- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Is Luckin Coffee Still an Opportunity After 47.5% Surge in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Luckin Coffee over the past few years, you know this stock has been anything but boring. Whether you’re sipping espresso or pondering portfolio moves, it’s hard to ignore growth numbers like these: up nearly 782% over the last five years. Even more recently, Luckin shares have climbed 6.6% in the past month and an impressive 47.5% year to date. These metrics have a way of grabbing your attention, especially if you’re wondering whether this stock’s best days are behind it or if more upside might be brewing.

Lately, Luckin Coffee has been stirring up headlines with its rapid store expansion and innovative marketing partnerships across China. Investors seem to be rewarding these moves, perhaps seeing reduced risk after years of volatility. As a result, the company’s risk profile has shifted, drawing in new interest from both retail and institutional players who see growth potential but are also eyeing valuation closely.

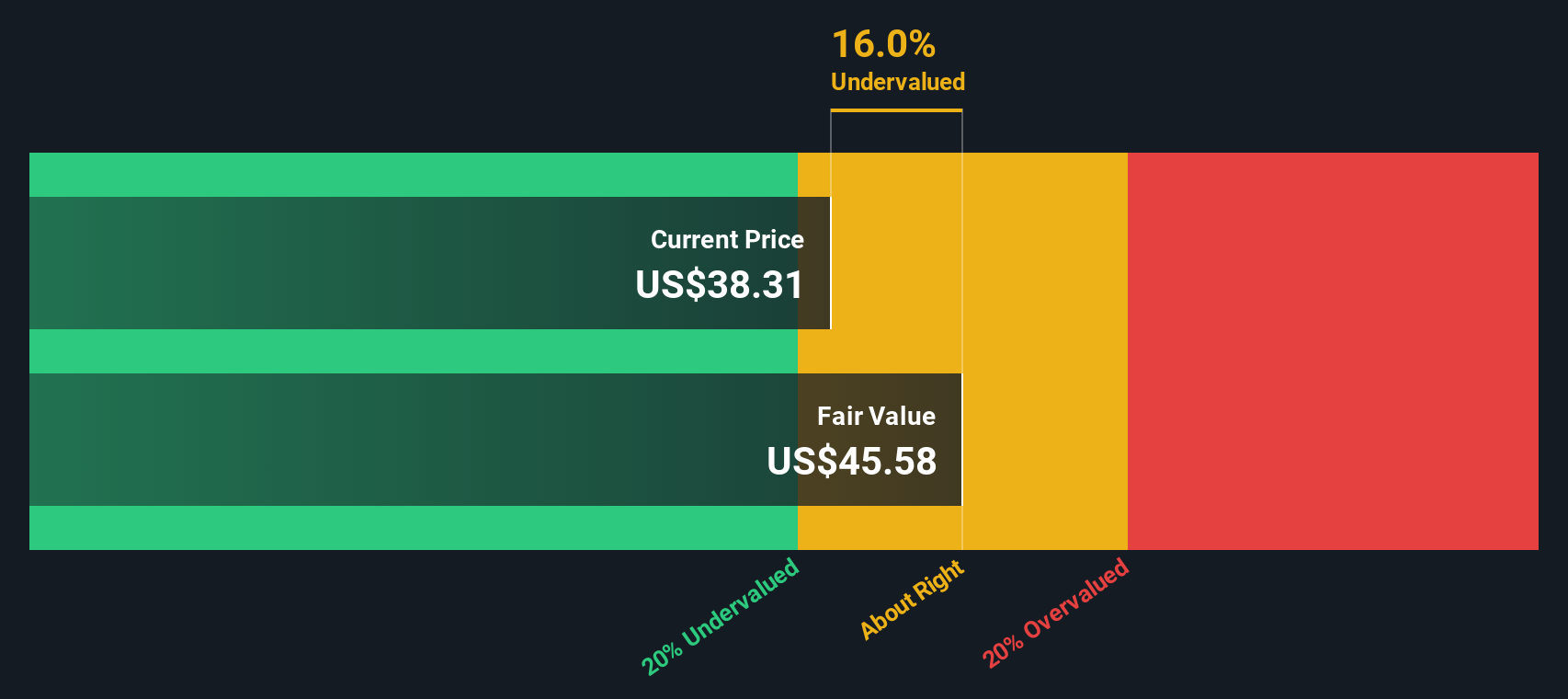

So, just how undervalued or overhyped is Luckin at this moment? If you look at it through a basic checklist of valuation methods, Luckin comes in strong, passing four out of six key checks. That gives it a value score of 4, which suggests more room for optimism than skepticism, at least on paper.

But are those traditional valuation approaches telling the whole story? Let’s break down each method and stick around, because I’ll share a perspective at the end that might just change how you gauge Luckin’s true value.

Approach 1: Luckin Coffee Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting those amounts back to today’s value. For Luckin Coffee, this model relies on anticipated cash flows in the years ahead, taking into account both near-term analyst forecasts as well as longer-term trend projections.

Currently, Luckin Coffee generates CN¥3.62 billion in Free Cash Flow (FCF). Looking further ahead, analysts anticipate that FCF could reach CN¥4.68 billion by 2027, and extrapolated estimates project CN¥9.22 billion by 2035. These forecasts reflect sustained growth, driven in part by Luckin’s continued expansion and increasing operational scale.

Based on the DCF approach, the company’s estimated intrinsic value comes in at $46.20 per share. With the model indicating the stock is trading at a 14.0% discount to this calculated fair value, Luckin appears to be undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Luckin Coffee is undervalued by 14.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Luckin Coffee Price vs Earnings (PE)

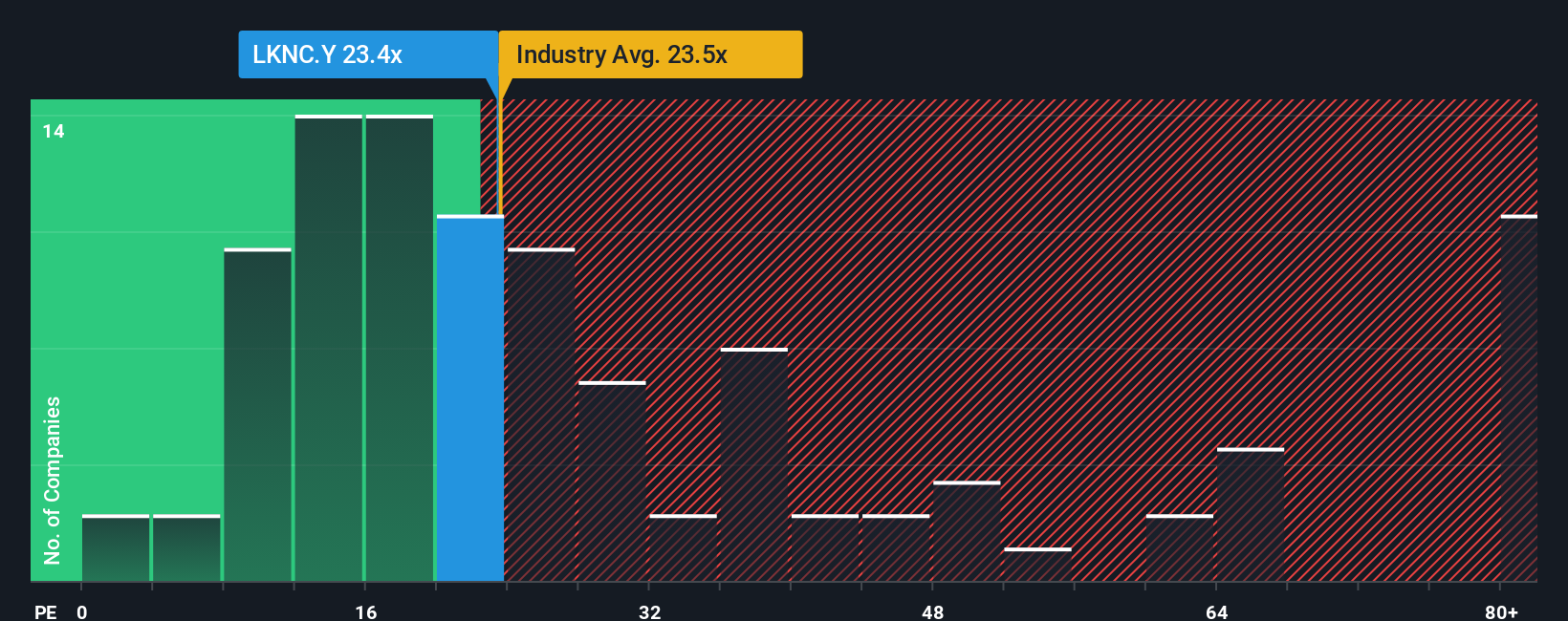

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Luckin Coffee, because it links a company’s market price directly to its earnings performance. With profitability now in focus for Luckin, the PE ratio helps investors assess how much they’re paying for each dollar of current earnings, while indirectly reflecting the market’s expectations for future growth.

Growth prospects and risk factors play a major role in how high or low a company’s “normal” PE ratio should be. A business that’s expanding quickly typically commands a higher multiple, since investors are willing to pay up for those future earnings. At the same time, higher risk can mean a lower PE is justified.

Currently, Luckin trades at a PE ratio of 23.13x. That is in line with the hospitality industry average of 23.93x, but significantly below the average of its peers at 62.16x. On the surface, this could signal potential value. Instead of just comparing to those broad benchmarks, Simply Wall St’s “Fair Ratio” takes a granular look at Luckin’s capitalization, earnings growth, risk profile, profit margins, and where it sits within its industry. In Luckin’s case, that Fair Ratio lands at 29.52x, higher than the company’s current PE.

Because this Fair Ratio is more comprehensive than a simple industry average or peer comparison, it gives a clearer sense of what is justifiable for Luckin right now. With the current PE below the Fair Ratio, the numbers suggest Luckin Coffee’s shares may be undervalued based on its earnings potential and unique characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

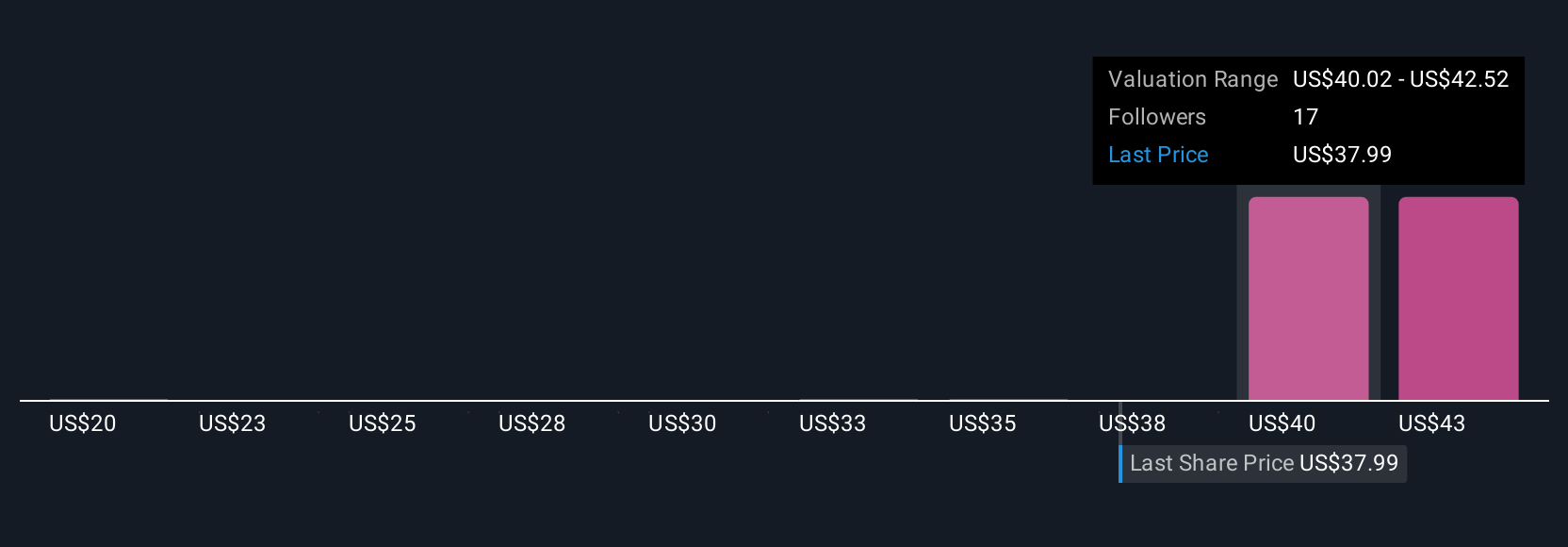

Upgrade Your Decision Making: Choose your Luckin Coffee Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, a more dynamic and approachable way to invest that goes well beyond just crunching the numbers. A Narrative combines your unique perspective on a company’s story, your expectations about future growth, and your sense of fair value into a single, coherent forecast. On Simply Wall St’s Community page, millions of investors easily create and follow Narratives, connecting news and events directly to financial forecasts and valuations in a way that makes sense to them.

With Narratives, it becomes much simpler to decide if now is the right time to buy or sell, because you can instantly compare the Fair Value from your Narrative with the current Price, and updates happen automatically whenever new information such as earnings releases or market-moving news comes in. For Luckin Coffee, one Narrative might see massive digital adoption and continued store expansion justifying a higher Fair Value, while another might focus on rising costs, brand risks, and growing competition, making a much more conservative forecast. Narratives let you tell your story, test your case and know exactly when your view has changed and why.

Do you think there's more to the story for Luckin Coffee? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives