- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK) Expands Fleet With New Ships and Hydrogen-Powered Innovation

Reviewed by Simply Wall St

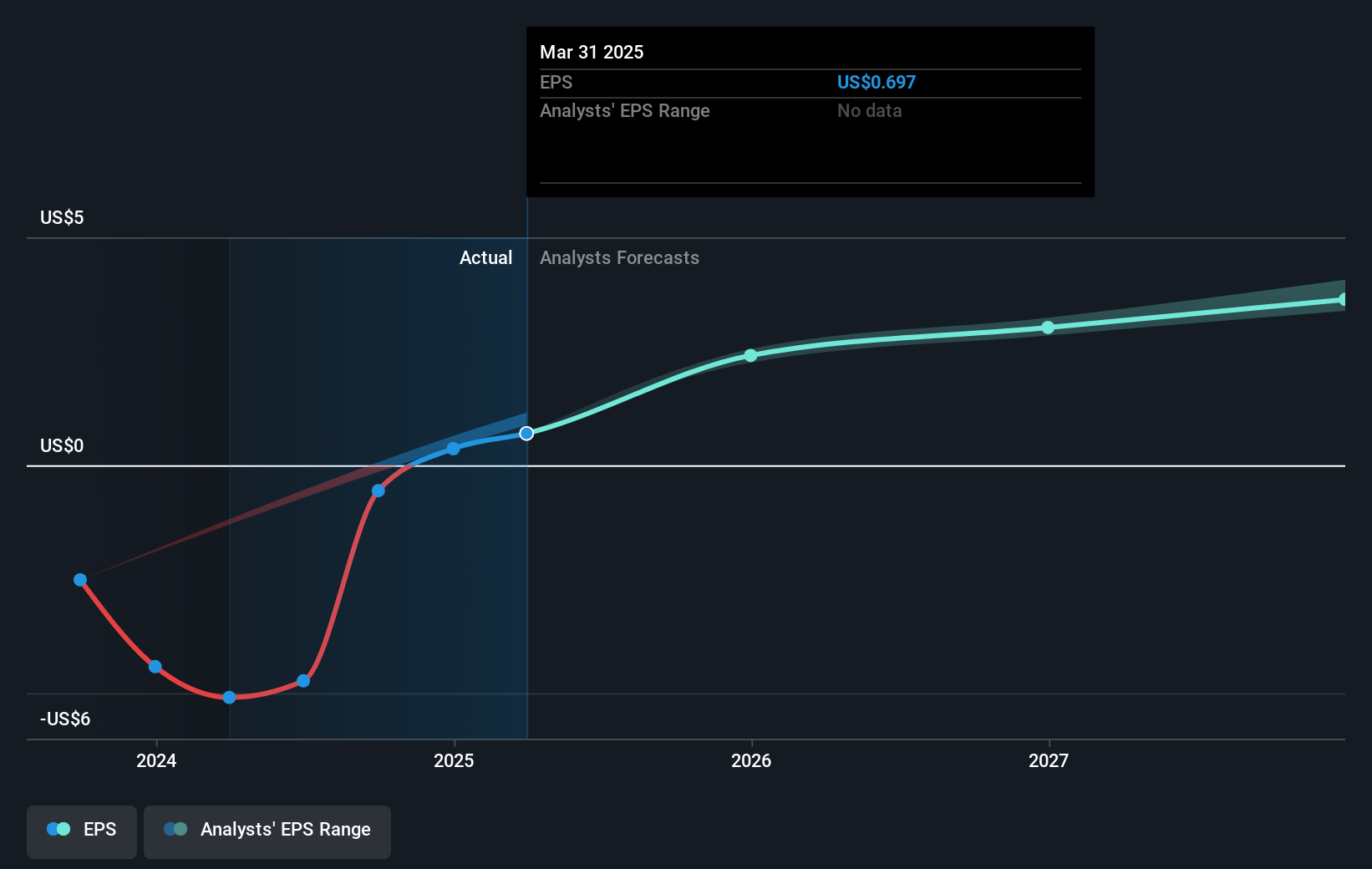

Viking Holdings (NYSE:VIK) recently celebrated the delivery of its new ocean ship, Viking Vesta®, marking a significant expansion in the company's fleet with plans for further innovative hydrogen-powered ships. Over the last quarter, Viking Holdings's share price rose 24%, considerably outpacing the overall market's 12% increase over the past 12 months. This robust performance may reflect the company's aggressive growth strategies, including its commitment to environmental sustainability and new itineraries, which resonate well with investor expectations in the growing experiential travel sector, bolstered further by a strong recovery trajectory in financials.

The recent delivery of Viking Holdings' new ocean ship, Viking Vesta®, supports the company's growth narrative, underscoring its commitment to fleet expansion and innovation. This addition is expected to enhance revenue potential as new itineraries attract environmentally conscious travelers. The news coincides with a share price increase of 24% over the last quarter, highlighting investors' positive reaction, especially when considered against the substantial total shareholder return of nearly 64% over the past year.

While Viking Holdings has outperformed the US Hospitality industry, which grew by 18% last year, the company's long-term prospects may be strengthened by its sustainable fleet expansion. Analysts project annual revenue growth of 14.9% over the next three years, with profit margins expected to rise to 24%. These forecasts are crucial, as revenue growth and improved profitability can directly impact the company's ability to meet or exceed its consensus price target of US$53.67. With the current share price at US$47.62, this represents a 11.3% potential upside, provided the projections materialize. The firm's success will depend on its ability to manage capital expenditures and mitigate risks associated with geographic concentration and evolving industry regulations.

Our expertly prepared valuation report Viking Holdings implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives