- United States

- /

- Hospitality

- /

- NYSE:YUM

Yum! Brands (YUM): Assessing Fair Value as Steady Growth Draws Investor Interest

Reviewed by Kshitija Bhandaru

Yum! Brands (YUM) stock has delivered a steady climb over the past month, up about 4%. Investors are watching closely as the company continues to post solid gains in annual revenue and net income growth.

See our latest analysis for Yum! Brands.

Momentum has been building all year for Yum! Brands, with its share price recently moving higher and a 12.5% total shareholder return over the past twelve months highlighting steady long-term progress. With recent announcements showing continued earnings strength, investors are viewing the company as a reliable growth story.

If this kind of resilience has you rethinking your watchlist, now is a great moment to discover fast growing stocks with high insider ownership

The question now becomes whether Yum! Brands shares are trading below fair value, which could point to untapped upside, or if the market is already factoring in its future growth potential and leaving limited room for new buyers.

Most Popular Narrative: 4.5% Undervalued

Yum! Brands’ most tracked narrative estimates fair value at $158.52 a share, compared to the last close of $151.35, implying modest upside. This sets up an interesting debate about whether robust expansion and digital transformation can unlock the value that analysts expect.

The rapid acceleration and global rollout of Yum!'s Byte digital platform, including AI-driven marketing, operational automation, and proprietary ordering/delivery solutions, positions the company to capture higher transaction volumes, expand check sizes, and enhance customer loyalty. This drives both top-line revenue growth and improves net margins over the long term.

Want to see what’s powering that bullish outlook? The narrative centers on a digital transformation story and bold profitability forecasts that challenge sector norms. Hungry for the financial assumptions and future profit targets baked into that valuation? The details might surprise you.

Result: Fair Value of $158.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in certain brands and the high upfront cost of tech investments could challenge Yum! Brands’ growth outlook if these issues are not carefully managed.

Find out about the key risks to this Yum! Brands narrative.

Another View: What Do Valuation Ratios Suggest?

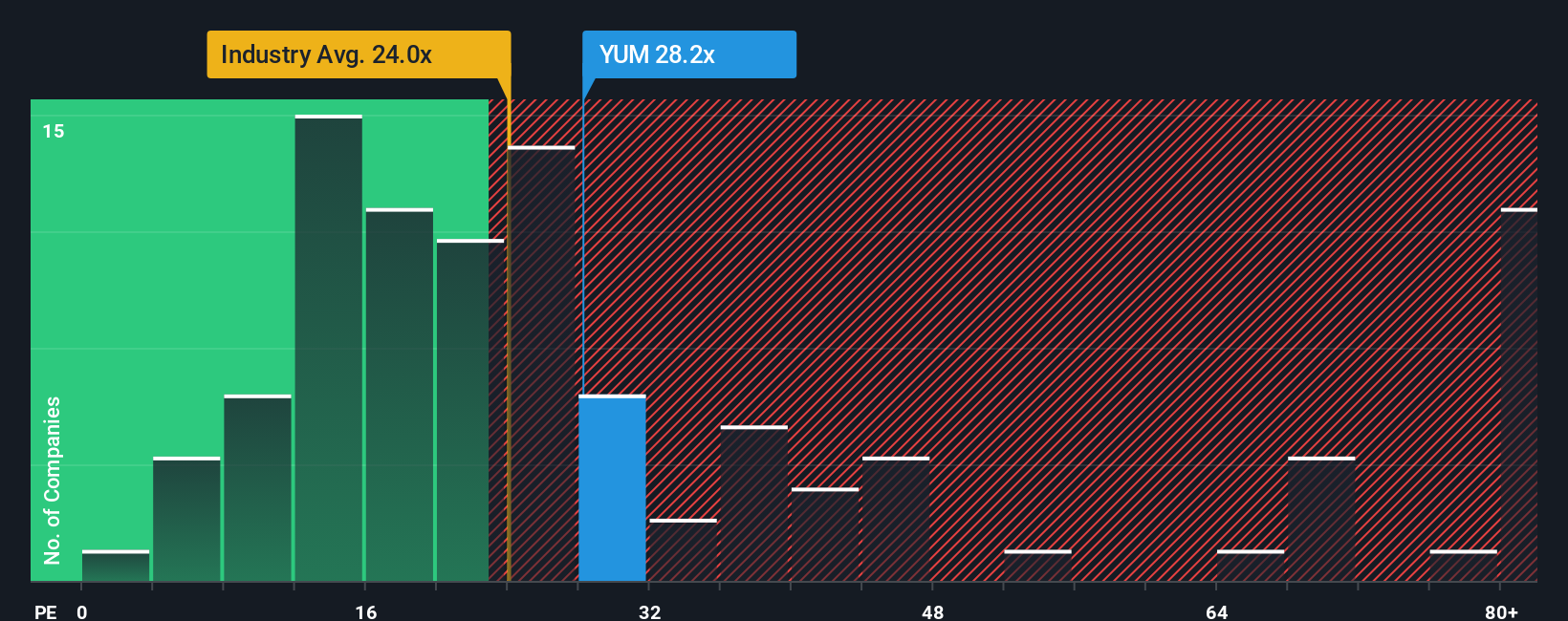

Looking at where Yum! Brands trades relative to other companies, its price-to-earnings ratio is 29.3x. This is above the US Hospitality industry average of 24x and the estimated fair ratio of 27.9x. That could mean there is some optimism already built into the price, leaving less margin for error. Is the market too optimistic, or could further upside remain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yum! Brands Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Yum! Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investing Targets?

Expand your horizons with carefully selected opportunities that could put your portfolio ahead of the crowd. Staying curious and moving beyond the obvious picks can make all the difference. Check out these standout ideas now before the next wave of enthusiasm leaves you watching from the sidelines:

- Unlock steady income potential by reviewing these 19 dividend stocks with yields > 3% offering yields above 3% to help strengthen your passive returns.

- Get ahead of tomorrow's tech breakthroughs by evaluating these 26 quantum computing stocks that are advancing the frontier of computing power.

- Take advantage of compelling prices with these 910 undervalued stocks based on cash flows, targeting stocks that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUM

Yum! Brands

Develops, operates, and franchises quick service restaurants worldwide.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives