- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK) Expands Nile River Fleet With New 82-Guest Ship

Reviewed by Simply Wall St

Viking Holdings (NYSE:VIK) recently announced a significant milestone with the float-out of its newest ship, the Viking Thoth, for the Nile River, scheduled for delivery in October 2025. This news, part of a broader strategy to expand its fleet, aligns with the company's recent 23% share price increase last month. While the broader market showed moderate gains, Viking’s developments likely added momentum to its stock performance. The company continues to enhance its presence in Egypt, with plans for fleet expansion highlighting its commitment to growth, contrasting the cautious broader market awaiting further developments from U.S.-China tariff discussions.

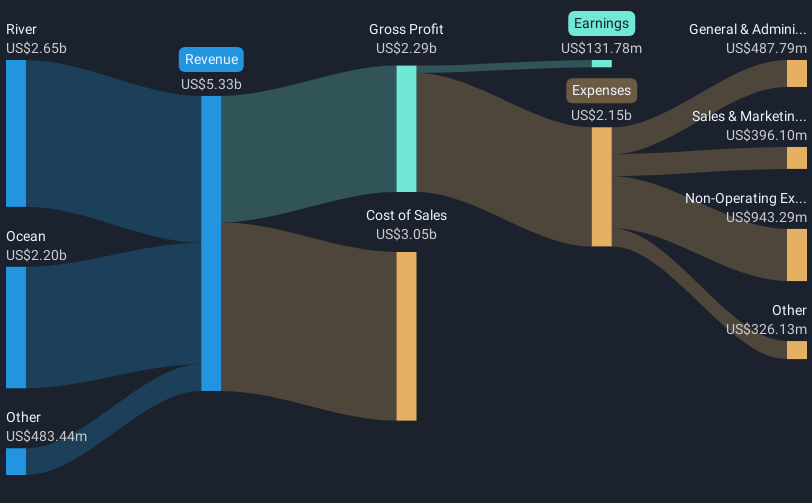

The float-out of Viking Holdings' latest ship, the Viking Thoth, marks a pivotal step in the company's fleet expansion, poised to enhance capacity beginning in 2025. This development aligns with the narrative of strong advanced bookings, which are anticipated to support future revenue growth. With 88% of capacity already sold and $5.3 billion in advanced bookings, the enhancement in Viking's offerings is expected to further solidify its market positioning and potentially improve profit margins through economies of scale. The news also comes against the backdrop of a robust share price performance, with a total return of 52.88% over the past year, outpacing the US Hospitality industry average of 7.7%. This illustrates investor confidence stemming from Viking's growth plans and strategic market penetration.

Short-term, Viking's stock experienced a 23% increase last month, reflecting enthusiasm around its expansion efforts. With shares currently trading 17.8% below the analyst consensus price target of US$51.56, there is room for potential growth if earnings and revenue forecasts materialize as expected. Analysts project revenue to increase by 12.2% annually, supported by capacity additions and a broadening customer base. Earnings are forecast to grow even more significantly at 38.64% per year, positioning Viking Holdings favorably for future valuation improvements and aligning with the company's strategic objectives.

Examine Viking Holdings' past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Viking Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives