- United States

- /

- Hospitality

- /

- NYSE:YUM

Is Yum! Brands Fairly Priced After Its 10% Stock Climb and Mixed Valuation Signals?

Reviewed by Bailey Pemberton

Trying to decide if Yum! Brands deserves a place in your portfolio right now? You are not alone. With a diverse range of fast-food giants under its umbrella, Yum! has long attracted investors looking for steady returns, but recent market swings have many pausing to reassess. Over the past year, the company’s stock price has climbed 10.5%, with a year-to-date gain of 8.2%. These are respectable figures in a turbulent market. However, the last seven days saw a slip of 1.0%, and the past month is down 2.9%, suggesting a bit of short-term caution or shifting sentiment.

This pattern echoes what we have seen in broader industry moves, with investors moving between defensive stocks and growth plays as rate and inflation discussions dominate headlines. Despite the minor pullback, Yum! Brands’ five-year return of 60.1% highlights real underlying strength. That said, when it comes to value, the conversation gets even more interesting. On a six-point valuation checklist, Yum! Brands is undervalued in just 2 out of 6 measures, giving it a current value score of 2. Is that enough to justify a buy right now, or is the market telling us something?

Let’s dig into the different valuation checks and what they reveal about Yum! Brands’ current pricing. If the regular approaches do not tell the whole story, there may be a smarter angle to watch for at the end of our analysis.

Yum! Brands scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Yum! Brands Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps to assess what Yum! Brands might be worth based on its anticipated ability to generate cash in the years ahead.

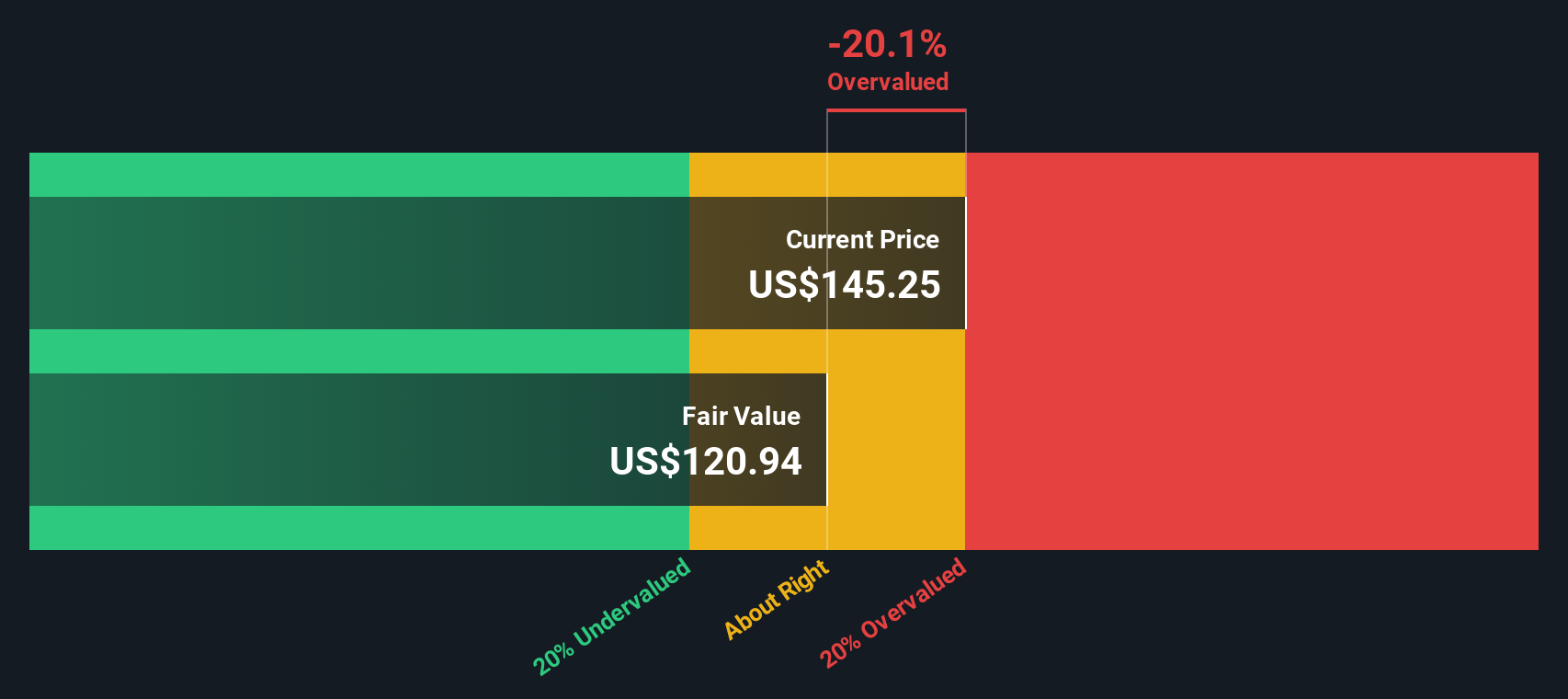

For Yum! Brands, the analysis starts with a current Free Cash Flow (FCF) of $1.5 Billion. Analyst forecasts extend for the next five years and anticipate growth in annual FCF, reaching $2.3 Billion by 2029. Looking further ahead, extrapolated projections estimate cash flows up to 2035, gradually increasing but at a slower pace as growth moderates.

Based on these forecasts and using a 2 Stage Free Cash Flow to Equity model, the DCF valuation arrives at an intrinsic fair value of $120.46 per share. Compared to the company’s current stock price, this suggests Yum! Brands is trading about 20% above its estimated fair value, which signals that the market currently prices in more optimism than the cash flow outlook supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Yum! Brands may be overvalued by 20.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Yum! Brands Price vs Earnings (PE)

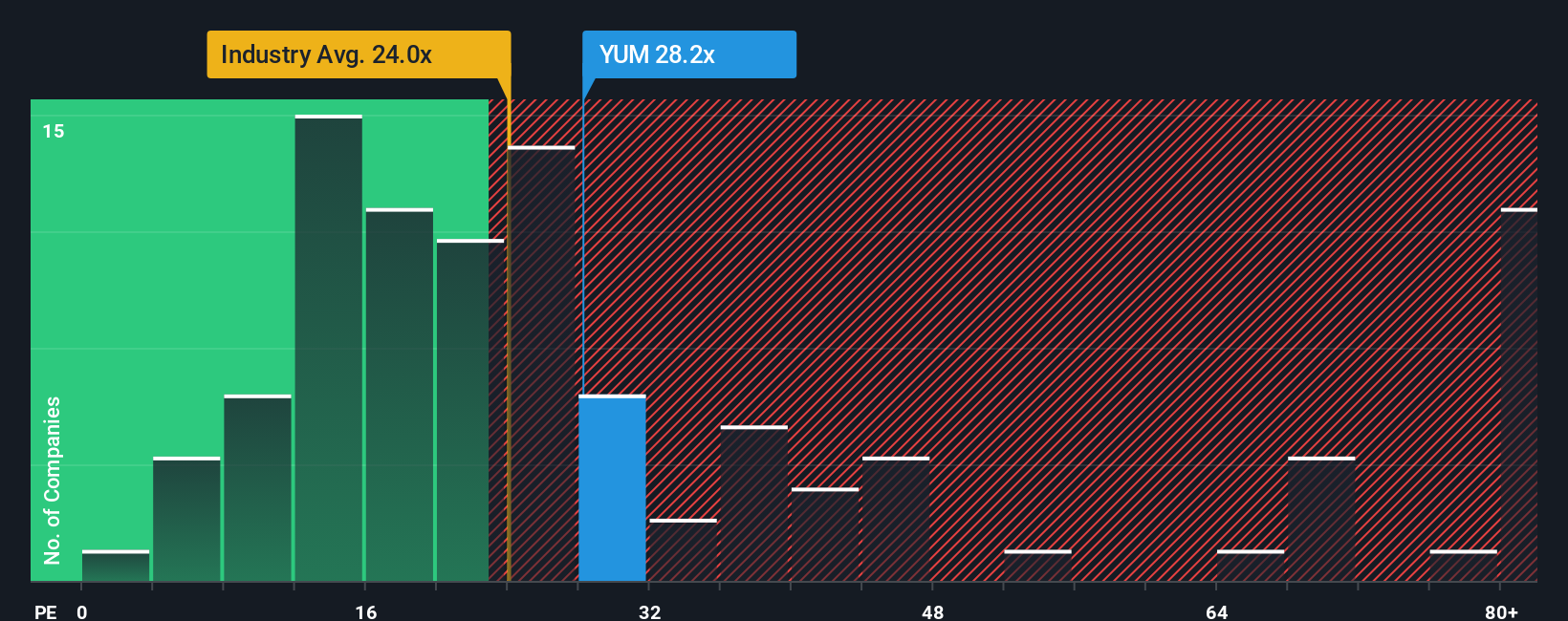

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Yum! Brands. It gives investors a quick way to gauge how much they are paying for each dollar of current earnings. Since Yum! Brands turns out consistent profits, the PE ratio offers valuable perspective on how the market is valuing its earnings power today.

The "right" PE ratio depends on a blend of growth prospects and risk. Companies expected to grow earnings quickly, or those seen as lower risk, often justify higher PE ratios. Conversely, slower-growing or riskier companies may trade at a discount. For Yum! Brands, the current PE comes in at 28x. That is slightly below the average for its listed peers, which is about 29.6x, but above the Hospitality industry average of 23.8x. These numbers imply the market sees above-average stability or growth potential in Yum! relative to the sector overall.

Simply Wall St’s proprietary “Fair Ratio” offers a more tailored take. This metric blends factors like growth outlook, risk, profit margin, industry context, and market size to estimate what a reasonable PE should be for Yum! Brands specifically, in this case, about 28x. This approach improves on peer or industry comparisons that might overlook company-specific strengths or weaknesses.

With Yum! Brands trading right at its Fair Ratio, the valuation appears justified based on its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Yum! Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind the numbers, allowing you to combine your own perspective on Yum! Brands’ future with assumptions about revenue, earnings, and profit margins. This ultimately leads to a fair value estimate that is grounded in reasoning rather than just statistics.

Narratives bridge the gap between a company’s unique story and its financial forecasts, linking everything you believe about management, strategy, expansion, and risks directly to an objective fair value. They are easy to use and available now on Simply Wall St’s Community page, where millions of investors share and update their views.

With Narratives, you can instantly see whether your outlook justifies buying or selling by comparing your Fair Value with the current share price. Every Narrative is dynamic and automatically updates when new news or earnings data is released, keeping your analysis relevant without extra effort.

For example, the most bullish Narrative on Yum! Brands assumes rapid global digital expansion and targets a fair value of $185 per share. The most cautious expects slow innovation and sees fair value closer to $142, demonstrating that your story truly does matter.

Do you think there's more to the story for Yum! Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUM

Yum! Brands

Develops, operates, and franchises quick service restaurants worldwide.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives