- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

What Luckin Coffee (LKNC.Y)'s Market Share Victory Over Starbucks Means for Shareholders

Reviewed by Sasha Jovanovic

- Luckin Coffee surpassed Starbucks in China by the end of 2024, reaching 22,300 stores and taking the lead in sales through rapid expansion, digital operations, and aggressive pricing strategies.

- The company's approach of blending coffee and tea beverages and integrating digital ordering has reshaped market preferences but raises questions about competition, product differentiation, and long-term profitability.

- We'll now examine how Luckin Coffee's rise to market leader through digital operations and store expansion affects its investment prospects.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Luckin Coffee Investment Narrative Recap

To be a long-term shareholder in Luckin Coffee, you need conviction in its aggressive growth strategy, digital-first model, and ability to sustain profitability amidst fierce competition. While Luckin’s rapid expansion and market leadership have fueled strong investor sentiment, the recent news is a validation of its growth catalyst but does not materially change the most pressing concern: the risk of overexpansion and potential store saturation, which could pressure margins if not managed carefully.

The most relevant recent announcement is Luckin’s latest quarterly earnings report, with Q2 2025 revenue rising to CNY 12,358.74 million and notable net income growth year-on-year. These results suggest that Luckin is still converting its high store count into top-line growth and profitability, supporting optimism around its near-term catalysts tied to scale and customer acquisition.

However, beneath the headline growth, investors should be alert to the potential for diminishing store productivity as expansion accelerates...

Read the full narrative on Luckin Coffee (it's free!)

Luckin Coffee's narrative projects CN¥73.6 billion revenue and CN¥6.9 billion earnings by 2028. This requires 21.5% yearly revenue growth and a CN¥3.0 billion increase in earnings from the current CN¥3.9 billion.

Uncover how Luckin Coffee's forecasts yield a $46.89 fair value, a 14% upside to its current price.

Exploring Other Perspectives

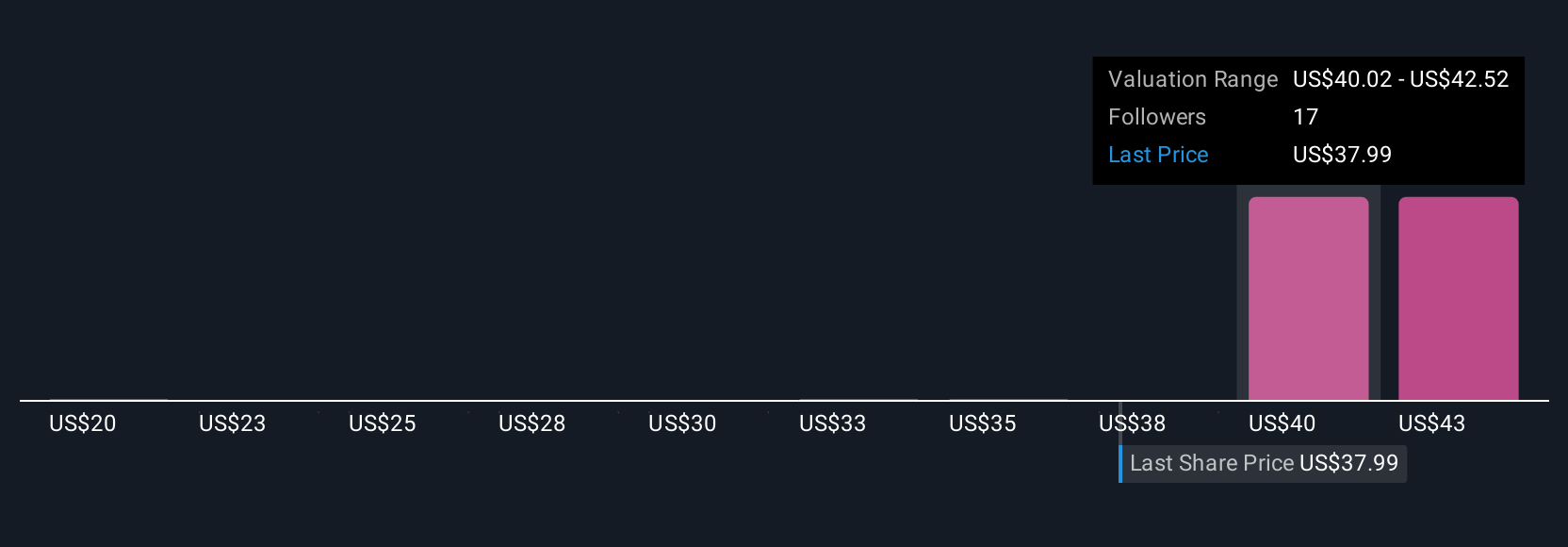

Simply Wall St Community members have published 10 fair value estimates for Luckin Coffee, ranging from CNY 32.39 to CNY 141.41 per share. With such divergent outlooks, it’s clear opinions differ widely while rapid expansion still raises questions about future margin pressure, explore several viewpoints to balance your own assessment.

Explore 10 other fair value estimates on Luckin Coffee - why the stock might be worth 21% less than the current price!

Build Your Own Luckin Coffee Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Luckin Coffee research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Luckin Coffee research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Luckin Coffee's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives