- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK): Evaluating Valuation After Strong Q3 Earnings and Profit Growth

Reviewed by Simply Wall St

Viking Holdings (NYSE:VIK) caught investors' attention after posting third quarter results that showed strong year-over-year gains in both revenue and net income. This performance highlights the company's ongoing operational momentum and improvements in profitability.

See our latest analysis for Viking Holdings.

After posting those robust earnings, Viking Holdings has seen a wave of enthusiasm reflected in its share price, which has climbed to $66.78. The 1-month share price return sits at an impressive 9.75%, and with a year-to-date share price return of 52.43%, momentum is clearly building as investors latch onto the company’s growth narrative and improved fundamentals.

If these results have you thinking about what other dynamic companies might be getting attention, this is a perfect moment to explore the market’s next wave and discover fast growing stocks with high insider ownership

With shares trading just shy of analyst price targets after such a remarkable run, the key question for investors is whether Viking Holdings is still undervalued or if all of its future growth is already reflected in the current valuation.

Most Popular Narrative: 2% Undervalued

Viking Holdings is trading just below the narrative's fair value estimate, suggesting a narrow margin to upside based on forward-looking projections. Investors hoping for more may need to weigh the assumptions closely.

Advanced bookings for core products remain exceptionally strong, with 96% of 2025 capacity and 55% of 2026 capacity already sold at higher rates. This indicates durable repeat demand and allows for mid-single-digit pricing growth that directly benefits company earnings and net margins.

The real power behind this price target lies in a handful of bold forecasts. Want a peek at the future financial leaps that analysts are betting on? Uncover the high-conviction growth ingredients and margin dynamics hiding in the details, only in the full narrative.

Result: Fair Value of $68.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, vulnerability to shifts in travel preferences or tighter environmental regulations could challenge Viking Holdings’ earnings resilience and put pressure on long-term profitability.

Find out about the key risks to this Viking Holdings narrative.

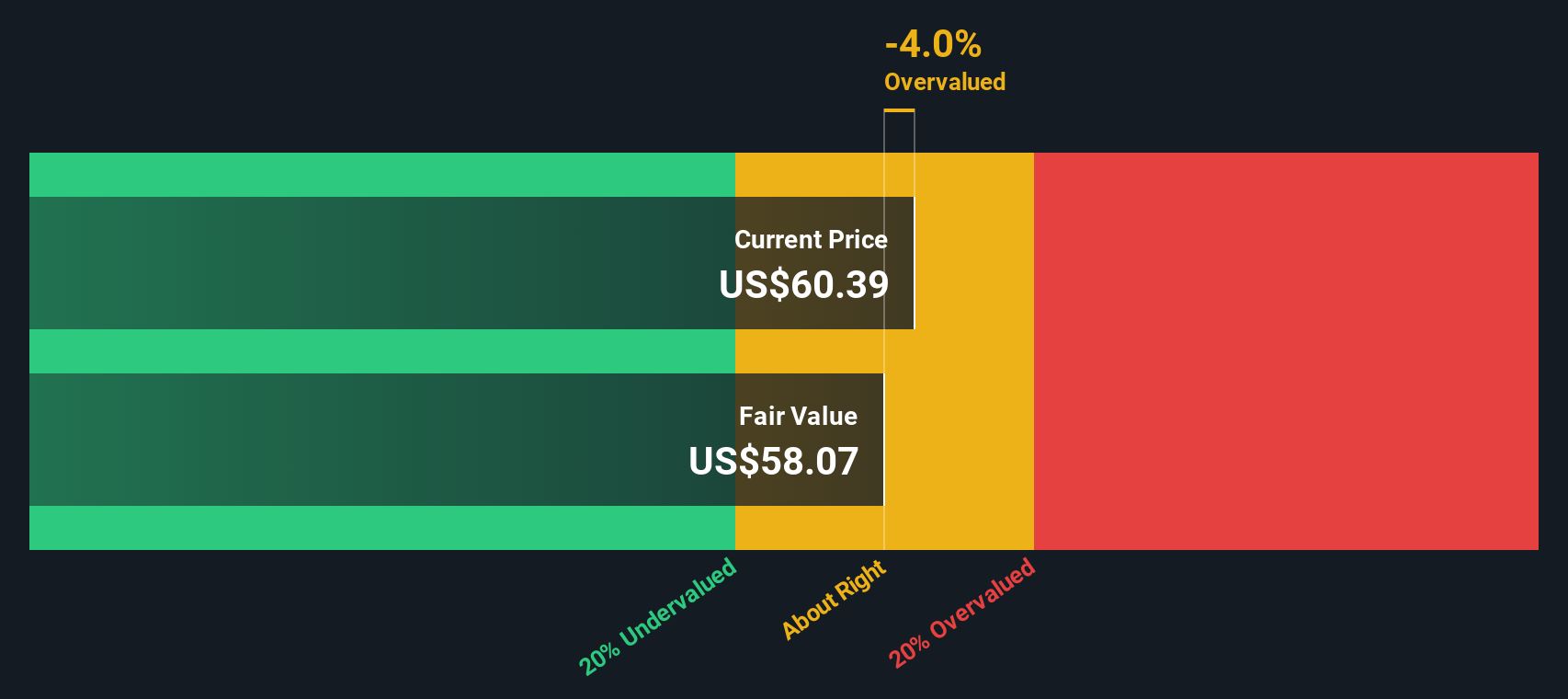

Another View: SWS DCF Model Suggests Caution

While analysts see Viking Holdings as slightly undervalued, our SWS DCF model presents a more conservative perspective. According to this approach, the shares trade above their estimated fair value of $57.69, which may indicate potential overvaluation based on long-term cash flows. Does recent momentum fully account for future uncertainties?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Viking Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Viking Holdings Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can easily craft your own view in just a few minutes, right here: Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for a single opportunity when there are so many untapped winners. Level up your strategy by searching for stocks that align with your goals before the next breakout leaves you behind.

- Uncover potential with these 914 undervalued stocks based on cash flows to spot companies trading below their true worth before they attract broader market attention.

- Boost your portfolio’s income stream by checking out these 15 dividend stocks with yields > 3% with attractive yields exceeding 3%. Lock in solid returns even in uncertain markets.

- Ride the next wave of technological breakthroughs and get ahead of the curve by harnessing these 25 AI penny stocks focused on artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026