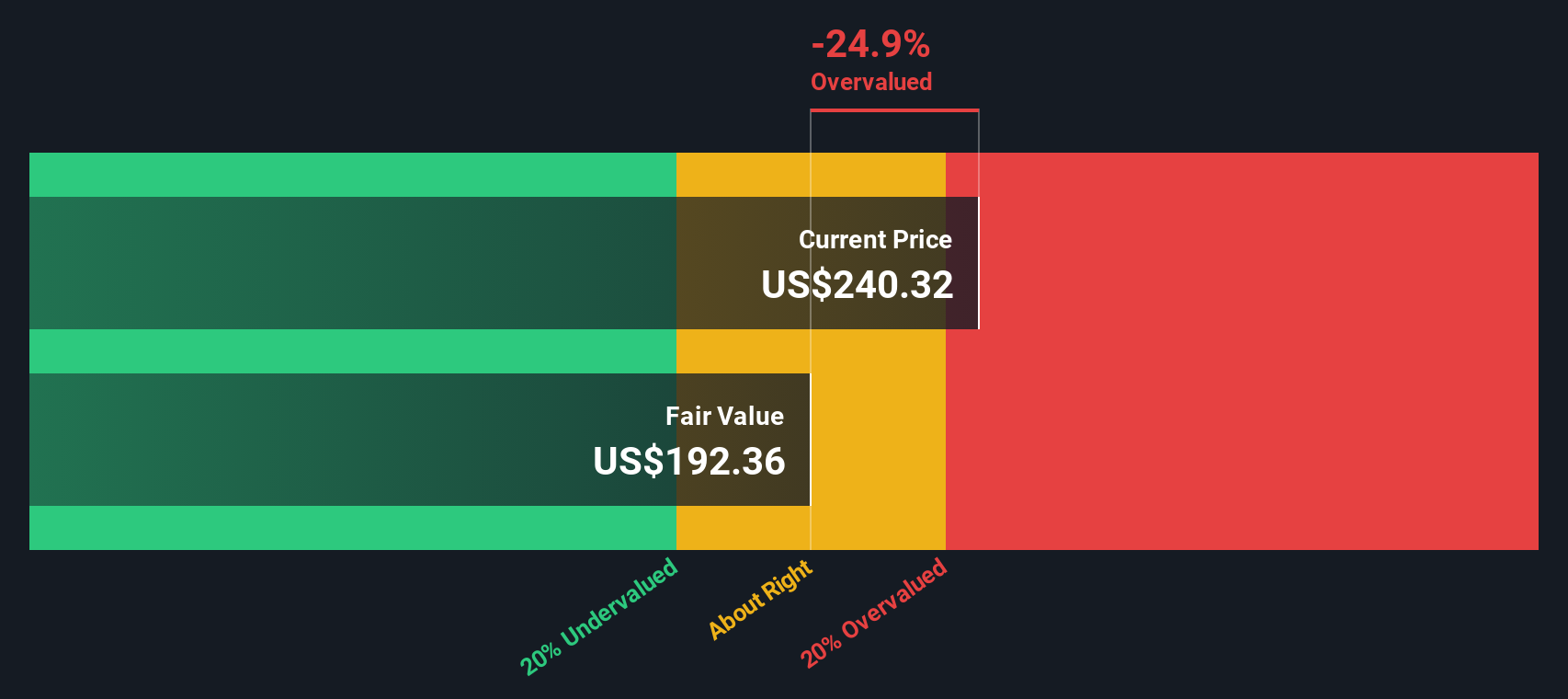

While analysts see Cboe Global Markets' stock as slightly undervalued based on consensus price targets and growth projections, our SWS DCF model offers a different perspective. According to this method, CBOE is trading above its estimated fair value by a significant margin, suggesting possible overvaluation. Could the optimism already be fully reflected in the current price, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cboe Global Markets for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cboe Global Markets Narrative

If you have a different perspective or want to dig into the numbers yourself, you can piece together your own view quickly and easily in just a few minutes. Do it your way

A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity slip by. The Simply Wall Street Screener is your shortcut to spotting unique stocks packed with potential.

- Uncover undervalued companies primed for growth by checking out these 904 undervalued stocks based on cash flows, which feature solid fundamentals and attractive price points.

- Capitalize on trends in artificial intelligence and find those tech trailblazers by exploring these 24 AI penny stocks, a collection full of AI-driven innovation.

- Capture the power of reliable income by searching these 19 dividend stocks with yields > 3%, which provides robust yields and consistent dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives