- United States

- /

- Capital Markets

- /

- BATS:CBOE

Assessing Cboe After a 22% Rally and Strong Q1 Earnings in 2025

Reviewed by Bailey Pemberton

Thinking about buying, holding, or selling Cboe Global Markets? You are not alone. The stock’s recent moves have caught the attention of both seasoned investors and newcomers, all eager to sort through what those swings could mean for their portfolio. This year, Cboe is up a robust 21.9%, pushing its five-year return to a remarkable 204.7%. Yet, the last week saw a slight dip of 2.7% after a fairly strong 30-day gain of 3.0%. These shifts, set against a backdrop of market uncertainty and evolving investor sentiment, hint at both growth potential and changing risk perceptions.

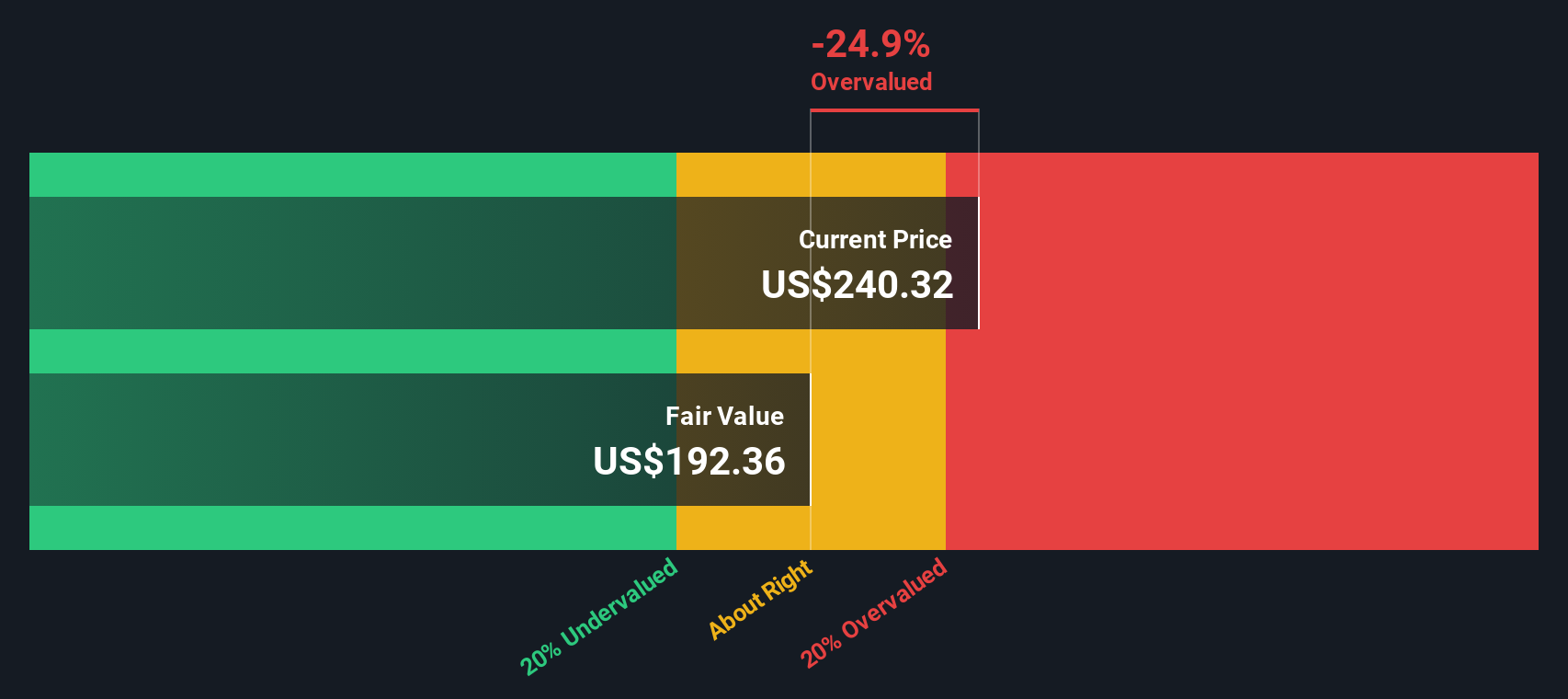

Much of Cboe’s longer-term momentum can be connected to ongoing shifts in global financial markets. As trading volumes and demand for market infrastructure rise across geographies, Cboe continues to carve out new opportunities, leveraging its platform and reach. However, in the valuation scorecard, Cboe clocks in at just 1 out of 6 on undervalued checks. This is a signal for value-focused investors to look closer.

So, how should you weigh all the data when trying to decide what Cboe is really worth? Next, let’s break down several standard valuation methods to see where the numbers point. In the end, I will highlight an approach that could give you an even sharper perspective on Cboe’s real value.

Cboe Global Markets scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cboe Global Markets Excess Returns Analysis

The Excess Returns model focuses on the company’s ability to generate returns above its cost of equity. This approach is particularly relevant for firms in the financial sector, where return on invested capital and growth in book value are strong indicators of value creation. For Cboe Global Markets, the data paints a clear picture of consistent profitability and capital efficiency.

Cboe’s Book Value stands at $44.60 per share, with a Stable EPS estimated at $11.38 per share based on projections from 8 analysts. The Cost of Equity is $4.38 per share, meaning Cboe delivers an Excess Return of $7.00 per share. The company’s average Return on Equity is an impressive 21.43 percent, and the stable Book Value is forecasted to rise to $53.11 per share according to 2 analyst estimates.

According to the Excess Returns Model, the estimated intrinsic value for Cboe shares is $188.42. At current market levels, this implies a 27.1 percent premium, indicating the stock is trading above its fair value. Put simply, the robust excess returns and high profitability are already fully reflected in the current valuation, and then some.

Result: OVERVALUED

Our Excess Returns analysis suggests Cboe Global Markets may be overvalued by 27.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cboe Global Markets Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular and effective tool for valuing profitable companies like Cboe Global Markets because it directly relates share price to the earnings generated by the business. For companies with reliable and growing profits, the PE ratio highlights how much investors are willing to pay today for each dollar of earnings.

When analyzing the appropriateness of a PE ratio, growth expectations and perceived risk play critical roles. A company expected to deliver higher earnings growth or maintaining lower risk often commands a higher PE multiple. Conversely, if growth prospects are modest or risks run high, a lower PE is typically justified.

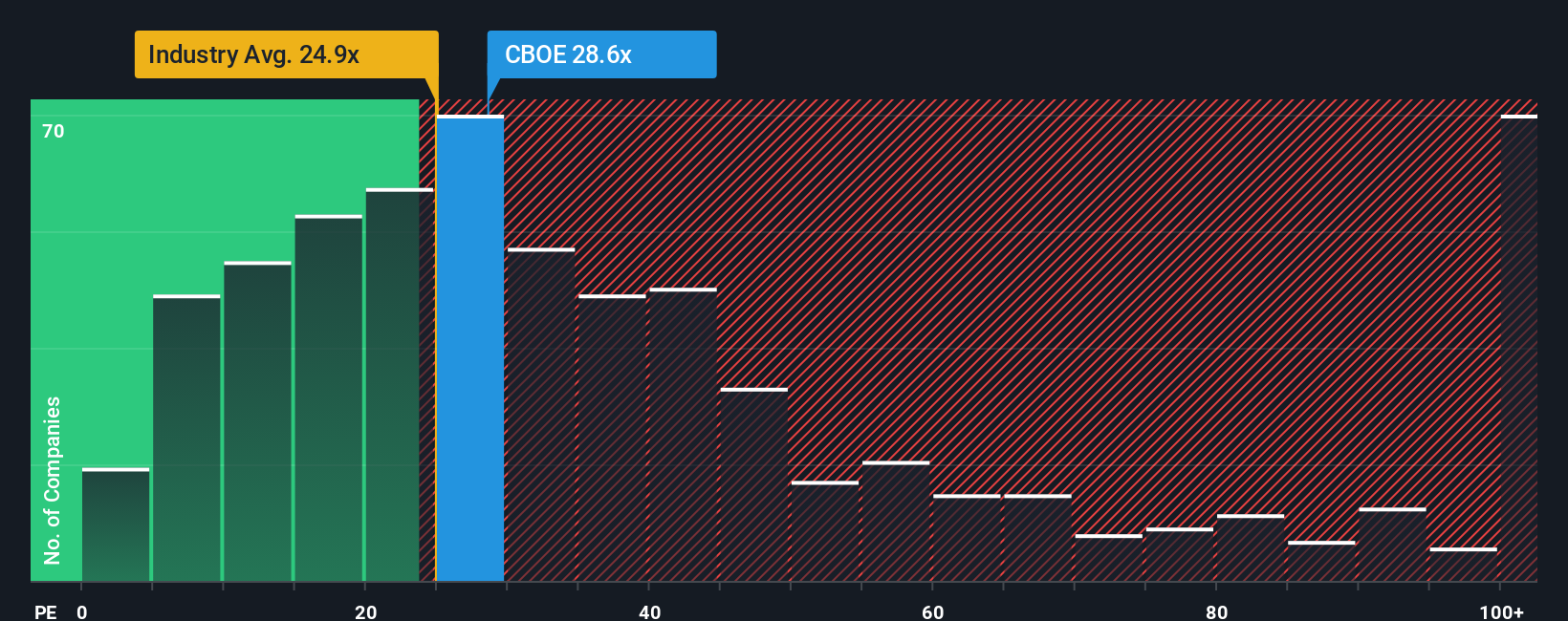

- Cboe’s current PE ratio is 28x

- Peer group average stands at 32.5x

- The industry average for Capital Markets is roughly 27.1x

Simply Wall St’s proprietary "Fair Ratio" offers a more nuanced benchmark, factoring in not just industry or peer comparisons, but also Cboe’s own qualities like earnings growth, profit margins, market cap, and risk profile. In Cboe’s case, the Fair PE Ratio is 16.25x. This number reflects the company’s unique blend of strengths and challenges.

While Cboe trades at a premium to both its industry and the calculated fair multiple, it is the Fair Ratio that offers the most balanced perspective by adjusting for Cboe’s specific outlook and risk. Because the gap between the current PE (28x) and Fair Ratio (16.25x) is notably wide, this suggests the stock is significantly overvalued using this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cboe Global Markets Narrative

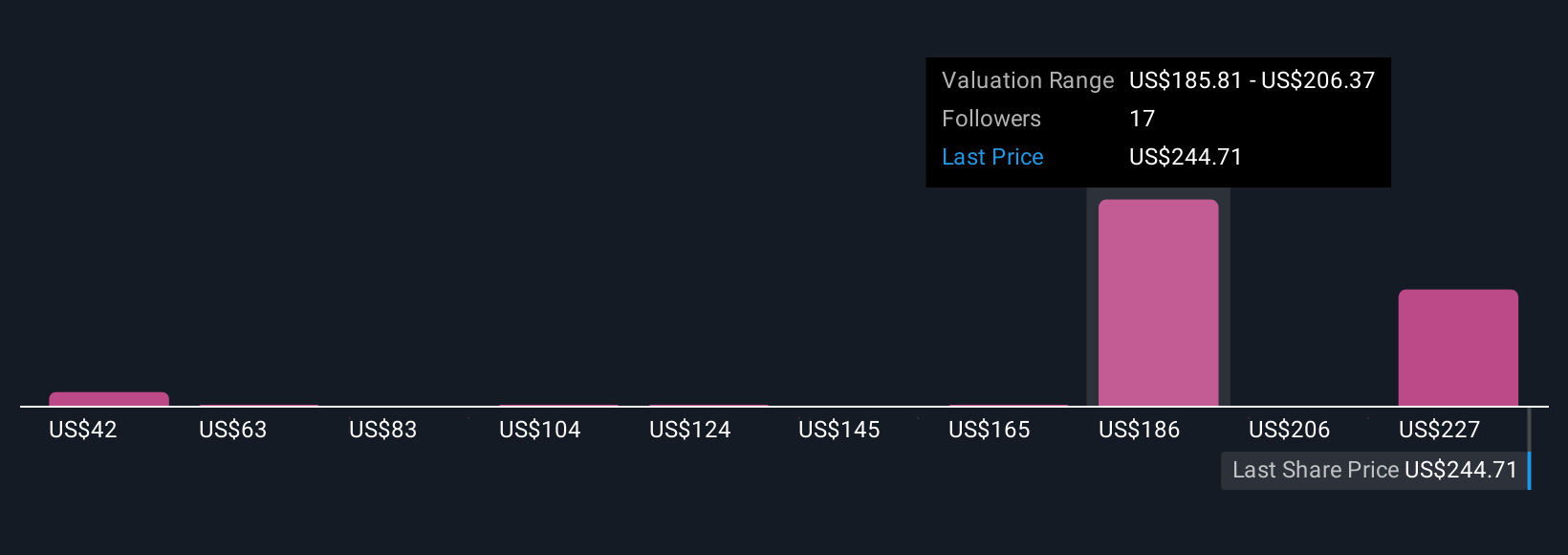

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind a company, the perspective you bring on what’s driving its future, paired directly with your own assumptions about revenue growth, profit margins, and fair value. With Narratives, you are not just looking at what the numbers say, but why they matter, linking the business story to a forward-looking forecast and ultimately, to a fair value that reflects your personal view.

On Simply Wall St’s Community page, millions of investors can view, share, and update Narratives in real time, making this an easy and accessible tool for anyone. Whenever news breaks or earnings results are published, Narratives update dynamically to help you react quickly and make more informed decisions. Narratives are especially powerful because they help you clearly compare your Fair Value with the current Price, so you can decide when you believe it is time to buy or sell.

For example, one investor might see Cboe’s ambitious expansion and high-margin services as reasons to assign a fair value of $265, while another who is more concerned about global competition and margin pressure might base their narrative around a $216 value. This shows how Narratives capture a range of perspectives and give you the tools to frame your own decision.

Do you think there's more to the story for Cboe Global Markets? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives