- United States

- /

- Hospitality

- /

- NYSE:YUMC

Is Now the Right Time to Reassess Yum China After Shifting Consumer Trends?

Reviewed by Bailey Pemberton

- Wondering if Yum China Holdings is currently a good deal or overpriced? Let's dive into what really matters for investors trying to spot value in this fast-moving market.

- The stock has seen some ups and downs lately, with a 1.8% gain over the last month but a modest 1.0% increase over the past year. This suggests changing perceptions about its growth or risk profile.

- Recent headlines have focused on shifting consumer trends in China and evolving strategies from major restaurant brands. These news items have helped shape investor sentiment around Yum China, making now a fascinating time to assess its worth.

- When it comes to valuation, Yum China scores a solid 5 out of 6 in our key undervalued checks. Next, let's delve into the specific methods analysts use to value a company like this, along with an insider perspective on understanding true worth that you will want to explore by the end of this article.

Find out why Yum China Holdings's 1.0% return over the last year is lagging behind its peers.

Approach 1: Yum China Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's value using a required rate of return. This approach helps investors assess whether the stock's current price reflects its underlying business prospects.

For Yum China Holdings, the latest reported Free Cash Flow (FCF) is $741 million. Analyst forecasts suggest that FCF will steadily grow over the next decade, with projections showing it could reach around $1.5 billion by 2035. While analysts provide estimates covering roughly the next five years, longer-term figures are extrapolated to provide a fuller picture of potential outcomes.

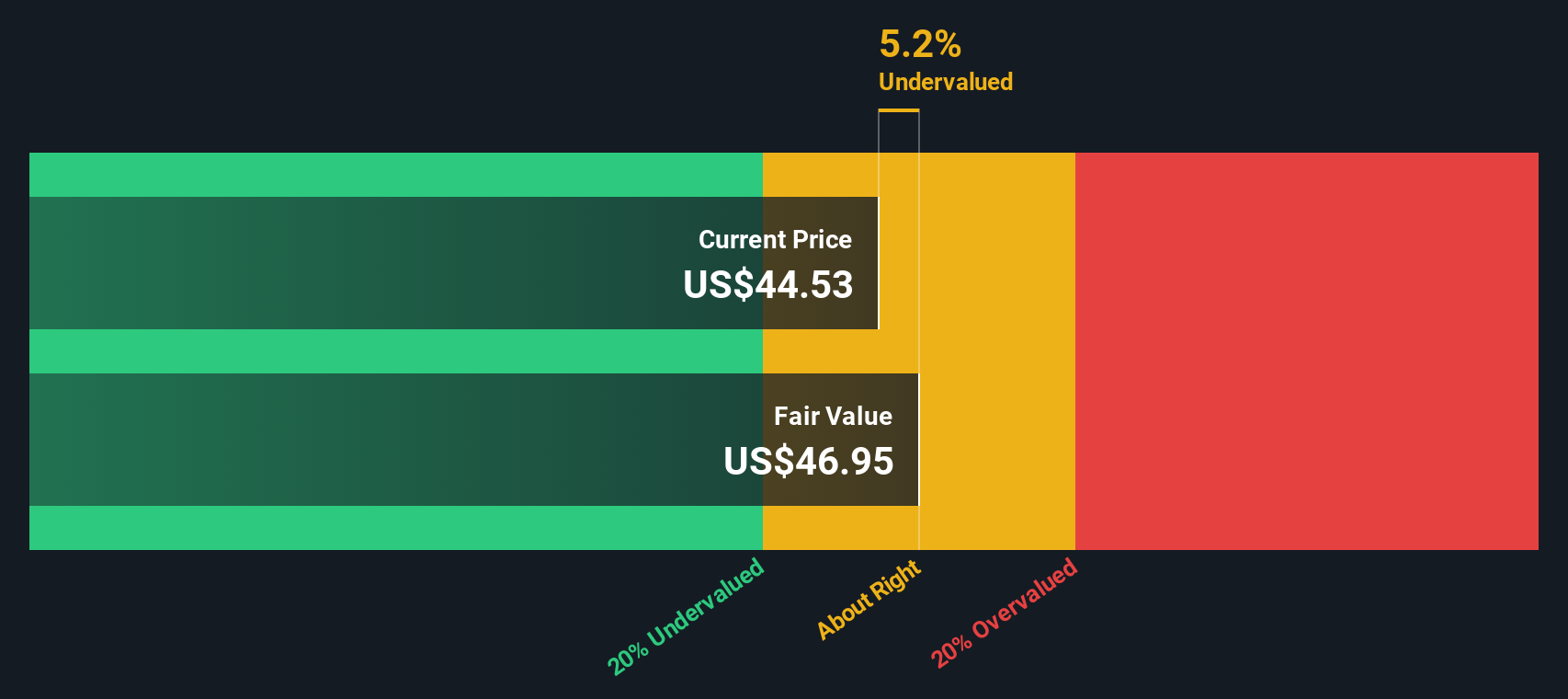

Using a 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of $50.20 per share. Compared to the current market price, this represents a 13.0% discount, indicating the stock is trading below its estimated fair value.

This analysis suggests Yum China Holdings is undervalued based on its future cash-generating potential and could offer an opportunity for investors looking for value in the hospitality sector.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Yum China Holdings is undervalued by 13.0%. Track this in your watchlist or portfolio, or discover 834 more undervalued stocks based on cash flows.

Approach 2: Yum China Holdings Price vs Earnings

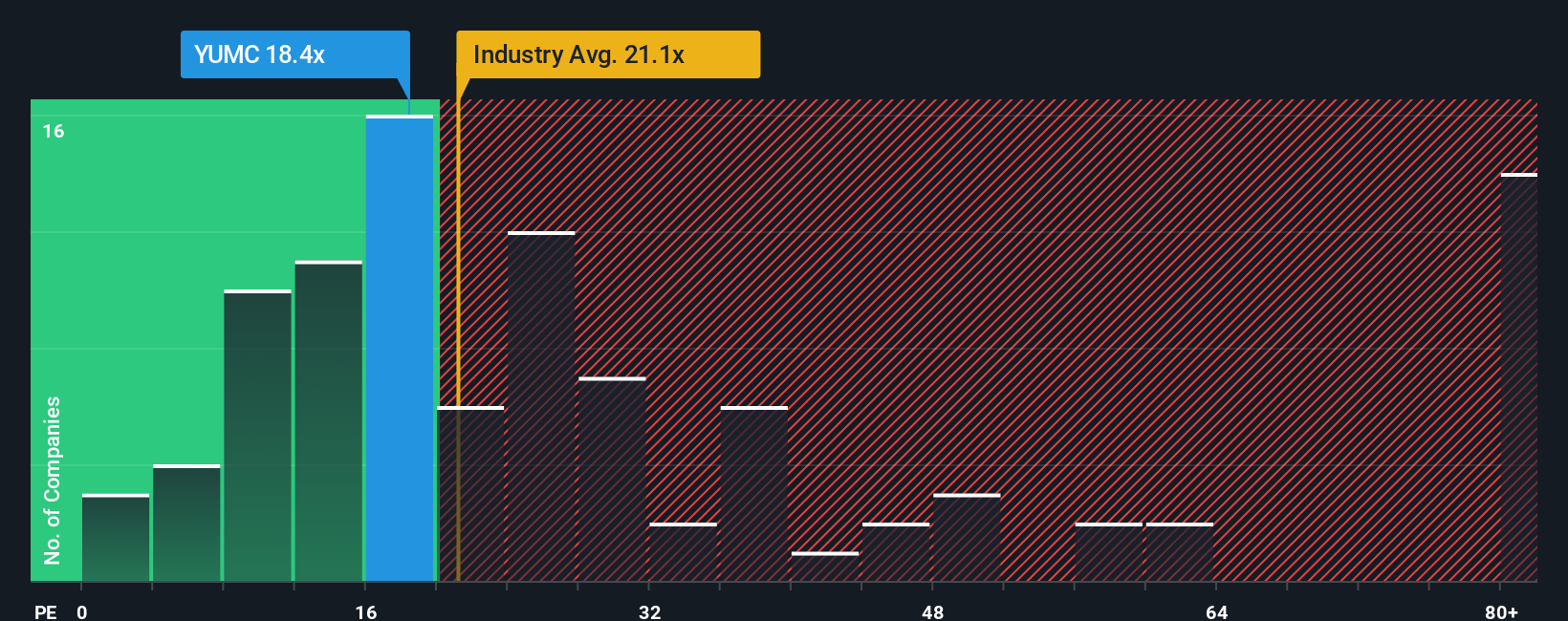

The Price-to-Earnings (PE) ratio is widely regarded as a suitable valuation metric for profitable companies because it directly compares a company's stock price to the earnings it generates. This makes it useful for understanding whether a stock is trading at a reasonable level relative to its profitability.

Growth expectations and risk are key factors in determining what a "normal" or "fair" PE ratio looks like. Higher growth prospects can justify a higher PE, while increased risks or low growth rates typically warrant a lower ratio. Investors should also consider how the company's margins and broader industry conditions affect what is considered fair.

Yum China Holdings currently trades at a PE ratio of 17.2x, noticeably below both the industry average of 23.5x and the peer group average of 23.8x. While these benchmarks provide context, they do not always reflect the specific fundamentals of the company.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated as 23.5x for Yum China Holdings, factors in important differentiators like earnings growth, profit margins, market capitalization, risk, and sector characteristics. It is designed to be a more holistic and tailored benchmark than a simple industry comparison.

Comparing Yum China’s actual PE ratio to its Fair Ratio reveals a notable discount, suggesting the stock may be undervalued based on its specific attributes rather than just industry averages.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Yum China Holdings Narrative

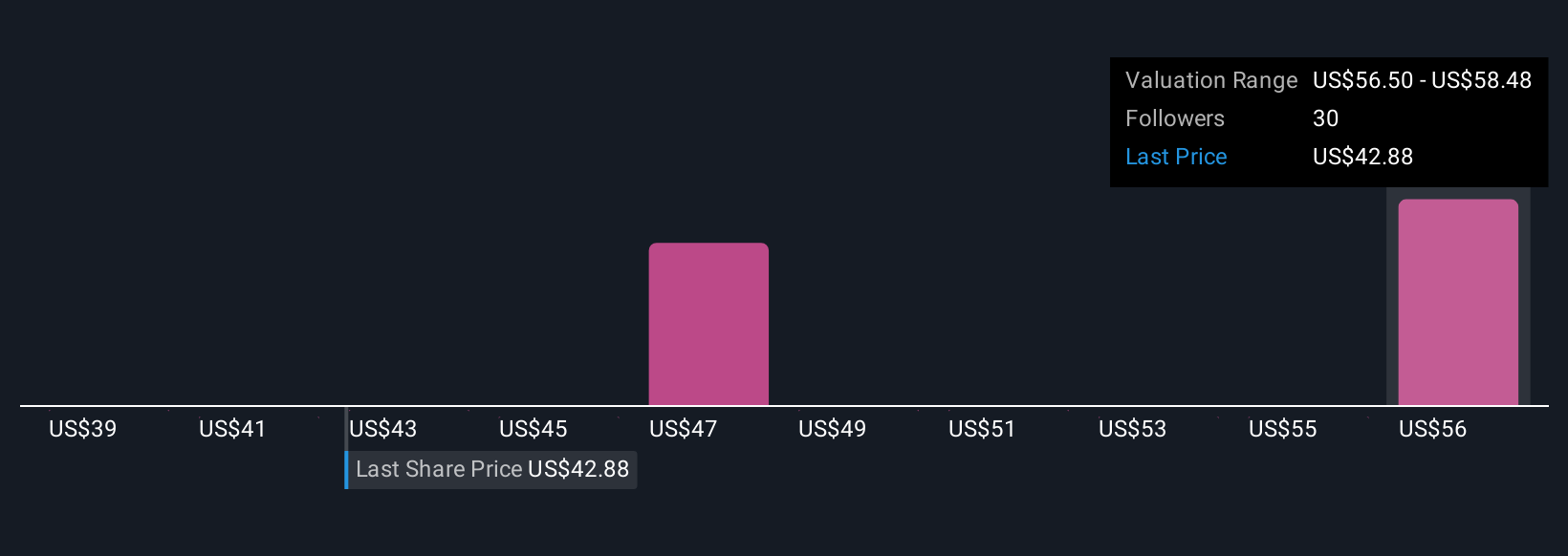

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are simple, powerful tools that let investors frame their own story about a company, combining personal views on growth, risks, and future performance with tangible financial forecasts to estimate its fair value.

By building a Narrative, you bridge the gap between what is happening in the real world and the company’s potential. This approach makes it easier to see how news, earnings releases, or strategic changes might shape future earnings, margins, or revenues. Narratives connect these assumptions to a fair value and, most importantly, make it straightforward to compare that value with today’s stock price, helping you spot buy or sell opportunities.

On Simply Wall St’s Community page, millions of investors use Narratives to refine decisions, and each Narrative updates dynamically as new information emerges. In this way, your analysis stays relevant and actionable. For Yum China Holdings, one Narrative projects rapid store expansion and digital innovation leading to a $76.0 price target, while another anticipates tighter margins and slower growth for a $53.1 target, illustrating how different perspectives can lead to different conclusions about what the stock is really worth.

Do you think there's more to the story for Yum China Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUMC

Yum China Holdings

Owns, operates, and franchises restaurants in the People’s Republic of China.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives