- United States

- /

- Hospitality

- /

- NYSE:VAC

Is Marriott Vacations Worldwide a Bargain After Its 7% Stock Rebound?

Reviewed by Bailey Pemberton

If you’re eyeing Marriott Vacations Worldwide and wondering whether it deserves a spot in your portfolio, you’re definitely not alone. The stock’s recent swings have caught the attention of more than a few investors, especially after a sharp 7.0% rebound over the last week. That pop came hot on the heels of a pretty rough stretch, with shares still down 11.7% for the past month and off a sobering 23.5% year to date. Longer-term holders have felt the pain too, with the stock sitting 12.1% lower than it was a year ago and deep in the red over three and five years. It has been a rocky ride, to say the least.

What’s been driving all this movement? While hotel and travel stocks have benefited periodically from travel demand and upbeat market sentiment, Marriott Vacations Worldwide remains under the microscope as investors try to sort out how much optimism is warranted about recovery pace, demand for vacation ownership, and the impact of broader market shifts. Mixed signals, such as pockets of stronger leisure travel but ongoing macro uncertainty, have kept risk perception high, but also created windows where forward-looking buyers see a bargain.

If you’re trying to make sense of it all, a great starting point is valuation. On our scorecard, Marriott Vacations Worldwide posts a value score of 5 out of 6, signaling it is undervalued by most of the usual checks investors rely on. But which valuation methods matter most, and what can they really tell us in today’s market? Let’s break down the different approaches, and stick around for one more powerful way to judge the company’s worth that is often overlooked.

Why Marriott Vacations Worldwide is lagging behind its peers

Approach 1: Marriott Vacations Worldwide Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This process gives investors a sense of what the stock is fundamentally worth.

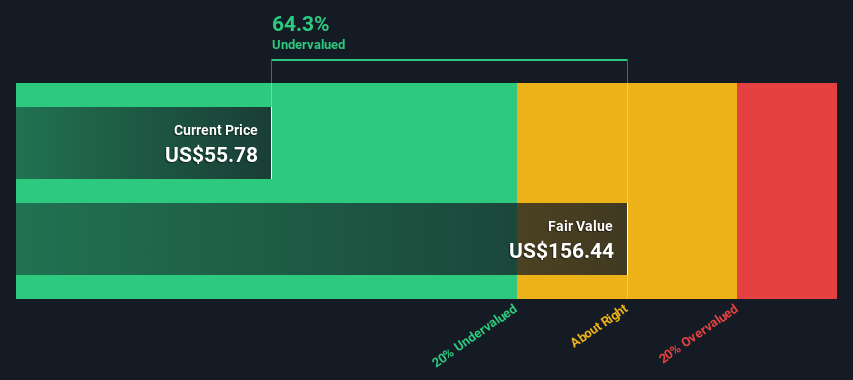

For Marriott Vacations Worldwide, the recent trailing twelve months free cash flow stands at $28.5 million. According to analyst estimates and subsequent projections, that figure is expected to increase significantly, reaching $303.5 million by 2026. Over the next decade, continued growth is forecast, with discounted future free cash flows rising each year. This is based on a two-stage model that incorporates both analyst outlooks for the near future and extrapolation for the years following.

This methodology produces an estimated intrinsic value of $183.27 per share. Compared to the current market price, this suggests the stock is trading at a notable 63.5% discount, indicating substantial undervaluation according to these cash flow projections.

In summary, the DCF approach offers a strong case that Marriott Vacations Worldwide shares are currently priced well below what their future cash generation could support.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marriott Vacations Worldwide is undervalued by 63.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Marriott Vacations Worldwide Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies because it links a company’s current share price to its net earnings. For firms with a reliable profit track record like Marriott Vacations Worldwide, the PE multiple helps investors quickly assess how much the market is willing to pay for a dollar of earnings.

Growth expectations and perceived risk play a big role in what counts as a “normal” or “fair” PE ratio. Companies with stronger growth prospects or more stable earnings usually command higher PE multiples. Those seen as riskier or with sluggish outlooks typically trade at lower ones.

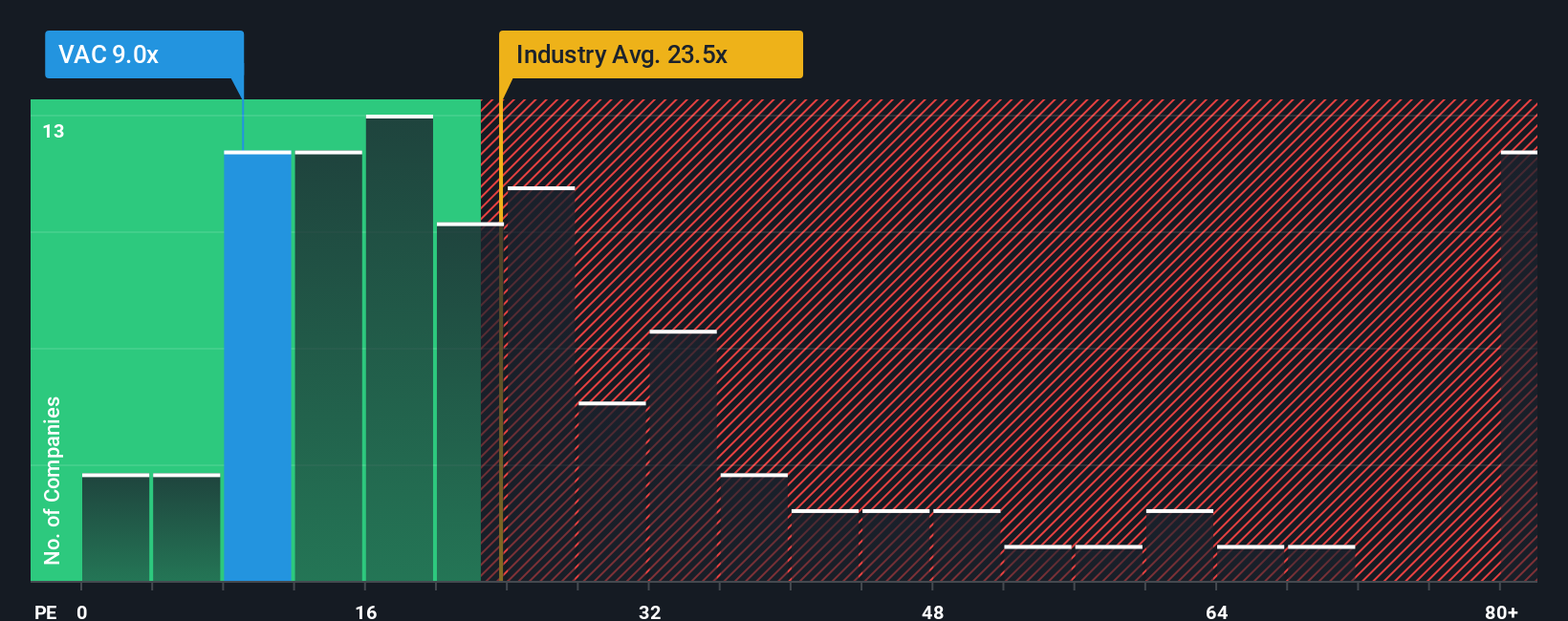

Marriott Vacations Worldwide is currently trading at a PE ratio of 8.9x. By comparison, the broader Hospitality industry average is 23.5x and the average across similar peers is around 27.5x. This points to a notable discount relative to the wider market.

However, rather than simply comparing Marriott’s PE to industry or peers, the Simply Wall St “Fair Ratio” model goes a step further. It adjusts for factors including the company’s growth outlook, industry trends, profit margins, market capitalization, and specific risks that may affect future results. This proprietary approach gives a more tailored benchmark for what the PE should be, given how Marriott Vacations Worldwide stacks up by these important metrics.

For Marriott, the Fair Ratio stands at 20.6x, markedly higher than the current 8.9x. This signals that, even after accounting for growth and risk, the stock appears meaningfully undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marriott Vacations Worldwide Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce Narratives. A Narrative is simply the story you believe about a company’s future. It is your view on how the business will evolve, what numbers (like future revenue, earnings, or profit margins) you expect, and what all of that should add up to in terms of fair value.

Instead of just looking at charts or ratios, Narratives connect the company’s “story” to concrete financial forecasts and then to a real-time estimate of what the stock is truly worth. This approach helps you see the logic behind your numbers, challenge your assumptions, and stay focused on the reasons behind your investment call.

Best of all, Narratives are quick and easy to create or follow directly on Simply Wall St’s Community page, where millions of investors share and refine their perspectives. Narratives update automatically as new news or earnings are released, so your fair value stays current without constant manual work.

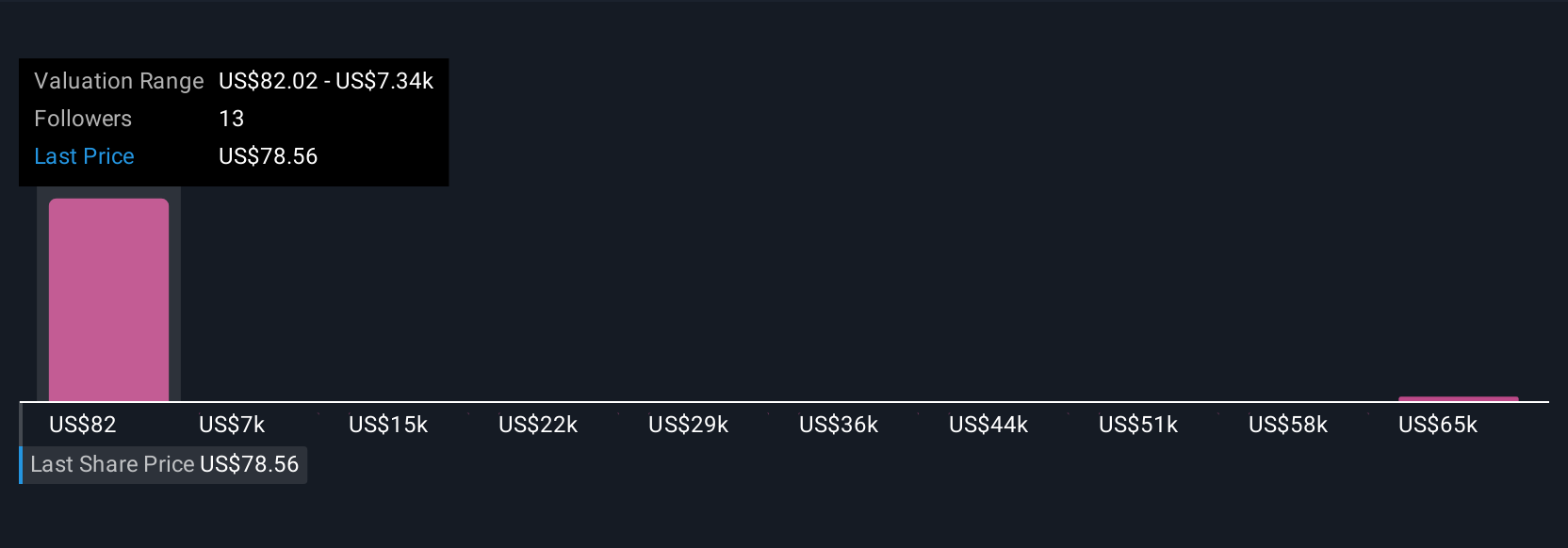

By comparing your Narrative fair value to today’s price, you can quickly spot buying or selling opportunities. For example, some investors see Marriott Vacations Worldwide as a turnaround play with a $127 upside if modernization wins out, while others cite rising costs and macro risks, estimating fair value as low as $65.

Do you think there's more to the story for Marriott Vacations Worldwide? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAC

Marriott Vacations Worldwide

A vacation company, engages in the vacation ownership, exchange, rental, and resort and property management businesses in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives