- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK): Assessing Valuation After Fleet Expansion Milestone and Industry Leadership Signal

Reviewed by Simply Wall St

Viking Holdings (NYSE:VIK) just marked a major business milestone by naming nine new river ships and surpassing 100 vessels in its fleet during a ceremony in Basel, Switzerland. Investors are curious about what this expansion means for future growth.

See our latest analysis for Viking Holdings.

Viking Holdings’ latest milestone has helped maintain investor momentum, with a year-to-date share price return of 35.93% and an impressive 52.19% total shareholder return over the past year. Even with some near-term volatility, the company’s expanding fleet and reputation for innovation are fueling optimism about further growth.

If Viking’s bold expansion has you searching for the next big travel-related opportunity, this is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With Viking’s rapid expansion and strong returns, the question now is whether its stock remains undervalued given its growth prospects, or if the market has already factored in the company’s future potential. Is there a true buying opportunity here?

Most Popular Narrative: 10.3% Undervalued

Compared to its last close price of $59.55, the most widely followed narrative places Viking Holdings’ fair value at $66.35. This suggests the market is yet to fully price in its next growth phase. The current gap between share price and narrative fair value raises questions about what is driving this optimism.

“Advanced bookings for core products remain exceptionally strong, with 96% of 2025 capacity and 55% of 2026 capacity already sold at higher rates, indicating durable repeat demand and allowing for mid-single-digit pricing growth that directly benefits company earnings and net margins.”

Want to know the secret behind this upbeat price target? The engine is aggressive financial projections for bookings, margins, and sustained pricing power. Curious about the bold assumptions guiding the consensus calculation? The full narrative exposes the numbers others are betting on. Will you?

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in luxury travel demand or stricter environmental regulations could present challenges to Viking Holdings’ ambitious growth expectations in the future.

Find out about the key risks to this Viking Holdings narrative.

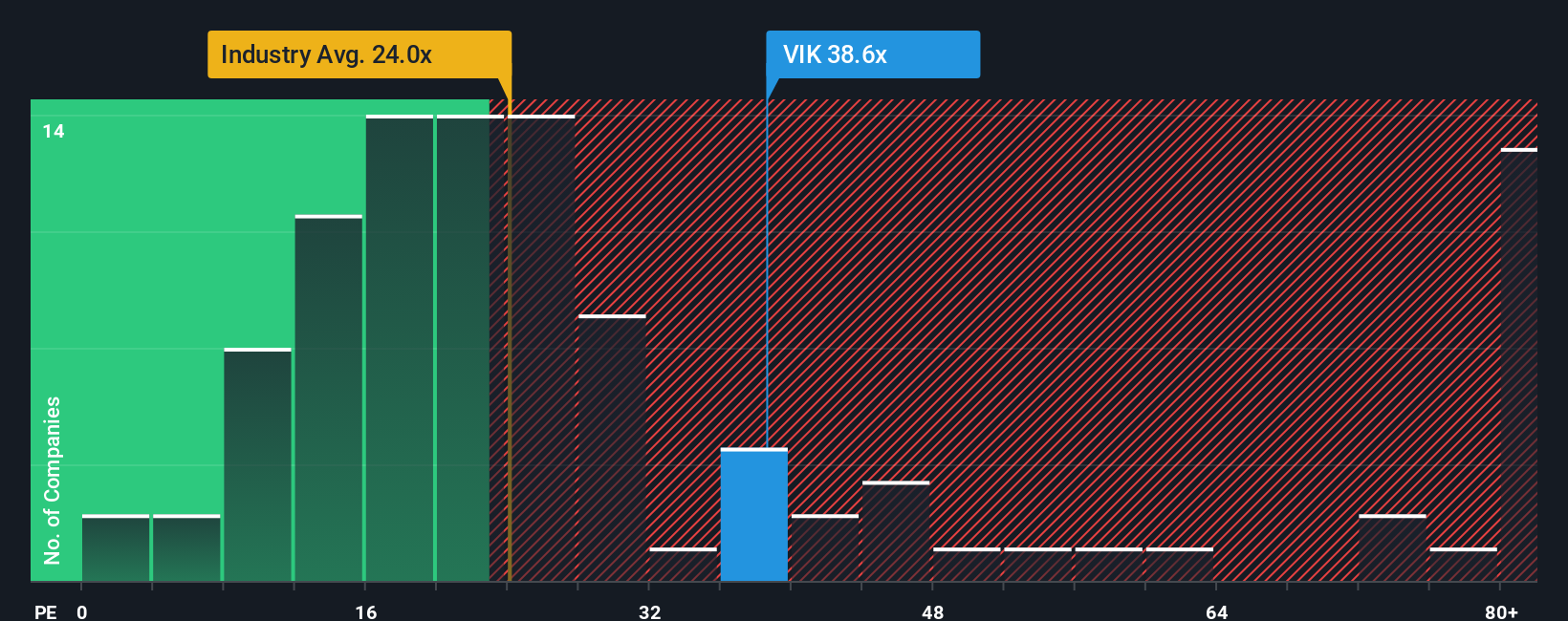

Another View: Price-to-Earnings Tells a Different Story

While the narrative values Viking Holdings above its current price, looking at its price-to-earnings ratio shows the stock is trading at 38x, which is noticeably higher than both the US Hospitality industry average of 23.9x and its peers at 22.2x. The fair ratio sits at 41x, which is closer but still above the industry. This gap highlights potential valuation risk if earnings do not keep pace with high expectations. Does this premium suggest lasting confidence or a vulnerability if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If you have a different perspective or want a hands-on look at the numbers behind Viking Holdings, you can easily build your own view and weigh the value signals for yourself. Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don't limit your portfolio. Broaden your investing edge by uncovering opportunities others overlook. Great ideas from all sectors are waiting in the Simply Wall Street Screener.

- Spot strong potential with these 853 undervalued stocks based on cash flows to find companies trading below their intrinsic value for a possible bargain entry before the crowd catches on.

- Capitalize on the future of health by using these 34 healthcare AI stocks to invest in innovative firms blending technology and medicine for breakthrough results.

- Boost your passive income by targeting these 21 dividend stocks with yields > 3% that consistently deliver yields above 3%, adding stability and cash flow to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives